- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Where do i enter the "state and local taxes" from my K-1 - box 11 code B

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter the "state and local taxes" from my K-1 - box 11 code B

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter the "state and local taxes" from my K-1 - box 11 code B

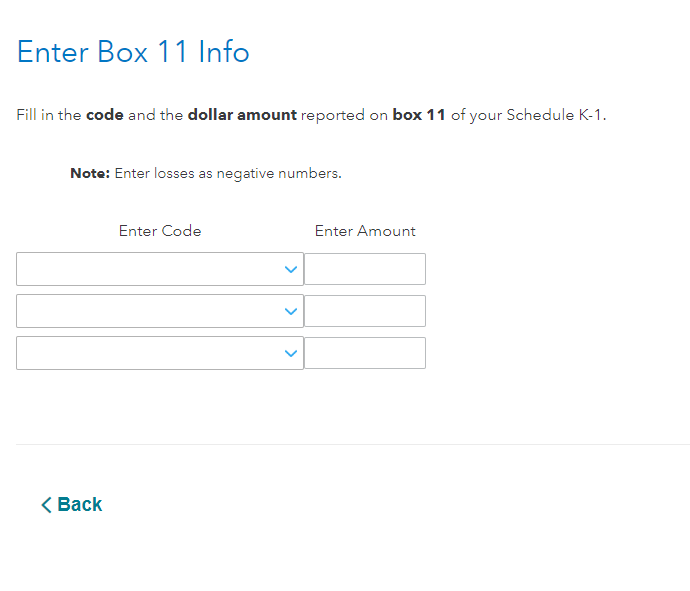

As you progress through the K-1 interview, there will be an option to select the boxes that you have data in. Select box 11. As you continue there will be a screen for Box 11 info. It provides for the entry of both the code and the amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter the "state and local taxes" from my K-1 - box 11 code B

My screen did not look like that as I entered the K-1 info. I just had boxes already labeled 11a… 11b and so on. I did not have the bottom part of the screen with the “drop down” to list “state and local taxes”…I have since submitted to the IRS so hopefully it will still be ok.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter the "state and local taxes" from my K-1 - box 11 code B

You have entered your S-Corp K-1 (Form 1120S Schedule K-1) as a K-1 from a Trust or Estate (Form 1041 Schedule K-1). You will need to amend your return to correct the entry, but you should not do this until you either see your return accepted or receive notice from the IRS that you need to amend it.

See How do I amend? if you need to amend your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter the "state and local taxes" from my K-1 - box 11 code B

Hi there @AliciaP1 the K-1 is in fact for a Trust. So hopefully that sounds promising? And then filed correctly?

thanks

Heather

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter the "state and local taxes" from my K-1 - box 11 code B

Yes, since that makes it excess deductions for state and local taxes, you should be fine.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kyra8fox

Returning Member

user17525953115

New Member

LizzyPinNJ

New Member

wphannibal

New Member

CQ60177

New Member