- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- USO ETF Partnership K-1

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

@michelleterral You can ignore the K-1 and just treat the transaction like any other stock. The reason you can do this is that you didn't hold the partnership long enough to actually be allocated any of its gains or losses, so entering it into TT wouldn't change anything.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

After much research and wasted time..... reading your response just made my weekend!! Thank you for taking the time to answer my question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

Hi,

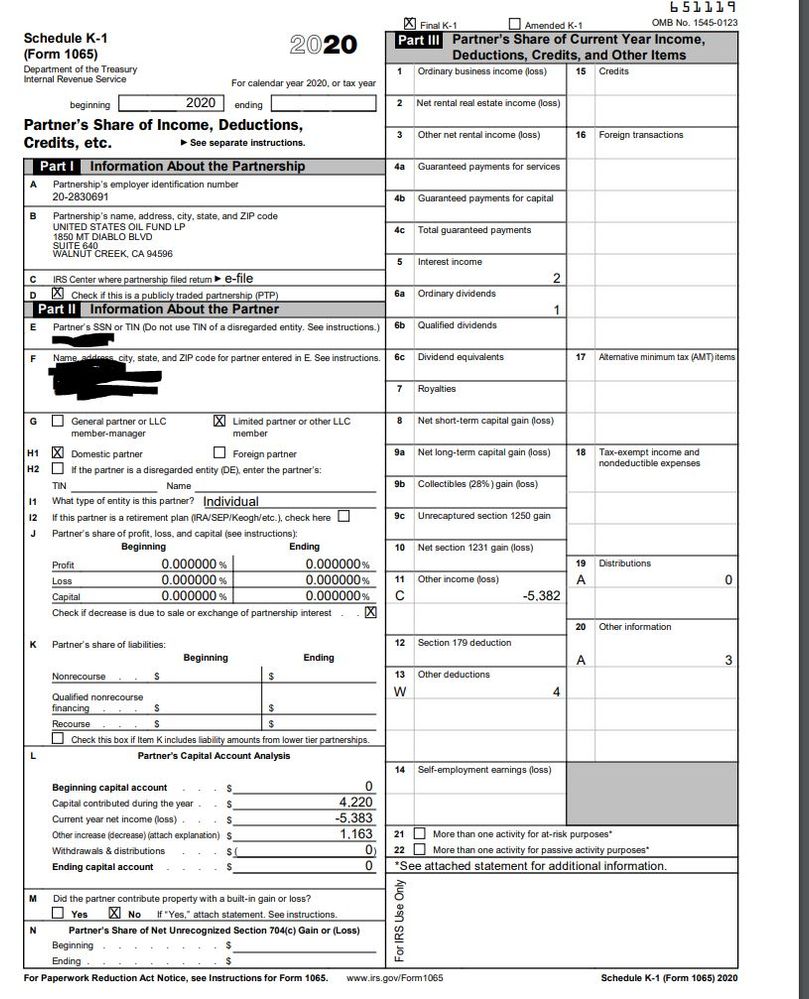

I have a situation that I'm trying to figure out. I've posted my k-1 below.

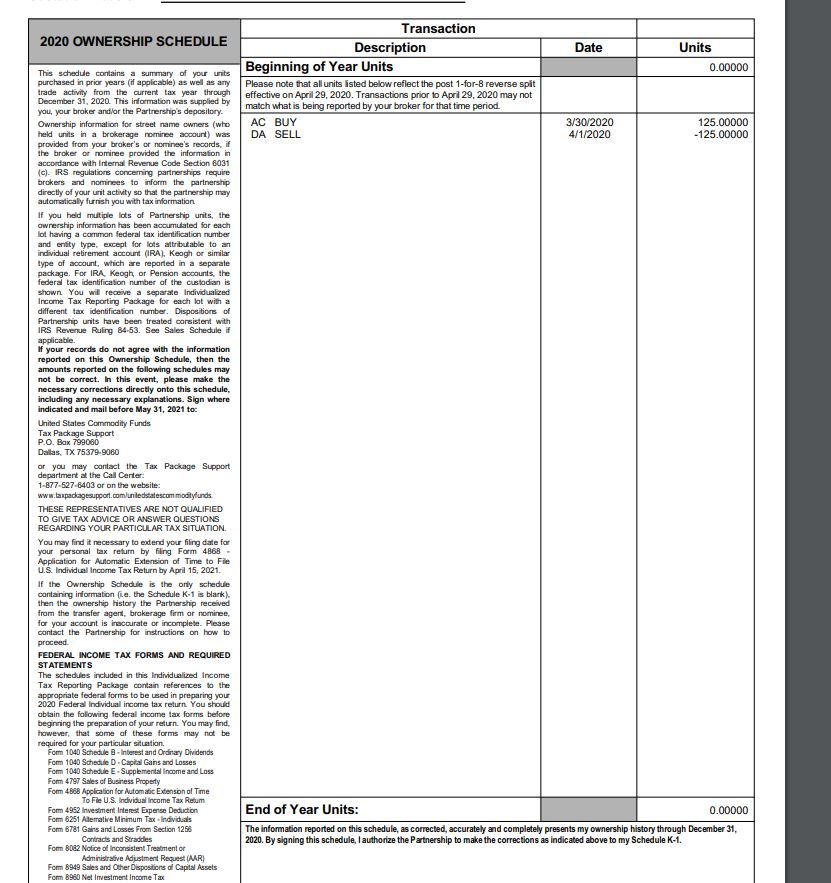

I bought 1000 USO shares on 3/29/20 at a price of $4.22 and sold all 1000 shares two days later on 4/1/20 for a scratch at $4.22. No profit no loss. (USO did a reverse split 1 for 8 so they adjusted me to 125 shares at some point)

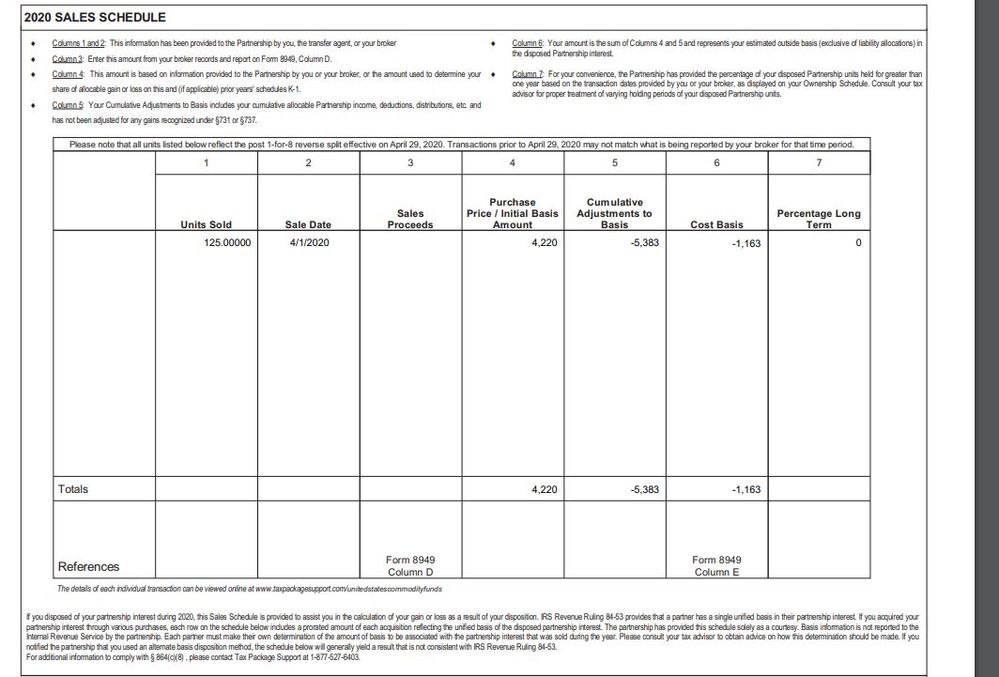

So I put a total of $4220 into this, and now I'm looking at the K-1 and it's showing a loss in Box 11C of -$5,382. I have no idea where they are getting these crazy numbers, but they assure me they are correct.

Even if I go with the numbers, and put the loss in where the software asks me to (which then puts the loss on Form 6781 I think), then if I understand correctly, I believe I'm supposed to adjust my cost basis down from my 1099B by -$5,382. If that's correct, it would give me a negative cost basis:

$4,220 - $5,382= -$1,163

Can I do this? What am I supposed to do here? Thank you to anyone that can help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

@joeygamb You're correct that your basis can't go below 0, so what has to happen is the $5,382 loss is going to be reduced to something that gives you a basis of $0. To do this, when you go through the K-1 interview there's a question about "All my investment is at-risk" (or words to that effect). You need to uncheck that box. TT will then point out that your losses are limited, and ask questions to fill things out correctly. The results will be on Form 6198. You'd then set your 1099-B cost to $0 for a $4220 cap gain, but TT should be putting the other K-1 entries onto your return to offset that.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

Thank you so much for your prompt reply @nexchap !

I will look into this later when I get home and see how it turns out. I'll post if I run into any other problems. I truly appreciate your help, and hopefully anyone with a similar situation will see this post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

@nexchap Trying to make things more clear for myself.... So will TT put all the K-1 info in the correct spot, be it Form 6781 or wherever? I think I read that on the form K-1 that box 11c will go there, but I just don't know for sure, and will TT know to put it there? I'm using 3rd party software (Tradelog) to sort and input all my stock trades. So should I go into Tradelog and adjust my cost basis on my USO to 0, which is what I think you are saying, which will give me a capital gain of $4220 there? (I just want to make sure TT is not doing that adjustment somewhere by itself that I don't know about) Then that will be offset by a $4220 loss somewhere else on the tax return. And then what happens to the extra $1,163? You're saying that is taken care of and basically disappears when I uncheck the "All my investment is at risk" box?

Also, if the K-1 loss does go to 6781 which gives the 60/40 tax treatment, will that matter when trying to match the short term loss from the 1099B adjustment?

Thank you so much for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

So will TT put all the K-1 info in the correct spot, be it Form 6781 or wherever? I think I read that on the form K-1 that box 11c will go there, but I just don't know for sure, and will TT know to put it there?

When it comes to partnerships and TT, "Trust but verify" is the best approach advice. You should be working with a version that allows 'Forms' mode, so you can see exactly what is showing up where. For something like 11c, it should go through to 6781 with no problem. But there are other less common codes that TT won't handle (e.g., 13K)

I'm using 3rd party software (Tradelog) to sort and input all my stock trades. So should I go into Tradelog and adjust my cost basis on my USO to 0, which is what I think you are saying, which will give me a capital gain of $4220 there? (I just want to make sure TT is not doing that adjustment somewhere by itself that I don't know about)

I'm not familiar with Tradelog, but the important point is that your cost basis on that trade is $0. As long as TT shows a $4220 cap gain, how you get it there isn't important (I adjust the 1099-B inside TT). And the concern about TT adjusting your 1099-B elsewhere is avoided by following the thread I included on one of the earlier posts on this thread (basically, don't let the K-1 interview create any 1099-B entries.

Then that will be offset by a $4220 loss somewhere else on the tax return. And then what happens to the extra $1,163? You're saying that is taken care of and basically disappears when I uncheck the "All my investment is at risk" box?

If you look carefully at the forms, you'll see $2 of Int and $1 of Div show up on Sched B, along with the the $4 deduction from 13W showing up somewhere. But the straddle on form 6781 won't be the full $5,382. It will be reduced to reflect that your investment was only $4,220. That reduction is going to be worked out on for 6198 when you uncheck the box. But you'll want to verify the mechanics to make sure that everything works (I'm not aware of any problems, but I add this caution only because I haven't personally had to do this). As to the extra $1,163, it vanishes when you fully exit the partnership.

Also, if the K-1 loss does go to 6781 which gives the 60/40 tax treatment, will that matter when trying to match the short term loss from the 1099B adjustment?

As described, you're going to wind up with a short term gain which is offset by a 60/40 long/short loss. I'm not familiar with the tax treatment of straddles in a partnership, so don't know if there's any other allowed adjustments to address that mismatch.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

@nexchap Thank you again very much for the follow up. I'm having a heck of a time with this.

I feel like I have everything ok until I get to the "All Investment at Risk" part. When I check the "Some Investment Is Not At Risk" box, I get some questions I have no idea how to answer. Is there any way you can help me through this? I'm beside myself. All for one lousy trade. First is this:

At-Risk Limitation - Ordinary Income (Loss)

Enter your ordinary income (loss) from the at-risk activity.

Enter the gain (loss) from the sale or other disposition of assets used in the activity (or of your interest in the activity) that you are reporting on the following forms and schedules.

Schedule D: ??

Form 4797: ??

Other form or schedule: ??

Again, no idea what to put up there in any of those boxes?

Then:

At-Risk Limitation - Other IncomeEnter the other income and gains from the activity, from Schedule K-1 of Form 1065, Form 1065-B, or Form 1120-S, that were not included in the amounts entered on the previous screens.

Enter the amount of other deductions and losses from the activity, including investment interest expense allowed from Form 4952, that were not included in the amounts entered on the previous screens.

Enter the adjusted basis in the activity (or in your interest in the activity) on the first day of the tax year. Also enter any increases and/or decreases for the tax year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

@joeygamb Unfortunately, I haven't worked through those forms myself, so hesitate to try to provide any advice. But at a high level, you know:

- You netted $0: if TT does something that results in your taxes going lower, there's clearly an error.

- In forms, the K-1 worksheet has a 'Section A' that shows (in col c) 'Net Income (Loss) Allowed'. Your work on the 'at-risk' stuff is going to result in the numbers that wind up in that column. If that winds up at roughly $4,220 you're on the right track.

- Some of the terminology you're being hit with actually shows up on the K-1, so should be easy to answer:

- Ordinary income (loss) is box 1).

- Sched D income will be the $4220 cap gain you're reporting

- Every other item will have detailed help if you right click on the answer.

- The int and div you got are increases to your basis. The loss on the straddle and the 13W deduction are reductions in basis.

Sorry I can't be more definitive.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

This is so confusing. Here's an idea...

Do you think it would be a flag if I just put -$4220 loss instead of the reported -$5382 from box 11C, and then I can adjust my cost basis down to 0 on the 1099-B, which would avoid dealing with this whole negative cost basis problem?

I believe the end result would be the same?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

@joeygamb I suspect that that would get you to the right outcome, but I just don't know enough about exactly how straddles in excess of basis are supposed to be adjusted to feel comfortable offering an opinion.

On the other hand, the tax consequences of this transaction should be really small (if not $0), so even if you make an error fixing it at some point down the road shouldn't be a problem.

My only other suggestion would be to call in to TT and see if you can get to someone who can walk you through the 6198 interview questions.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

@nexchap So the person I talked to who also seemed pretty familiar with K-1's tried to go step by step with me, unchecking the box you recommended, and completing the questions. We still couldn't get it to work out. So we ended up just adjusting my basis to 0 on the 1099-B Form 8949 for the trade, and limiting the loss to -4220 instead of the -5382 which flowed to the Form 6781. Hopefully it'll be fine. The outcome should be close to $0 like you said. Thanks again for all your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

@nexchap ,

I am seeking help from your expertise.

I bought shares of USO in 2020 and still holding the shares in 2021. Now, I received K-1 with positive number in Box5, 6a, 11C, and 13W. My questions are:

1) Since I am still holding ALL of the shares that I bought in 2020, do I still have to report the the K-1 in my tax return since I didn't receive any actual gain or sell any share in 2020?

2) If I do have to report these K-1 numbers in my 2020 tax return, do I have a chance to adjust my cost basis (as per your instructions above) in future tax return year when I sell the shares to get my extra money paid in tax back?

Looking forward to your help and direction! Thanks a ton in advance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

1) Yes. You're a partner in a partnership, so you have to report all the taxable activity of your share in the partnership each year. If taxes are owed, you pay your share whether you sold units or not.

2) Yes. When you sell, your cost basis is adjusted for ALL activity in all prior years.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

walnist

Level 1

DB12345

New Member

vicentebcarvalho

Returning Member

ben301

Level 2

mrlloyd95

Returning Member