- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- USO ETF Partnership K-1

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

need help i started tax now i have lost contact. john [removed] phone [phone number removed]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

Hi @nexchap

I was adjusting the cost basis of 1099-B based on the cumulative adjustment in K-1. In my case, the cumulative adjustment is negative so I corrected my 1099-B as below.

K-1 (from USO)

| Amount ($) | |

| Purchase price | 2000 |

| Cumulative Adjustment | -500 |

| Cost basis | 1500 |

Original 1099-B (from Robinhood)

| 8949 (Box A) | 8949 (Box C) | |

| Cost basis | 1950 | 52 |

| Sale proceeds | 1650 | 42 |

| Income (loss) | -300 | -10 |

Amended 1099-B (Edited in TurboTax)

| 8949 (Box A) | 8949 (Box C) | |

| Cost basis | 1950 | 52 |

| Sale proceeds | 1650 | 542 (=42+500) |

| Income (loss) | -300 | 490 (=-10+500) |

I updated the number in the sale proceeds of Box C. Is this correct? (Q1) I did this because the cost basis of box A has been reported to IRS. (Q2) Also, I updated sales proceeds instead of cost basis because K-1 indicates negative cumulative adjustment.

Thanks a lot in advance!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

@PowerTaxer Doing it that way reports the correct Cap Gain in total, but I'm not sure that changing the Sales Proceeds number is the best way to do it. I say this strictly because I'm not expert enough to know whether the tax code uses your total proceeds in any other ways than Sched D.

Personally, I'd be more comfortable correcting the basis Robinhood supplied to the IRS (changing the 1950 to 1450). That's completely allowed, and if the IRS ever asks for an explanation you can just say "Robinhood doesn't understand the stuff they broker...." and then maybe add the bit about K-1 basis adjustments.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

@nexchap I appreciate your prompt comment! I didn't know if it is ok to change the cost basis reported as box A!

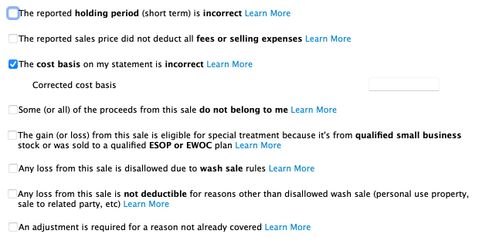

I have one follow-up question. In the process of writing a 1099-B item in TT, I found that there is a pop-up like the below capture. Given I have adjusted the cost basis of this item, should I check "The cost basis on my statement is incorrect"? or just leave it not checked.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

@PowerTaxer When you correct a cost basis that's been reported to the IRS, they want a code explaining why its being changed. That pop-up is where TT helps automate figuring out the code. You'd leave the box checked, enter the correct basis, and TT will adjust the 1099-B.

You may have done it correctly already in Forms mode, but if so then letting TT overwrite it with its own automation won't hurt anything and will confirm your changes.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

@nexchap, you and @ThomasM125 seem to have the best handle on this PITA, so let me ask this: How on earth do I respond to the at-risk prompts for USO in the TurboTax Schedule K-1 interview?

Background: I bought and sold (entirely) a small position in USO in 2020 for a small loss. This showed on my 1099-B, which arrived in a timely fashion. I filed my taxes.

Then I got a Schedule K-1 from USO. If I go to amend in TurboTax, adjust the cost basis for USO down on the 1099-B by the amounts in the sales schedule that USO sent, and then do the TurboTax K-1 interview, everything seems OK until I reach the screen prompting me to check boxes indicating whether my investment was at-risk. By the running tally at the top of the screen, whether I now owe taxes on a loss in this garbage investment depends on how I check this box. It seems to me that my entire investment *was* at-risk, no? And: Did I do the right thing by adjusting the cost basis on my 1099 down in accordance with the USO sales schedule, then doing the Schedule K-1 interview?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

@Anonymous You would check the "at-risk" box.

When you first buy a position in a partnership (e.g., for $100) your entire investment is "at risk": if the parternship went bankrupt, you'd have lost your investment. Over time, though, the partnership may start giving you back cash (ROC distributions) or losses on the K-1. Once that total reaches $100, you no longer have anything "at risk" -- you put in $100, and the partnership has given you back $100 (either as cash or as eventual deductions on your taxes). At that point the rules for handling K-1s change.

That obviously doesn't apply to your situation.

As for adjusting your 1099-B: definitely the right thing to do. Whether you made the adjustment correctly can be verified by looking at the combination of your capital gain/loss, and and other items of loss or income that came through on the K-1. When you find them all on your tax return, the total your paying taxes on should still match your "small loss"

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

@nexchap : Things must more or less match up, as making the amendment--and checking the "at-risk" box--causes TurboTax to tell me that I must return $1 to the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

@nexchap Thanks for all the responses you gave to everyone, that helped me a lot!

I have a slightly different question from everyone: I did buy some USO in 2020 but haven't sold yet. I received a k1 with some "other incomes" (11C). So if I understand correctly, this year I am paying taxes on those incomes, even though I haven't sold anything, and if say I sell this year, then on my next return in a year I'll change the cost basis and ultimately get back this money, am I correct?

What surprises me is that I always try to do my taxes with 2 different softwares (to check everything computes correctly), and when I entered the same information in the other software, it didn't make me pay any taxes on those "other incomes".

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

@corelema Your understanding is correct. Reporting the income this year results in taxes this year. But your basis on the shares increases by the income you report, so that when you eventually sell your Cap Gain will be lower.

As to the other software, I'm not aware of anything that would allow you to postpone reporting the income. But there's a lot about taxes where I'm not an expert. It sounds like it would be worth following up with them to understand why they believe it doesn't need to be reported.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

I think I've almost figured it (thanks to the extremely helpful people in this thread like @nexchap ), but have 2 remaining questions:

1) Why does the Purchase Price / Initial Basis Amount reported in my 2020 Sales Schedule (K-1 from USO) differ from the Cost or Other Basis reported in the 1099-B (from Robinhood)? It differs by about $167. Because of this, none of the numbers add up. I can still subtract the Cumulative Adjustment to Basis (since mine is negative), but I don't end up with the new Cost Basis (as reported in the Sales Schedule)? It looks like @PowerTaxer had the same issue. Does this matter?

2) Why do I enter 0 for sales price and 0 for basis on K-1 itself when it asks about the sale?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

@taxalex on your questions:

- You may need to clarify, since you don't specify whether either of them report the correct purchase price. But possibilities are:

- The K-1 gets the purchase price from your broker. If that's wrong, you should correct it.

- Some brokers make a partial adjustment to your basis. Distributions that are classified as Return of Capital lower your basis. Because the broker sees those distributions, some lower your basis accordingly and report that on the 1099-B. So your 167 disconnect may be the difference between your cumulative adjustments and your distributions.

- The basis reported by the broker will never be accurate, since they don't get the K-1. They don't see all those other adjustments.

- If you enter real numbers on the K-1 sales interview, it will calculate a Capital Gain/Loss AND create a new 1099-B. Since you already have a 1099-B for this transaction, you have to make sure you don't double-count. Its simpler to enter 0s and keep the K-1 out of the Capital Gain/Loss calculation. This thread goes further into the issues, particularly if you ever invest in anything that also declares Ordinary Income on a sale: https://ttlc.intuit.com/community/investments-and-rental-properties/discussion/how-i-report-the-sale...

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

Hi @nexchap ,

thanks a lot for help!

In my case, if I have several USO transactions and reported as several sales in 8949 (per TurboTax, I cannot merge them), then, where to put "Cumulative Adjustments to Basis"? Can I add it to one of the sale item's cost basis only?

But this is very very confusing, actually, I have to split "Cumulative Adjustments to Basis" into two transactions because cost basis of each of transations is less than "Cumulative Adjustments to Basis" and corrected cost basis cannot be less than $1....

I am really worried that IRS won't figure it out and come to me later. :(

Another Q is:

Last year, USO merged 8 to 1. My case, say, I had 87 shares, so, 7 of them were not merged and my K-1 shows 0.875 shares (0.875 x 8 = 7) were sold on 04/28/2020. So, I only had 10 new shares after that.

But... I couldn't find such transaction in my broker account... And I don't remember (maybe, I missed it) if I got a form/money for that.

Question is: should I report this 0.875 share in 1099-B? If so, what's the cost per share ( 0 or original purchase price)?

thanks a billion!

======from TT===============

For sales that aren't identified as Box A or Box D sales, or that require adjustments, you have a choice to make. If you choose to enter summary totals for these sales, then you'll be required to mail in a statement with specific information about each individual sale. Otherwise, you can just enter each sale one at a time in TurboTax, and you won't have to mail anything in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

@ajay1900 Sometimes the K-1 gives lot specific adjustments. If yours doesn't, it should at least provide a split on the adjustments between any short term sales vs long term sales -- you need to make sure that the correct gain/loss is reported in those categories. But within short or long term, you can just spread the adjustments proportionally: for example, if the adjustments work out to $10/share, then a 100 share sale would pick up $1000, and a 20 share sale would pick up $200.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

USO ETF Partnership K-1

I received a K-1 as a result of USO stocks purchased and sold with a loss in 2020 along with a great deal of other stocks and this is the only one I am completely confused about. My K-1 actually shows beginning and ending profit, loss, and capital of 0.0 and the only numbers on the form that is not 0 os the Partners capital account analysis which shows capital contributions during the year of $31,000 and then withdrawals and distributions of the same amount ( this is also the amount paid for the stock at time we purchased) .

I really hate to ask a stupid question and I have tried to find something specific online that I must be missing before posting this but I am at a loss.

Any and all input is very much appreciated.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

DB12345

New Member

vicentebcarvalho

Returning Member

ben301

Level 2

mrlloyd95

Returning Member

pinguino

Level 2