- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

Hi,

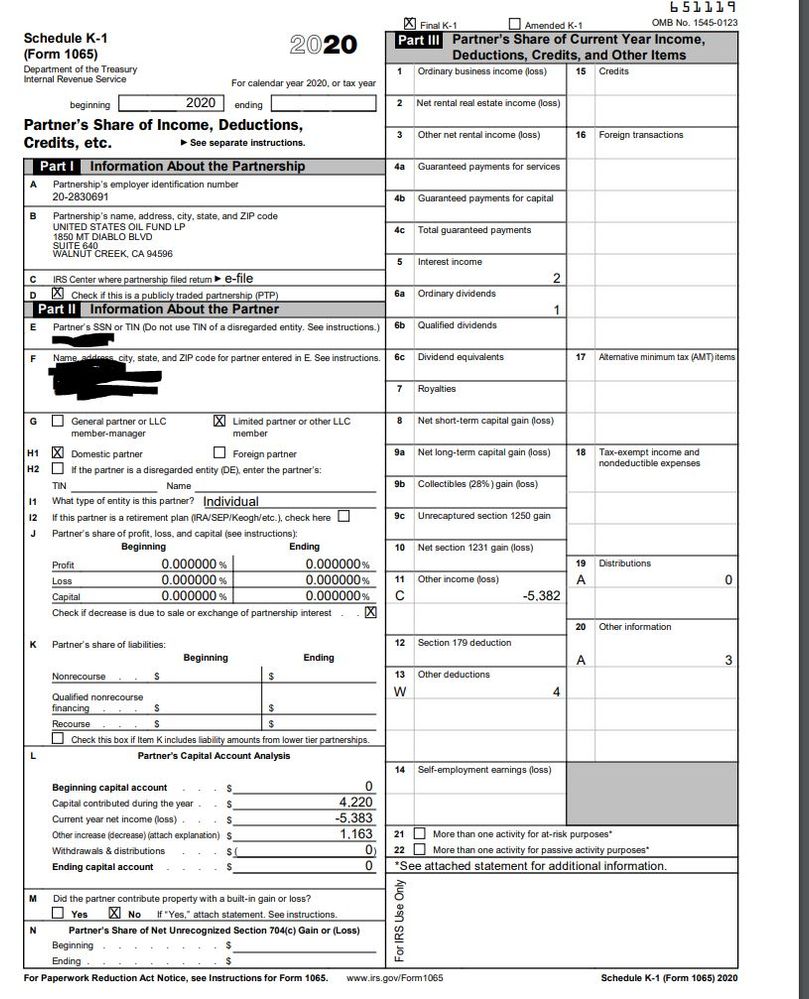

I have a situation that I'm trying to figure out. I've posted my k-1 below.

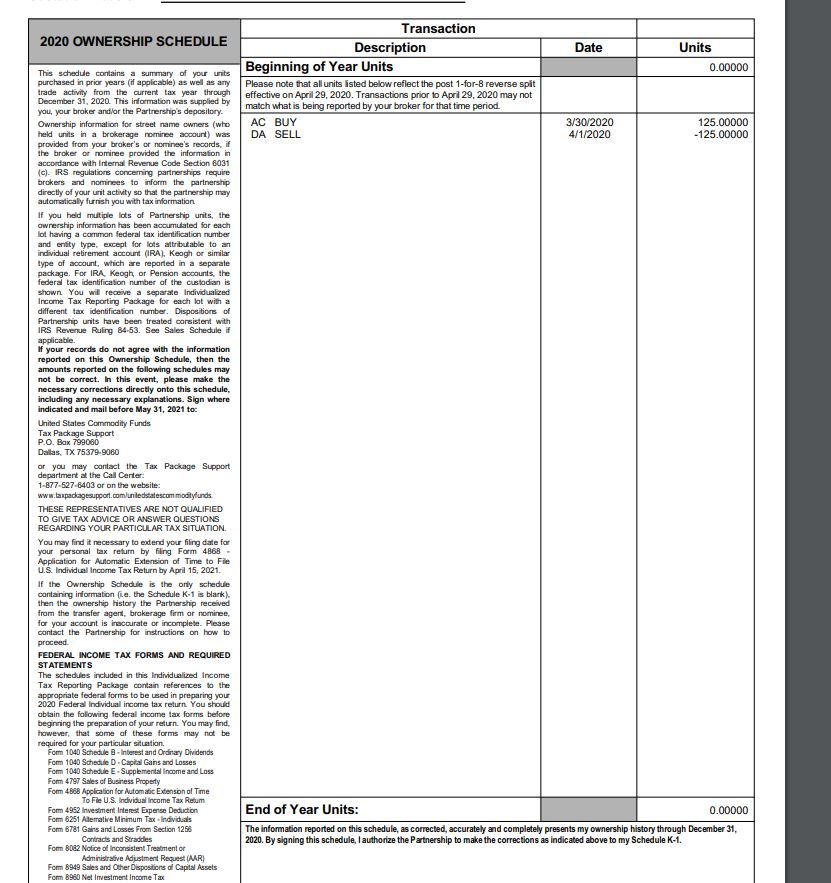

I bought 1000 USO shares on 3/29/20 at a price of $4.22 and sold all 1000 shares two days later on 4/1/20 for a scratch at $4.22. No profit no loss. (USO did a reverse split 1 for 8 so they adjusted me to 125 shares at some point)

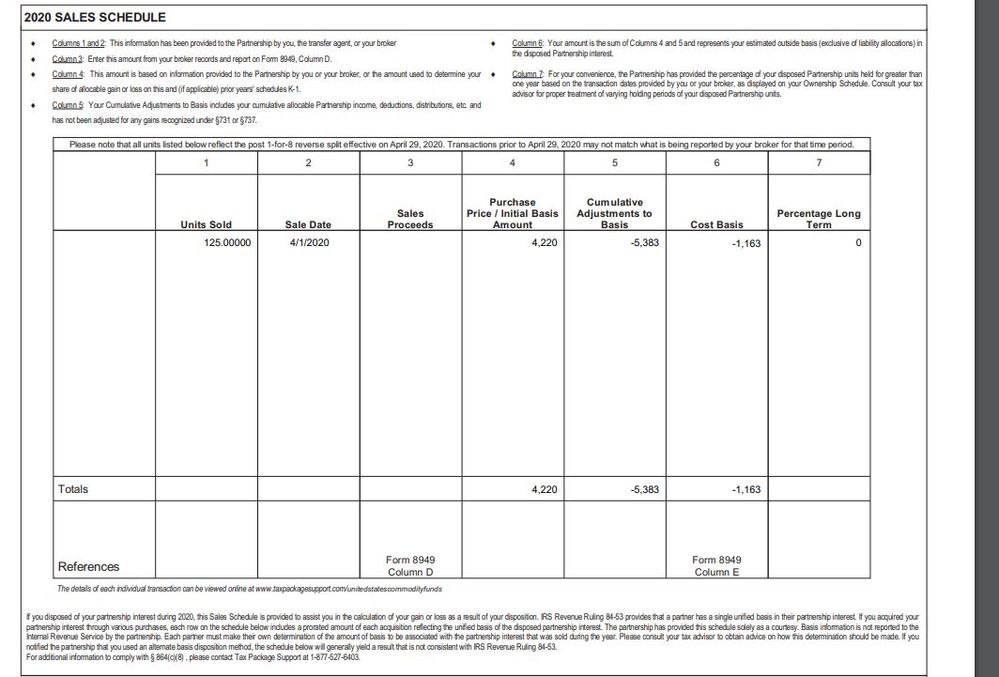

So I put a total of $4220 into this, and now I'm looking at the K-1 and it's showing a loss in Box 11C of -$5,382. I have no idea where they are getting these crazy numbers, but they assure me they are correct.

Even if I go with the numbers, and put the loss in where the software asks me to (which then puts the loss on Form 6781 I think), then if I understand correctly, I believe I'm supposed to adjust my cost basis down from my 1099B by -$5,382. If that's correct, it would give me a negative cost basis:

$4,220 - $5,382= -$1,163

Can I do this? What am I supposed to do here? Thank you to anyone that can help!