- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Used farm equipment asset class - TurboTax says 5 year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Used farm equipment asset class - TurboTax says 5 year

I am entering my used farm equipment purchases (tractor, implements) for depreciation, and everything I've found online indicates they should be 7-year property. However, when I enter them in TurboTax, it puts them in as 5-year property. If I go back through the Edit button to review the information, the "I purchased this asset new" box is checked, even though I selected "None of the above" when I entered the asset. If I deselect the "I purchased this asset new" box and continue, it still keeps it at 5-year depreciation and the box is again checked when I go back through to review. Can anyone explain this? Isn't used farm equipment (such as a tractor implement) supposed to be 7-year depreciation? I have a screen capture video of this occurring during the asset entry, and I'm concerned that my previous years' taxes may have been incorrect due to this issue. I first noticed it on 2019, but I think it's the same for previous years, as well.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Used farm equipment asset class - TurboTax says 5 year

Per PUB 225, a new tractor (new farm machinery and equipment) has a useful life under GDs of 5 years. This changed with TCJA. A used tractor still has a life of seven years.

[Edited 3/9/21|1:18 PM EST]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Used farm equipment asset class - TurboTax says 5 year

Colleen,

Thanks for replying, but I'm specifically asking about USED farm equipment and machinery (specifically an implement which attaches to a tractor). To clarify, it was purchased from someone else, and is several years old. Here's what I've found:

Changes to treatment of certain farm property

The new law shortens the recovery period for machinery and equipment used in a farming business from seven to five years. This shorter recovery period, however, doesn’t apply to grain bins, cotton ginning assets, fences or other land improvements. The original use of the property must occur after Dec. 31, 2017. This recovery period is effective for eligible property placed in service after Dec. 31, 2017.

Per Pub 946: https://www.irs.gov/publications/p946#en_US_2019_publink[phone number removed]

5-year property...

h. Any machinery equipment (other than any grain bin, cotton ginning asset, fence, or other land improvement) used in a farming business and placed in service after 2017, in tax years ending after 2017. The original use of the property must begin with you after 2017.

7-year property...

b. Used agricultural machinery and equipment placed in service after 2017, grain bins, cotton ginning assets, or fences used in a farming business (but no other land improvements).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Used farm equipment asset class - TurboTax says 5 year

The equipment while new to you, is used and would be 7 years. This begins your use of the tractor. You deserve to get your money out of it. You are depreciating the tractor over a 7 year period based on what you paid. If the tractor does not last that long, you would do a disposal to claim the rest of the money. If the tractor lasts longer than 7 years, you got your money out of it.

The tools could be supplies or may need to be depreciated, depending on the cost. Invoices/ costs under $2,500 can fall under de minimis rules and be written off, not subject to depreciation. See Tangible Property Final Regulations | Internal Revenue Service & Reform Changes

[Edited 3/9/2021 | 11:43 am PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Used farm equipment asset class - TurboTax says 5 year

However we sometimes don't make a lot of profit and may want to stretch the item over the 7 year period. All equipment is new if using your it's new to you. I thought the 7 year was for purchased equipment that is used when purchased. I'm not sure depreciating quicker is always the best choice and TT should certainly allow for this which I think in the past they did. I remember being asked if equipment was used or new. We should have the option.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Used farm equipment asset class - TurboTax says 5 year

The following information is taken from IRS Publication 225, which is the famer's guide (also provided by @ColeenD3).

Property used in farming business.

For 3-, 5-, 7-, or 10-year property used in a farming business and placed in service after 2017, the 150% declining balance method is no longer required. However, for 15- or 20-year property placed in service in a farming business, you must use the 150% declining balance method over a GDS recovery period or you can elect one of the following methods.

Tax Reform under the Tax Cuts and Jobs Act (after 2017):

The TCJA changes how farmers and ranchers depreciate their business property. Here are changes to depreciation that affect farmers:

- New equipment and machinery is five-year property.

- Used equipment remains seven-year property.

- The 150-percent declining balance method is not required for property used in a farming business and placed in service after December 31, 2017.

As a reminder, you can choose to use the alternative depreciation system (ADS) versus the general depreciation system (GDS) for a lower depreciation amount and more evenly averaged using the straight line method, sometimes a longer recovery period, but not always. It depends on the equipment. The GDS uses an accelerated method.

Please use the chart in the publication provided because it's not optional. If you use ADS, you use the required recovery period, if you use GDS then you would use the required recovery period. Both are based on IRS tax law. The links are provided for your convenience and review if you choose.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Used farm equipment asset class - TurboTax says 5 year

So if i buy a piece of used farm machinery isn't it 7 year? There is no selection for used equipment in TT to place it on the 7 year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Used farm equipment asset class - TurboTax says 5 year

Thank you, Coleen and Amy, for updating your answers. My question about how to enter it as 7 year property in TT still stands, since TT automatically changes it to 5-year when I enter it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Used farm equipment asset class - TurboTax says 5 year

Thank you, Amy, for updating your answer. My question about how to enter it as 7 year property in TT still stands, since TT automatically changes it to 5-year when I enter it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Used farm equipment asset class - TurboTax says 5 year

I have the same problem. I went to the asset entry worksheet form (line 47) and changed the life to 7 years . TurboTax tells me that the calculated value for the Asset Class (i.e. 5 years) is the only valid choice based on type of asset selected and that I should cancel the override. However, as you noted, since the IRS says that used farm equipment is 7 year property, I am sticking with the 7 year asset life.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Used farm equipment asset class - TurboTax says 5 year

Rather than override, simply choose general purpose tools to provide a work-around in the program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Used farm equipment asset class - TurboTax says 5 year

I am encountering this same issue. I have about 15 used farm equip items to enter and TT always defaults it to 5 year and I can't find a place to change that. I spoke with a live tax expert and they recommended using the "general purpose tools" section instead of the farm equipment section. I don't see the category of "general purpose tools" as a work-around. I tried to enter it into the "Tools, Machinery, Equipment, Furniture" section, and that goes to 5 year as well. What should I do to enter all this farm equipment correctly as 7 year items?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Used farm equipment asset class - TurboTax says 5 year

I personally do not like work-arounds. (I think of the problem of entering something as a tool when it is actually equipment and I shudder to think about an audit.) I did this year what I did last year. Go to the asset entry worksheet form, line 46 and change the life to 7 years . TurboTax will tell you that the calculated value for the Asset Class (i.e. 5 years) is the only valid choice based on type of asset selected and that you should cancel the override. However, since the IRS says that used farm equipment is 7 year property, I am sticking with the 7 year asset life. You can access the asset entry worksheet form when you are entering the asset. It takes less than a minute to do this -- and you are assured that the information is correct. Turbo Tax should change this; not everyone using Turbo Tax knows that used farm machinery has a 7 year life. I don't understand why they want you to use workarounds.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Used farm equipment asset class - TurboTax says 5 year

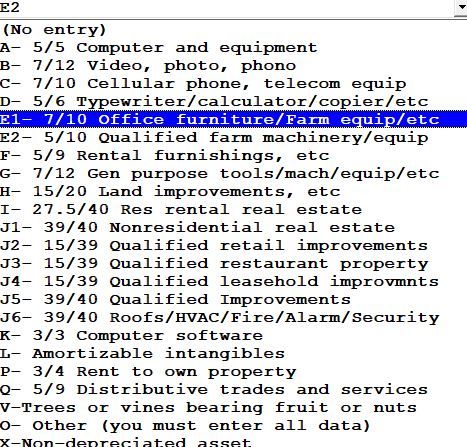

If there is an option for Office Furniture, choose that. That has the same 7/10 year recovery period.

I am a tax professional that uses ProSeries, which is built on the same base programming as TurboTax. In my software, the depreciation category is called "Office Furniture/Farm Equipment".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Used farm equipment asset class - TurboTax says 5 year

Worked like a charm. Thanks

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

unclesamiamnot

New Member

jumpinjezebel

Level 1

TLLau

Returning Member

jaketdotson

New Member

in Education

mwpnw

Level 1