- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- State tax free dividends

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax free dividends

I am filing an 1120S and part of the dividends I received should be state tax free. I don't see anywhere on the 1120S I can enter this in. I also looked at the K-1 that the business produced and I don't see how I can push the tax free dividend onto my 1040. What should I do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax free dividends

are they tax free for federal? if not, why are they tax free for state and what state? the answer is that there may a specific line on 1120s and thus flow-thru to k-1 and state k-1 to enter this rather than as regular dividend income on schedule K line 5.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax free dividends

Thanks for the quick response. Treasuries are federally taxed and non-taxable in CA. I don't see anywhere on the 1120S or schedule K. What am I missing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax free dividends

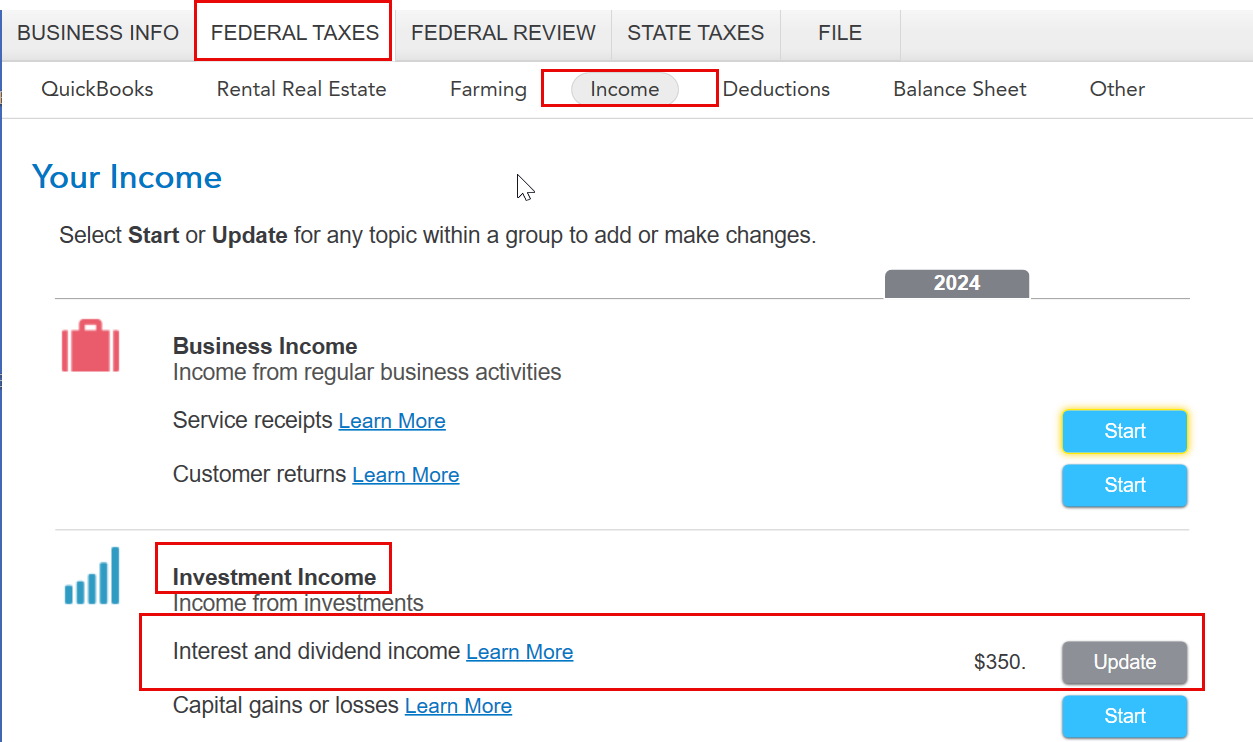

Assuming the income is from interest from U.S. obligations, it can be entered in TurboTax Business but the entry point will be slightly different. In TurboTax, this would have been entered in the Federal Taxes tab under the income section. Select update/start to the right of Interest and dividend income.

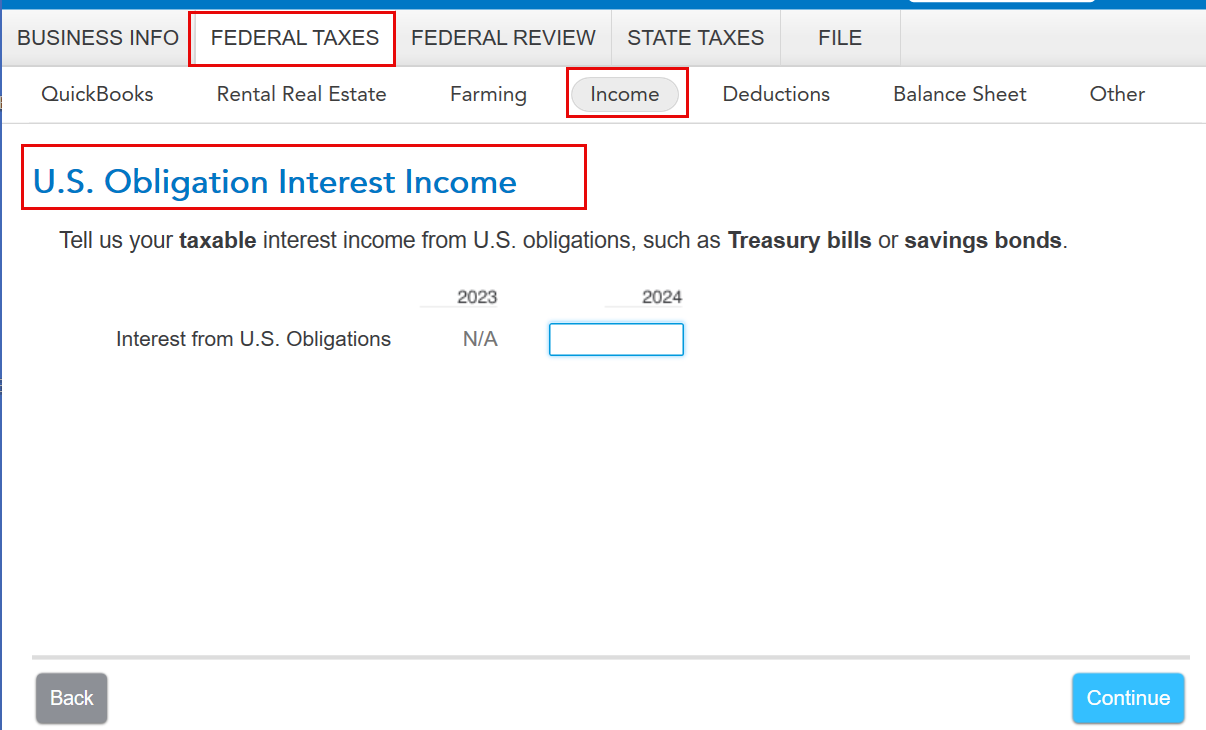

Proceed through the screens until you see a screen titled "U.S. Obligation Interest Income." You will enter your income amount here.

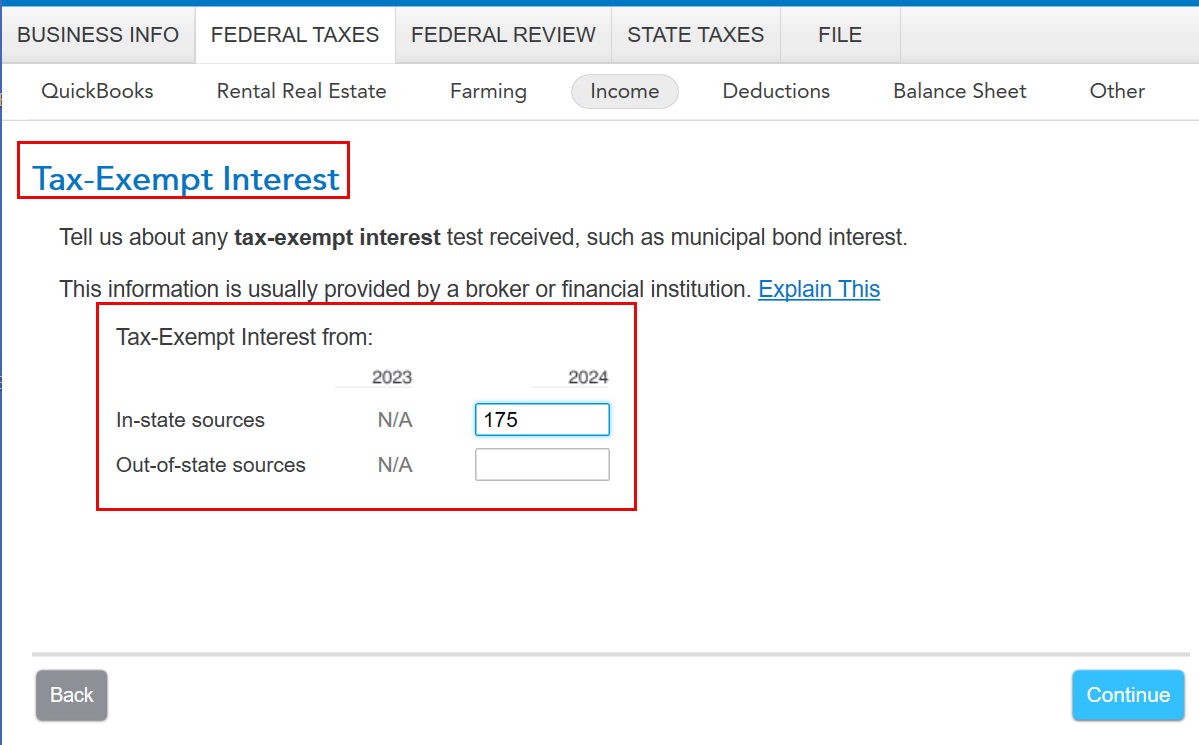

Once you make those entries, you will be able to break out any in-state or out-of-state sources if applicable on the screen titled "Tax-Exempt Interest."

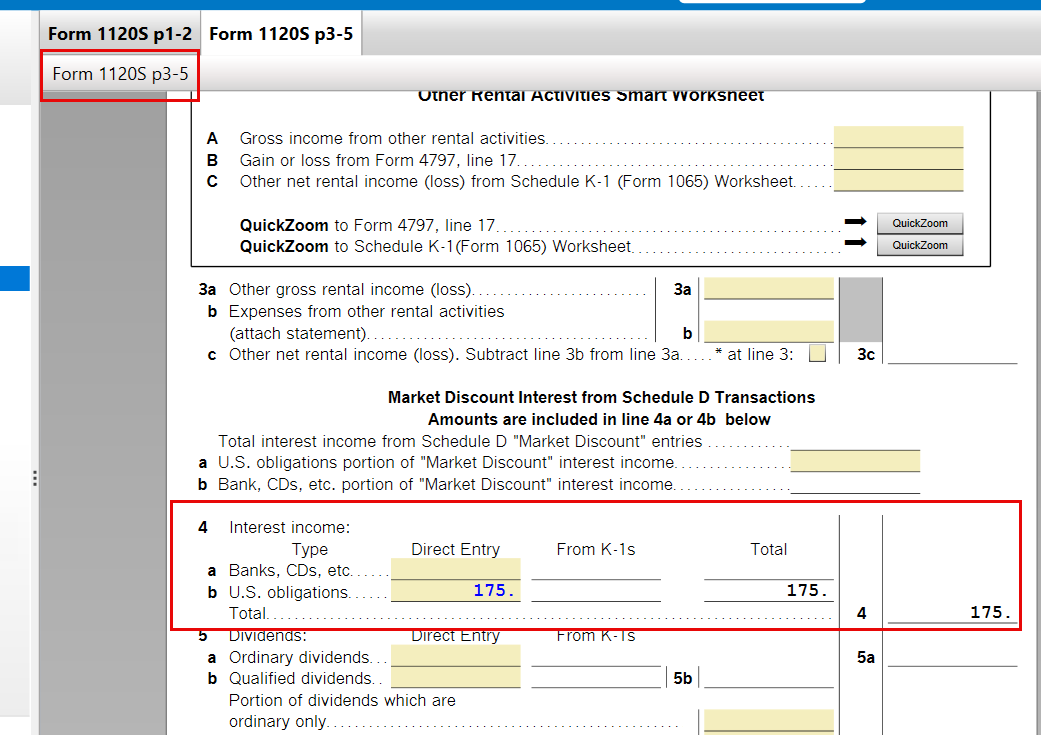

You can then preview your forms by select Forms on the top right of the program. Locate and open Form 1120-S p3-5. You should see the adjustment for U.S. obligations on line 4b as shown in the example below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

chapmandebra3

New Member

bobfrazz1019

New Member

bmc4

Returning Member

M_S2010

Level 1

nstuhr

Returning Member