- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

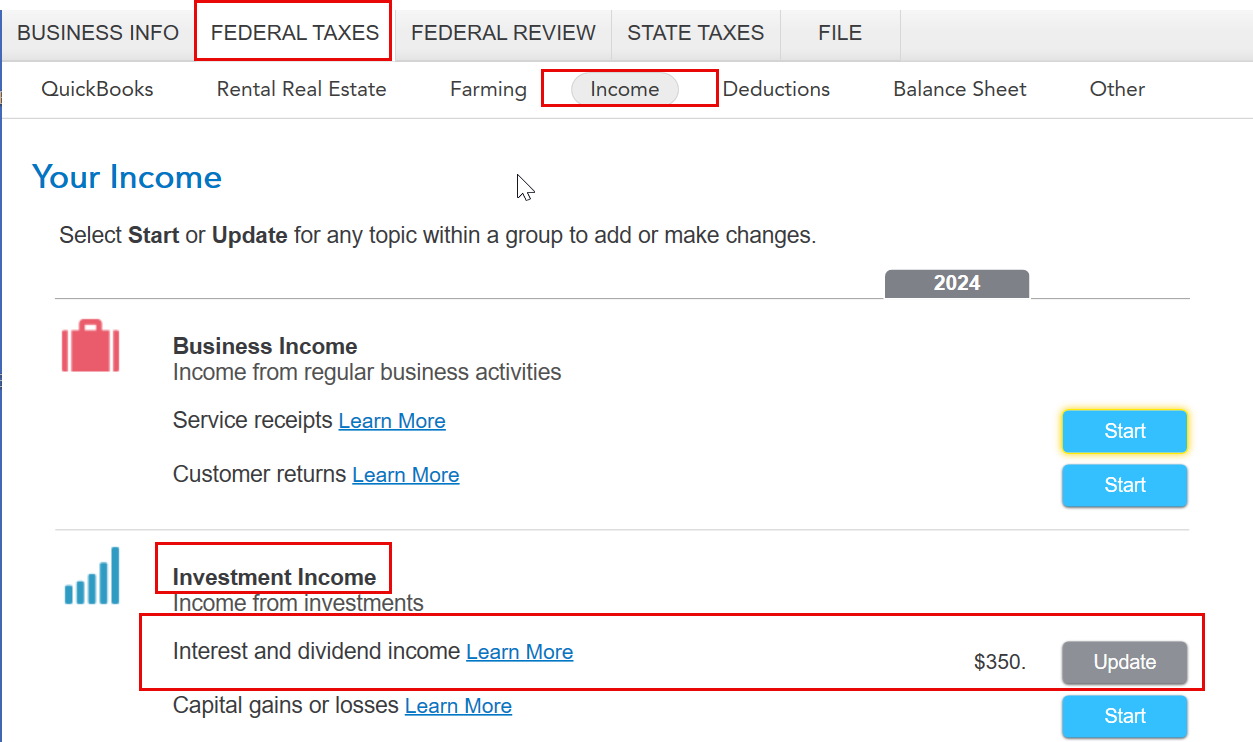

Assuming the income is from interest from U.S. obligations, it can be entered in TurboTax Business but the entry point will be slightly different. In TurboTax, this would have been entered in the Federal Taxes tab under the income section. Select update/start to the right of Interest and dividend income.

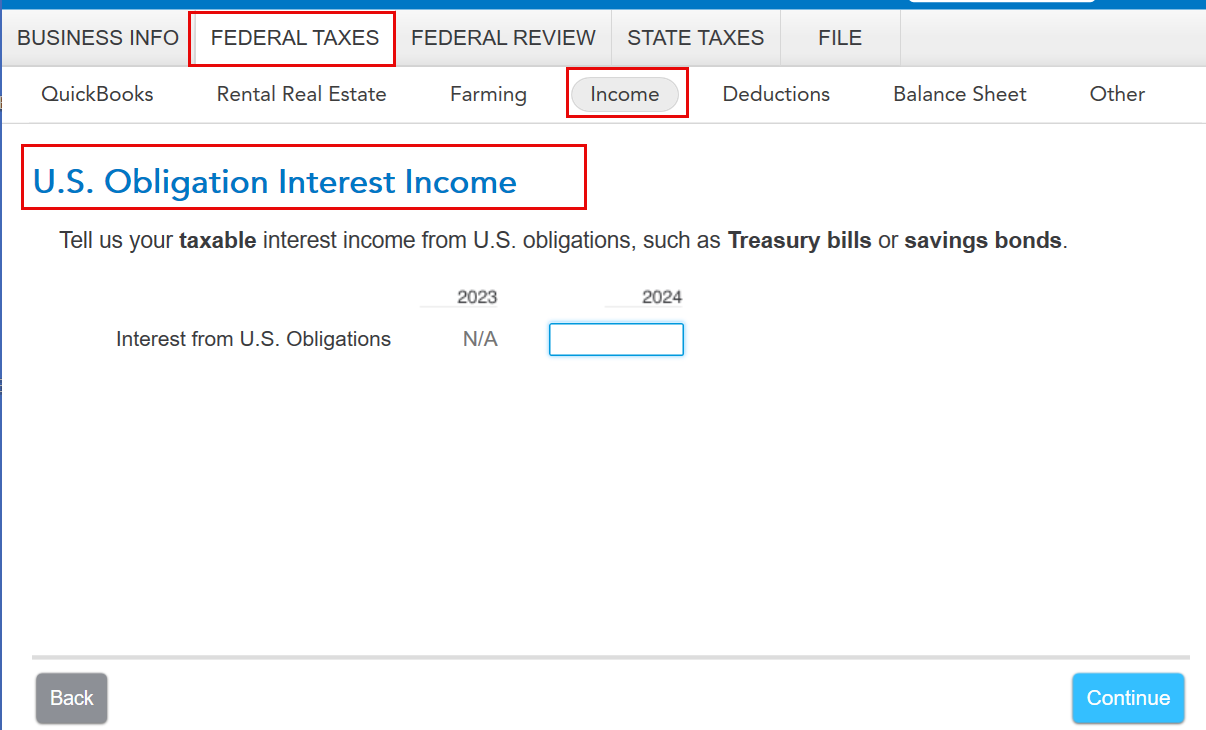

Proceed through the screens until you see a screen titled "U.S. Obligation Interest Income." You will enter your income amount here.

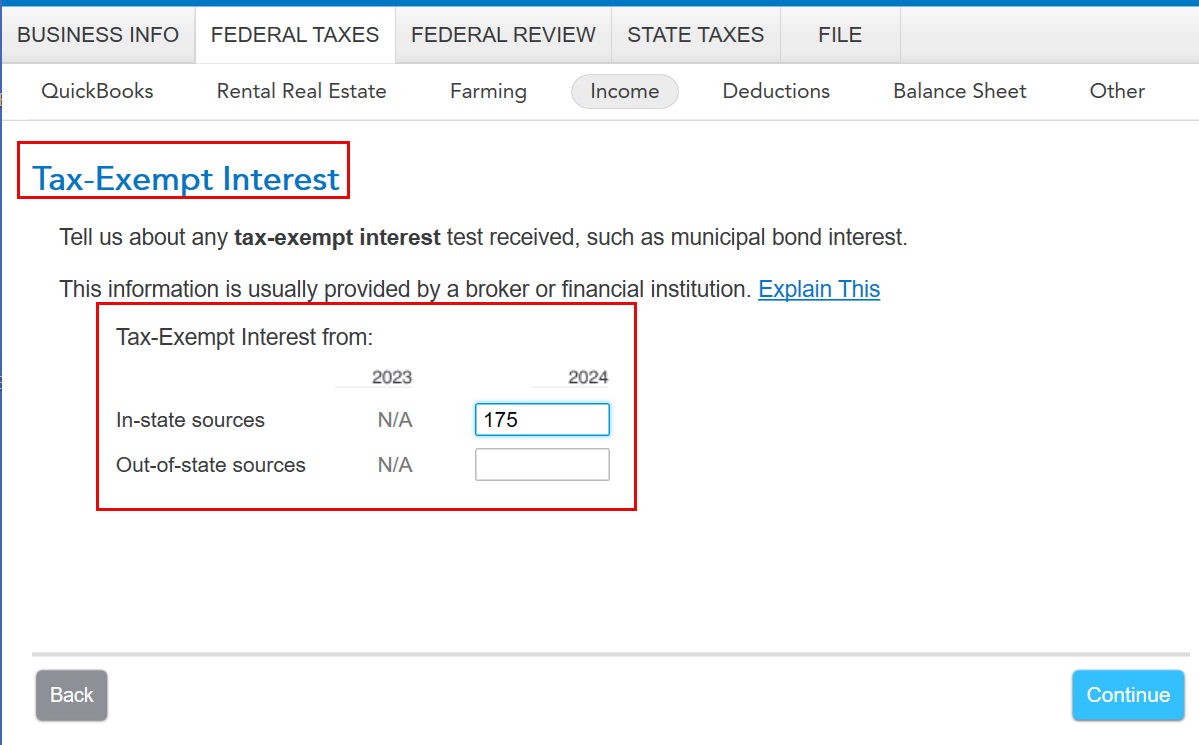

Once you make those entries, you will be able to break out any in-state or out-of-state sources if applicable on the screen titled "Tax-Exempt Interest."

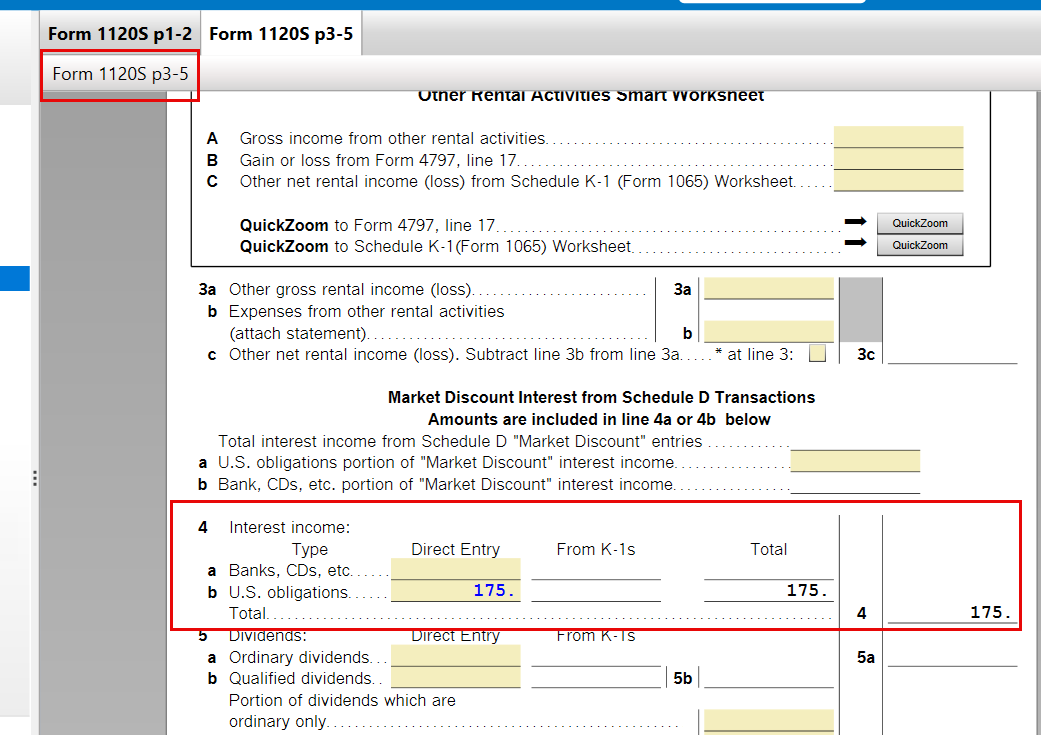

You can then preview your forms by select Forms on the top right of the program. Locate and open Form 1120-S p3-5. You should see the adjustment for U.S. obligations on line 4b as shown in the example below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"