- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Solo 401k and its effect on w2, 1120S and 941

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solo 401k and its effect on w2, 1120S and 941

I have contributed (through my S corp):

$ 30,000 - Elective deferral Solo 401K, of which

$ 12,000 - is employee contribution (profit sharing) and

$ 18,000 - is the Employer contribution (elective deferral).

How would my W2 reflect above contribution apart from entry on 12 D.?

My questions for the pros for W2 form are-

1. What should be the amount on Box 1

2. What should be the amounts on Box 3 and 5

3. What should be the amount on Box 12 D

Questions about 1120 S form

4. Line 17 is for the profit sharing plans etc… so should It show $12000?

5. What should be on Line 8 which is for salaries & wages, Should this amount be $30000

6. What should we report on Forms 941/940 related to solo 401K?

As per above example, do we report 30,000 on Form 941 Line 2, & 48,000 on Form 941 5a, 5c?

Please help in the above situation.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solo 401k and its effect on w2, 1120S and 941

You are confusing the terms:

- $18,000 is your elective deferral

- $12,000 is your employer profit sharing contribution

- $30,000 is the sum of your elective deferral and your employer contribution

Regarding your W-2:

- Box 1 = $30,000

- Boxes 3 and 5 = $48,000

- Box 12 = code D, $18,000

Form 1120S should show:

- line 8 [actually line 7 for officers of the company, see comments below] = $30,000

- line 17 = $30,000

Form 941:

- line 2 = $30,000

- Lines 5a and 5c = $48,000

I'm not familiar with Form 940, so I will refrain from commenting on that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solo 401k and its effect on w2, 1120S and 941

Line 7- Compensation of officers- $48,000

Line 18- Pensions, Profit share, etc- $12,000

Even though the total expense is the same at $60k, the company’s expense is $48k for wages, and $12k in Employer contributions, the reduced amount of Officer Compensation could be deemed insufficient compensation of >2% shareholders.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solo 401k and its effect on w2, 1120S and 941

The instructions for lines 7 and 8 of Form 1120S say:

"Don't include salaries and wages reported elsewhere on the return, such as amounts included in cost of goods sold,

elective contributions to a section 401(k) cash or deferred arrangement, or amounts contributed under a salary reduction SEP agreement or a SIMPLE IRA plan."

However, there is some ambiguity here since it does not say that the elective deferrals of officers *must* be shown on line 17 rather than on line 7 or 8, but I think they should be. If Form 1125-E is required, The $18,000 of elective deferral would be included on Form 1125-E line 3 to produce $30,000 on line 4 to transfer to Form 1120S line 7. The instructions for Form 1125-E line 3 say:

"Enter compensation of officers deductible elsewhere on the return, such as amounts included in cost of goods sold, elective contributions to a section 401(k) cash or deferred arrangement, or amounts contributed under a salary reduction SEP agreement or a SIMPLE IRA plan."

Pension, Profit-Sharing, etc., Plans is line 17 of Form 1120S, not line 18. Line 18 is for fringe benefits paid to employees owning 2% or less of the company.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solo 401k and its effect on w2, 1120S and 941

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solo 401k and its effect on w2, 1120S and 941

The only difference with a contribution to the Designated Roth Account in the 401(k) is that the amount would not be included on Form 1120S line 17 because it is not deductible. It also would not reduce the amount on line 7 for officers or line 8 for other employees. In other words, Roth contributions will not be reflected anywhere on Form 1120S. The only place it appears in tax reporting documents is with code AA in box 12 of the officer's or other employee's W-2.

I did not mean to suggest that Form 1125-E would be required when the entity has less than $500,000 in total receipts. I was using the calculation method on Form 1125-E simply to justify not including elective deferrals on Form 1120S line 7 or 8 and including them on line 17 instead.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solo 401k and its effect on w2, 1120S and 941

Dmertz,

Does this mean that we can use box 3 instead of box 1 to calculate the max S-Corp Employer contribution (25% of salary) to a 401(k)? That is good news since box 3 is a bigger number than box 1. I just haven't been able to find out yet which W2 box to use for determining my maximum contribution (as sole owner/employee of my S-Corp).

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solo 401k and its effect on w2, 1120S and 941

Actually, in most cases box 5 reflects your compensation. Box 3 is limited to the Social Security wage base, $132,900 for 2019.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solo 401k and its effect on w2, 1120S and 941

Yea there is some ambiguity in the instructions. The instructions for lines 7 and 8 of Form 1120S, the key words are "...reported elsewhere on the return...". I took that to mean that if you reported the 401k elective deferral on line 17, don't also report it under line7/8. And then Line 17 also uses the same wording "Enter the deductible contributions not claimed elsewhere on the return...". I took it to mean if you place the contribution on one of the lines, don't also include it on the other line. But from my interpretation, I would come to the conclusion that one could put the 401k employee elective deferral on line 7 or line 17.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solo 401k and its effect on w2, 1120S and 941

The IRS permits the elective deferrals t to be reported on either line 7 or line 17. However, I believe that TurboTax Business wants to see agreement between the line 7 amount (or perhaps the sum of line 7 and line 8 amounts) and the sum of W-2 box 1 amounts. If the elective deferral is included on line 7, I think that causes TurboTax to complain of a mismatch in the sums.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solo 401k and its effect on w2, 1120S and 941

So, on my W2, what number do I put in Box '16' (State wages, tips, etc.)? Should it match Box 1 of my W2, or Boxes 3 and 5?

I pay myself a salary of $42,000, I am doing $19,000 elective deferral and $6,000 employer profit sharing. I put $25,000 in my Solo 401K.

- Box 1 = $23,000

- Boxes 3 and 5 = $42,000

- Box 12 = code D, $19,000

- Box 16 = ??????????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solo 401k and its effect on w2, 1120S and 941

State wages should match federal wages (except perhaps in California if an HSA contribution was made through the employer; HSA contributions made through an employer to a resident of California are not excludible from state income).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solo 401k and its effect on w2, 1120S and 941

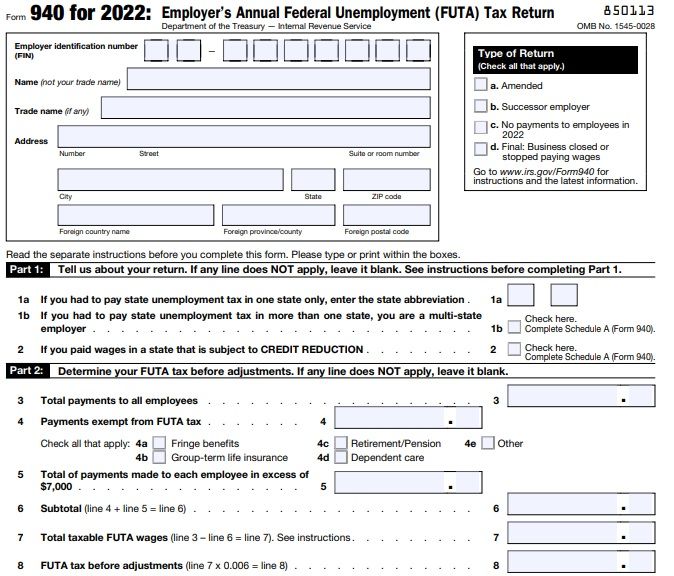

This is a very helpful thread @dmertz, thank you. Can you tag anyone who can answer the Form 940 part? Should box 3 on Form 940 match Box 1 of W2 (or boxes 3&5)? Then I suppose you check box 4c for Retirement /Pension?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solo 401k and its effect on w2, 1120S and 941

Box 3 on Form 940 should show ALL compensation paid to employees during the year regardless of other reporting (or taxable) limits. In the example in the original question, box 3 on the Form 940 would be $48,000. Then box 4 would be $18,000 and box 4c would be marked.

Box 3 total payments are defined by the IRS as:

Compensation, such as the following.

—Salaries, wages, commissions, fees, bonuses, vacation allowances, and amounts you paid to full-time, part-time, or temporary employees.

Fringe benefits, such as the following.

—Sick pay (including third-party sick pay if liability is transferred to the employer). For details on sick pay, see Pub. 15-A, Employer's Supplemental Tax Guide.

—The value of goods, lodging, food, clothing, and non-cash fringe benefits.

—Section 125 (cafeteria) plan benefits.

Retirement/Pension, such as the following.

—Employer contributions to a 401(k) plan, payments to an Archer MSA, payments under adoption assistance programs, and contributions to SIMPLE retirement accounts (including elective salary reduction contributions).

—Amounts deferred under a non-qualified deferred compensation plan.

Other payments, such as the following.

—Tips of $20 or more in a month that your employees reported to you.

—Payments made by a predecessor employer to the employees of a business you acquired.

—Payments to nonemployees who are treated as your employees by the state unemployment tax agency.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solo 401k and its effect on w2, 1120S and 941

Thanks for the specifics.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mgc6288

Level 4

ESmithCA

Returning Member

Marjie33

Level 1

mgasparibc

New Member

jamesjr-baladez

New Member