- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- smart check bug - Keogh/SEP/Simple contribution worksheet: Line 6a

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

smart check bug - Keogh/SEP/Simple contribution worksheet: Line 6a

2020 tax year product, The full message is "Keogh/SEP/Simple Contribution Worksheet: Line 6a, Taxpayer elective deferrals to an individual 401(k) plan should not be greater than $19500" The amount on the line is not greater but is equal to the value and the smart check flags this as an error, if I zero it out the error goes away but then another error comes up because the sum of the contributions does not match the total, catch up + Employer match + employee elective deferrals

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

smart check bug - Keogh/SEP/Simple contribution worksheet: Line 6a

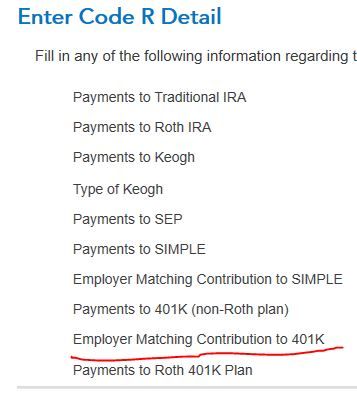

With the help of a fellow partner I identified the issue. It is an entry issue during the interview for my K-1.

when entering any Employer contribution reported in box13 code R of your K-1, make sure to enter it on the line shown and NOT the line above. Although it is not exactly a "matching contribution" in my case it is an employer profit share, if entered in the line above TT assumes it is employee elective deferral and then generates the erroneous error described in the post above.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

smart check bug - Keogh/SEP/Simple contribution worksheet: Line 6a

With the help of a fellow partner I identified the issue. It is an entry issue during the interview for my K-1.

when entering any Employer contribution reported in box13 code R of your K-1, make sure to enter it on the line shown and NOT the line above. Although it is not exactly a "matching contribution" in my case it is an employer profit share, if entered in the line above TT assumes it is employee elective deferral and then generates the erroneous error described in the post above.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

smart check bug - Keogh/SEP/Simple contribution worksheet: Line 6a

I have the same problem with line 6a on the Keough, SEP and Simple Contribution Worksheet, re-entered the 401(k) contribution exactly as described in the response to the original question and still got the number 0 on line 6a flagged with an error. Any other suggestions? What happens if I simply ignore the error and file my return anyway? Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

smart check bug - Keogh/SEP/Simple contribution worksheet: Line 6a

I encountered the same issue and by following the instructions was able to file my return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

smart check bug - Keogh/SEP/Simple contribution worksheet: Line 6a

I would not recommend filing with the error. I assume some entry error similar to what I did, I would recommend rechecking your entries for each contribution and be sure that they are properly categorized

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

smart check bug - Keogh/SEP/Simple contribution worksheet: Line 6a

Unfortunately, it won't let you electronically file so long as it perceives the "0" to be an error. I'm running into the problem with line 7b of the worksheet. It doesn't like the "0" on that line and I can't figure out how to make it okay.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

smart check bug - Keogh/SEP/Simple contribution worksheet: Line 6a

Hey TurboTax, fix the bug. If you put in $19500, that is not more than $19500.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tianwaifeixian

Level 4

randob

Level 2

eedavies4

New Member

soccerfan1357

Level 1

tianwaifeixian

Level 4