- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Schedule K1 box 20 code Z

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 box 20 code Z

I am doing my S corporation tax return with turbotax business.

I received a schedule K1 from my partnership.

on my K1, in box 20, it says: Z* STMT.

I came to a step " enter box 20 information ", I select "Z" on Select Code drop box, I do not know which number should I enter....

I received Statement A- QBI Pass-through Entity Reporting(Schedule K-1, Box 20, Code Z) along with K-1.

But I do not know how to use the information in this statement, and cannot find anywhere in Turbotax to enter this statement information.

I will state an information on Statement A.

______________________________________________________

Partner's share of : SSTB

QBI or qualified PTP items subject to partner-specific determinations:

ordinary business income(loss): (this number is same as in K-1 box1)

Section 179 deduction:(this number is same as in K-1 box 12)

Charitable contrubutions ATT.:(this number is same as in K-1 box 13)

W-2 wages : (this number is not found any elsewhere in K-1, and is less than number in K-1 box 4)

UBIA of qualified property :( this number is not found any elsewhere in K-1)

Section 199A dividends : blank box

_______________________________________________________

Please help !!!!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 box 20 code Z

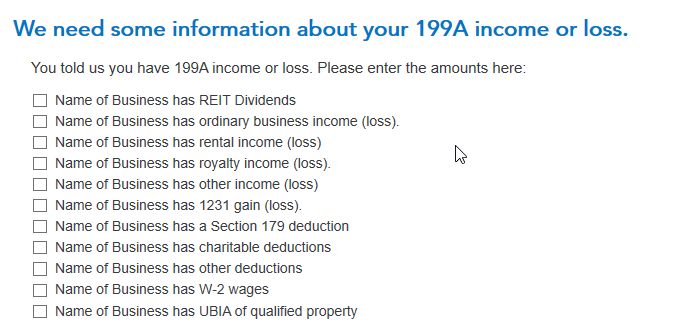

Enter the code Z when you enter the K-1 box 20 screen, but you don't need to enter an amount on that screen. Continue on, and you'll eventually find the screen "We need some more information about your 199A income or loss". When you check the box next to a category on that screen, a place will open up to enter the amounts from the Statement or STMT that came with your K-1. The applicable category (or categories) on this screen (and the following "Let's check for some uncommon adjustments" screen, if applicable) must be completed in order for your K-1 QBI information to be correctly input into TurboTax.

To get back to the K-1 summary screen and find the Schedule K-1 to edit, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to find the K-1 you need to edit.

Here are the "We need some information about your 199A income or loss" and "Let's check for some uncommon adjustments" screens where you enter the information from your K-1 Section 199A Statement/STMT:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17696276279

New Member

mcknight

New Member

t482

New Member

mark1110

Level 2

in [Event] MetLife & TurboTax Present: The Ask Us Anything Forum

user17696251199

New Member

in [Event] MetLife & TurboTax Present: The Ask Us Anything Forum