- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Will e-file be supported for Form 8995A Schedule B by April 15th? July 15th?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Will e-file be supported for Form 8995A Schedule B by April 15th? July 15th?

I have everything good to go and my QBI Aggregation looks great. I am unable to e-file because Schedule B (aggregation) of 8995-A is not yet supported as of 3/29/2020 in TurboTax.

Is this being actively worked on where I can wait and e-file instead of paper filing? I have seen other questions similar to @DavidS127 but the responses were more to help correctly set up aggregation, not if e-file was going to be supported soon.

Thanks,

Steve

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Will e-file be supported for Form 8995A Schedule B by April 15th? July 15th?

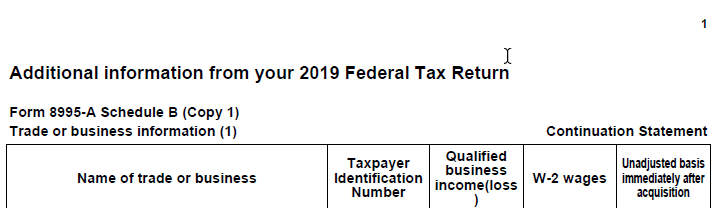

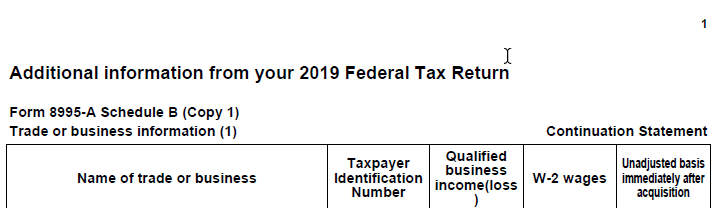

When I aggregated 4 businesses together in TurboTax, and "print/previewed" the Schedule B, I got the same result. Note, however, that the PDF includes a "Continuation Statement" with the title "Additional information from your 2019 Federal Tax Return". It shows in the PDF bookmarks as "Additional Information". That Additional Information Continuation Statement has the other two businesses listed.

The reason TurboTax does this is that the actual IRS Form 8995A Schedule B form doesn't have "room" for more than two businesses, so this additional information statement is needed.

Here is a screenshot if the heading for that Additional Information statement:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Will e-file be supported for Form 8995A Schedule B by April 15th? July 15th?

Form 8995-A Schedule B e-file will be enabled in the update scheduled on or about 4/1/2020.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Will e-file be supported for Form 8995A Schedule B by April 15th? July 15th?

So any day now?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Will e-file be supported for Form 8995A Schedule B by April 15th? July 15th?

The form has not been approved yet by the IRS for e-filing. Every new or updated tax form must pass several checkpoints before TurboTax can incorporate the form on it's software. Here's how it works:

- The government must approve the form to make sure it follows the tax law.

- The government then has to approve the tax software-specific version of that form.

- We then rigorously test the form in the software to ensure it's accurate.

- The government gives our form their final stamp of approval.

- We can then include it in the TurboTax program.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Will e-file be supported for Form 8995A Schedule B by April 15th? July 15th?

Hi @DavidS127

It appears that turbotax is able to e-file now with the latest update. However when I look at my FORM 8995-A Schedule B, line 3, I think there may be an error.

I have 4 businesses listed, all 4 show up in the online GUI with a vertical scroll bar to see them. However on the print version like 1 & 2 are filled out with my first 2 (of 4) businesses but line 3 (there are only 3 lines) says "See Statement".

I cannot find a document anywhere that has the "Statement" and thus I am missing 2 lines of businesses showing up in the PDF. Is this an error or where are the other 2 businesses listed?

Thanks

Steve

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Will e-file be supported for Form 8995A Schedule B by April 15th? July 15th?

When I aggregated 4 businesses together in TurboTax, and "print/previewed" the Schedule B, I got the same result. Note, however, that the PDF includes a "Continuation Statement" with the title "Additional information from your 2019 Federal Tax Return". It shows in the PDF bookmarks as "Additional Information". That Additional Information Continuation Statement has the other two businesses listed.

The reason TurboTax does this is that the actual IRS Form 8995A Schedule B form doesn't have "room" for more than two businesses, so this additional information statement is needed.

Here is a screenshot if the heading for that Additional Information statement:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dinesh_grad

New Member

gtchen66

Level 2

johntheretiree

Level 2

mc_downes

New Member

saikrishnanaidupasyavula

New Member