- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Where in TurboTax do I show property purchased in Like Kind (1031) exchange

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where in TurboTax do I show property purchased in Like Kind (1031) exchange

Thanks in advance to anyone who can walk me through this. I'm probably missing something very obvious.

Searching on TurboTax, it says that once I find "Like Kind" in search, and click the link, "This will take you to Any Other Property Sales? " Nope. It doesn't.

So I'm forced to do it manually. Looking at my old rental property, I did find where I could say I disposed of it, and I was able to put in the sales price and date.

But it never asks me if it was Like Kind, or any info abotu a property I bought with the proceeds.

Help!

I did go through the proper 1031 process. Sold the property in March 2021, had an agent record the 1031, identified the new property within 30 days, and closed on it less than a month later. Where do I link this purchase up to avoid the tax hit from the capital gains?

If it matters, I'm using QuickBooks on a Mac desktop.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where in TurboTax do I show property purchased in Like Kind (1031) exchange

To enter your Like Like Exchange in TurboTax follow these steps:

- With your return open in TurboTax, search for like kind (2 words, no dash) and then click the "Jump to" link at the top of your search results.

- This will take you to Any Other Property Sales? Check the second-to-last box from the bottom for like-kind and section 1031 exchanges and click Continue.

- n the next screen, answer Yes and proceed through the interview questions. We'll fill out Form 8824 for you

This TurboTax link Where do I enter a like-kind or Section 1031 exchange (Form 8824)? has information you may find useful.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where in TurboTax do I show property purchased in Like Kind (1031) exchange

Thanks for your quick reply. I'm sorry, I'm just not seeing what the instructions say. I've had other people walk through it, and we're not getting to the "Any Other Properties" choice either.

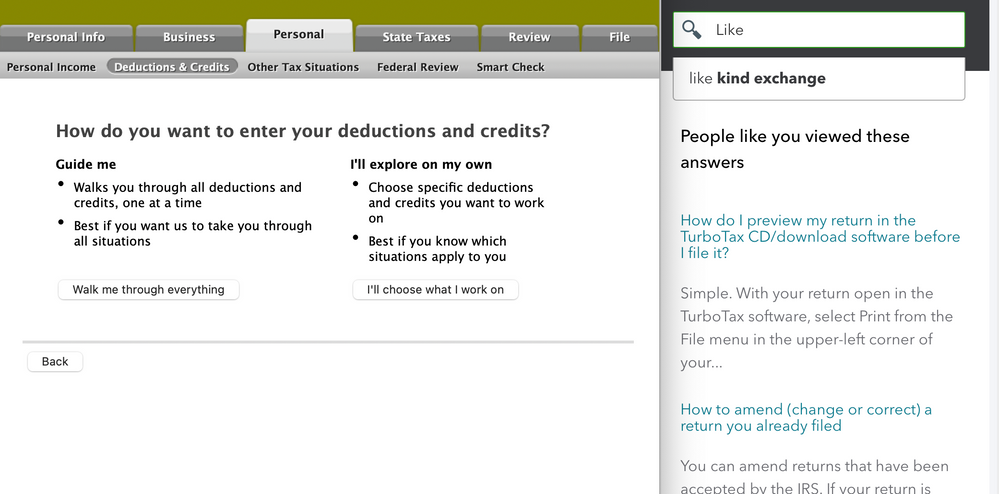

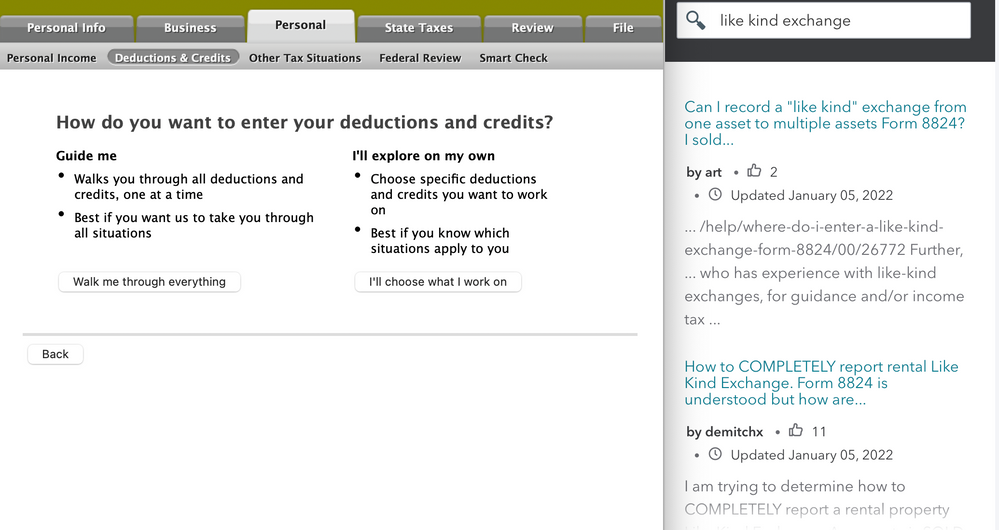

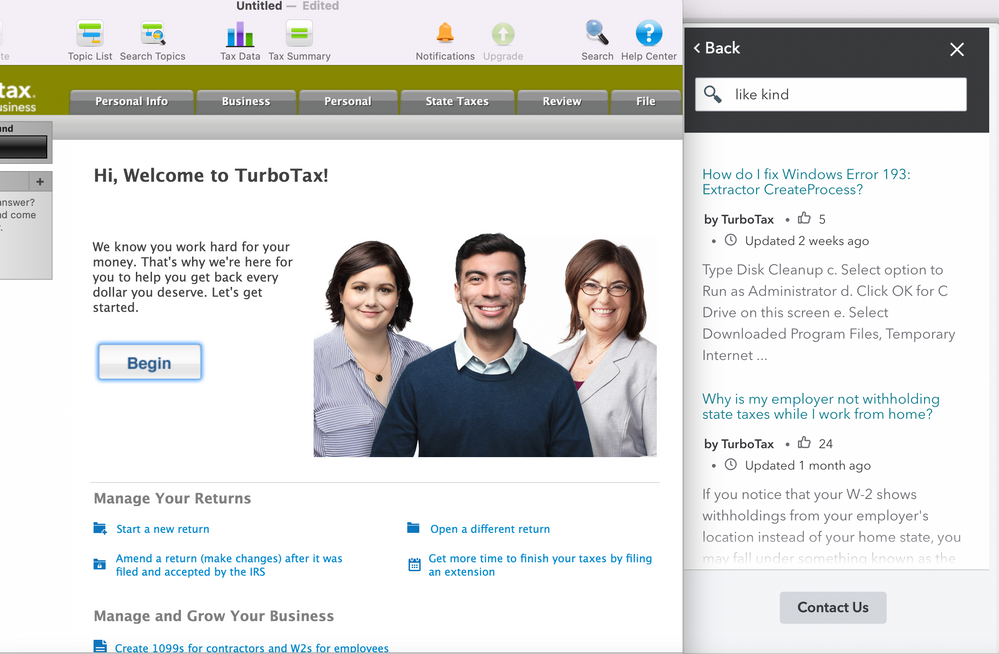

- With your return open in TurboTax, search for like kind (2 words, no dash)

- Did this. The search feature completes the phrase by offering a drop down labeled "Like Kind exchange"

- and then click the "Jump to" link at the top of your search results.

- What does "Jump to" mean? We're assuming it means to click on the drop down box that says "Like Kind exchange". We did that.

- This will take you to Any Other Property Sales?

- What does "take you to" mean? Should it open a new search page? Jump to something in my own tax return? Nothing is happening here. We just get the list of topics in the search box that all answer other questions about Like Kind exchanges.

- Check the second-to-last box from the bottom for like-kind and section 1031 exchanges

- In the search results? Second to last listing has nothing to do with our situation, and it's not in a box. I don't think this is what we're supposed to be seeing.

- Are these instructions only for TurboTax's on line version only? Nothing is displaying as these confusing instructions say it will.

- Please see screen captures below.

- Please help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where in TurboTax do I show property purchased in Like Kind (1031) exchange

It it a little trickier this year. Follow these steps:

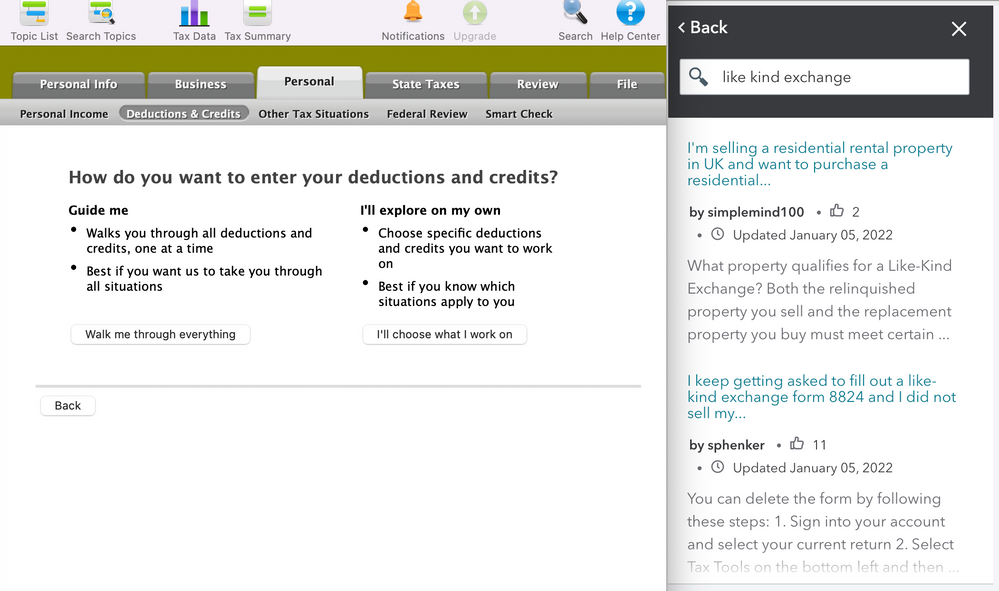

- You want to type in like kind and do not hit enter. Instead, click the magnifying glass.

- Once you click the magnifying glass, then the articles change and you get the jump to link

- Click on the jump to like kind words

- It will take you to Any Other Property Sales?

- Select 1031 Like- Kinds Exchange

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where in TurboTax do I show property purchased in Like Kind (1031) exchange

Thanks for sticking with this.

I ended up having to call TurboTax. It appears that the sequence you see was never programmed correctly for Mac users. So I never see the "Jump To" option described. (Believe me--we tried EVERY variation to make it show up. They were screen sharing with me, and could not make it appear.)

They advised I go in the back way, by adding property, and then noting it was a like kind exchange when prompted how it was purchased.

They said they'd put a ticket in for the missing code, for other Mac users.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where in TurboTax do I show property purchased in Like Kind (1031) exchange

Turbo Tax will not let me file electronically until I enter date sold. If I enter a date, it automatically considers it a capital gain. I have read in other threads on Like-kind exchanges to leave this blank. Is there a work around in Turbotax so I can efile?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where in TurboTax do I show property purchased in Like Kind (1031) exchange

Hello greddy,

I have to say, TurboTax has not done it well this year.

In addition to the problem that I had (noted above: TurboTax failed to program in the "Jump To" link to start completing forms like the 8824. This ONLY affects Mac desktop users), once I found a way to manually find and fill in the 8824, I ran into a similar issue, with the sale being counted as pure capital gains, Like-Kind exchange notwithstanding.

Far too much time speaking to the first line TurboTex Help desk people who had never heard of Like Kind exchanges, I finally got up to a senior rep ... twice. The first time, they said the TurboTax was adding the 8824 form on March 17th. In today's call, they said that while the form is finally up, it's "not ready" to use, and will be updated on March 31st.

So, looks like we have to wait to file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where in TurboTax do I show property purchased in Like Kind (1031) exchange

Did you ever get this resolved? I'm a Mac user and still can't get this to work, for the 1031 exchange. It's April 11th already!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where in TurboTax do I show property purchased in Like Kind (1031) exchange

Hi Aj90,

I'm sorry to say that though I got it in, my solution is not repeatable.

I had to called TurboTax support repeatedly. There's no way to pick up with the senior technician who had been helpful, the one who at least knew that the form hadn't been loaded yet.

Once it was loaded, after many calls another tech told me that it "wasn't ready," meaning they thought there would be more updates.

I called back and sat through long cues 4x. The worst part was that TurboTax was getting much more aggressive, trying to hang up, saying that I was asking a tax question not a product question, or trying to sell me on a support membership.

I just stuck with it, and FINALLY got someone who patiently worked through the lines with me. Even he was saying that the prompts in the form were using circular reasoning. There's one spot, when you finally get it loaded that they ask something to the effect of "Did you do X last year." And then it says, "If you did, answer No." Makes no sense.

Very disappointed with TurboTax on its set up for this sort of transaction.

I guess all I can leave you with is: hit the help line, and just keep calling until you get passed up to a human being. Sorry I can't be more help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where in TurboTax do I show property purchased in Like Kind (1031) exchange

Im in the same boat.

not a Mac user. but keep getting a gain for the year on my in-like exchange even though the prompts tell me i wont. what the heck. i have extended this long enough. Im screwed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where in TurboTax do I show property purchased in Like Kind (1031) exchange

I keep seeing this answer but my software does NOT have a search function at the top - it has Help and when I open and put in like kind it doesn't give me anything related to that. If I click on the little arrows that take me to Search and Help, I just get canned info on like kind exchanges from the "digital assistant". No jump to button anywhere. I have entered all my information 4 times after talking with one of the accountants who told me to just start over. Assuming the 8824 is correct - which I an not convinced of - it still is not transferring the information or telling me what goes where. More than the money I've spent is the inordinate amount of time I have wasted trying to get around the convoluted like kind exchange in TT and just finish the dang taxes. Can anyone just email me a step by step way to properly enter it and get it to transfer from the 8824 form? Or do I just need to pay an CPA as well? I have followed numerous instructions on here and even though I think it has figured the basis wrong (too low), I would go with it IF I could figure out how to get it put on the proper boxes from the 8824.

I'm on a Mac Desktop, Ventura 13.2 OS, using Turbotax Premier. Thanks in advance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

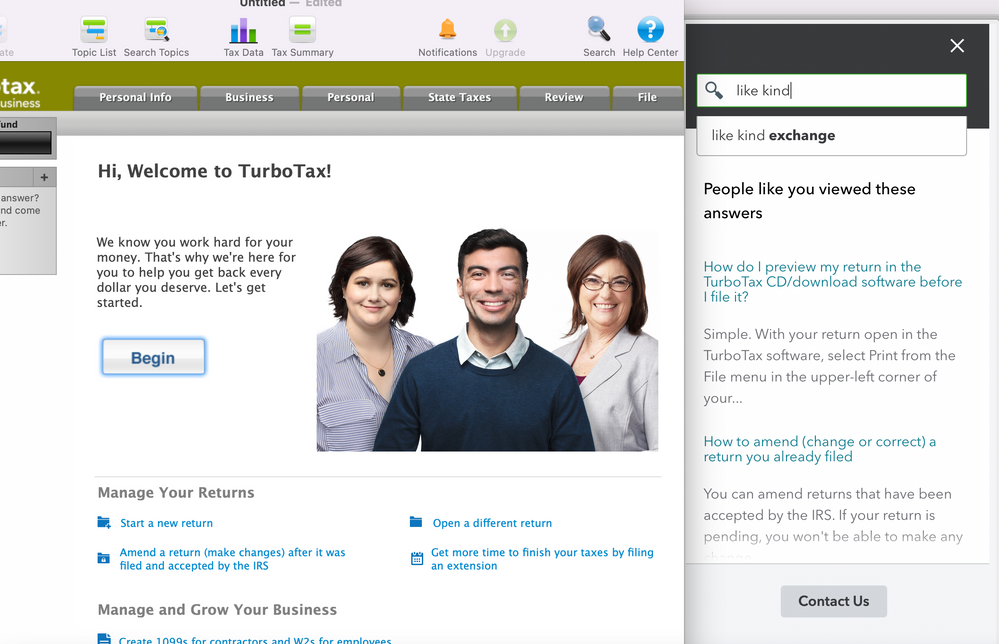

Where in TurboTax do I show property purchased in Like Kind (1031) exchange

I don't know about anyone else, but my desktop does not look like that. (Macbook Air, Ventura 13.2, Turbo Tax Premier). It forms in black, details and estimate are grayed out, then it has topic list, search topics, tax data, tax summary, notifications, and upgrades, all in black, then >>. If you click on>>, it shows Help Center and Search. If you click on search you get the digital assistant which gives you the some places to go look at, most of which say click on help and type in like kind and you're right back at square one.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where in TurboTax do I show property purchased in Like Kind (1031) exchange

A like-kind exchange begins with entering information in the following manner:

- From the screen Your income and expenses (which you access by selecting Wages & Income from the left margin)

- Scroll down to Other Business Situations.

- Click on the Show more drop-down arrow if necessary to reveal the options.

- Select Start across from Sale of Business Property.

- On the screens that follow, you should see an option to select like-kind exchanges.

- Continue to enter your information

- You should see screens such as Sales of Other Business Property, Total Gross Proceeds, and these screens may not relate to your tax situation. If they do not, then select No, Continue, or Done as appropriate.

- On the screen Like-Kind Exchanges is where you can enter the information about your replacement property.

@marjeanb

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where in TurboTax do I show property purchased in Like Kind (1031) exchange

Unfortunately, the 8824 will NOT transfer anything to my tax return so I cannot finish entering the new property info for depreciation and the gain from boot won't go to my tax return. Again, apparently it doesn't like Macs.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where in TurboTax do I show property purchased in Like Kind (1031) exchange

You are correct that the Search function is different for Mac users (the "digital assistant"). You can also use the Search Topics tool on the top bar.

If you follow the steps that GeorgeM777 provided, you can enter the information for the disposition by like-kind exchange. When you have completed these steps in your Mac, go to Forms and look for Form 8824, which will populate from your entries in the Like-Kind Exchanges screen.

Next, look for Form 4797. Any ordinary gain (including "boot") or loss resulting from the like-kind exchange will appear on Line 16 of Form 4797. Any total gain or loss on Line 18b of Form 4797 will be transferred to Schedule 1, Part 1, line 4.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

scatkins

Level 2

user17524159637

Level 1

Jeff-W

Level 1

lyle_tucker

New Member

MoisesyDith

Level 1