- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Since the IRS says to use your SSN or Sole Proprietorship EIN and not your LLC's EIN if you are a single member LLC classified as a disregarded entity what EIN do you use on line D on schedule C? ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Since the IRS says to use your SSN or Sole Proprietorship EIN and not your LLC's EIN if you are a single member LLC classified as a disregarded entity what EIN do you use on line D on schedule C? SP EIN or LLC EIN?

If you use your SSN or sole proprietorship EIN on w9s for your LLC classified as disregard entity, do you put your Sole proprietorship EIN or LLC's EIN on line D on schedule C?

Taxpayer Identification Number

For federal income tax purposes, a single-member LLC classified as a disregarded entity generally must use the owner's social security number (SSN) or employer identification number (EIN) for all information returns and reporting related to income tax. For example, if a disregarded entity LLC that is owned by an individual is required to provide a Form W-9, Request for Taxpayer Identification Number (TIN) and Certification, the W-9 should provide the owner’s SSN or EIN, not the LLC’s EIN.

For certain Employment Tax and Excise Tax requirements discussed below, the EIN of the LLC must be used. An LLC will need an EIN if it has any employees or if it will be required to file any of the excise tax forms listed below. Most new single-member LLCs classified as disregarded entities will need to obtain an EIN. An LLC applies for an EIN by filing Form SS-4, Application for Employer Identification Number. See Form SS-4 for information on applying for an EIN.

A single-member LLC that is a disregarded entity that does not have employees and does not have an excise tax liability does not need an EIN. It should use the name and TIN of the single member owner for federal tax purposes. However, if a single-member LLC, whose taxable income and loss will be reported by the single member owner needs an EIN to open a bank account or if state tax law requires the single-member LLC to have a federal EIN, then the LLC can apply for and obtain an EIN.

Also what happens if you use your LLC's EIN on a single entity LLC?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Since the IRS says to use your SSN or Sole Proprietorship EIN and not your LLC's EIN if you are a single member LLC classified as a disregarded entity what EIN do you use on line D on schedule C? SP EIN or LLC EIN?

Not sure where you are confused ... if you sole prop LLC has an EIN then it goes on the Sch C along with the SS# so any income reported in either number will be joined up on the same Sch C form by the IRS ... it is just that simple. You cannot have an EIN for the sole prop and a different one for the LLC for the SAME business. Not even sure how you could get 2 numbers for the same entity.

When you fill in a W-9 to get an EIN for the business then please use the EIN after all that is one of the reason's you got an EIN so you didn't have to give away your SS# everywhere.

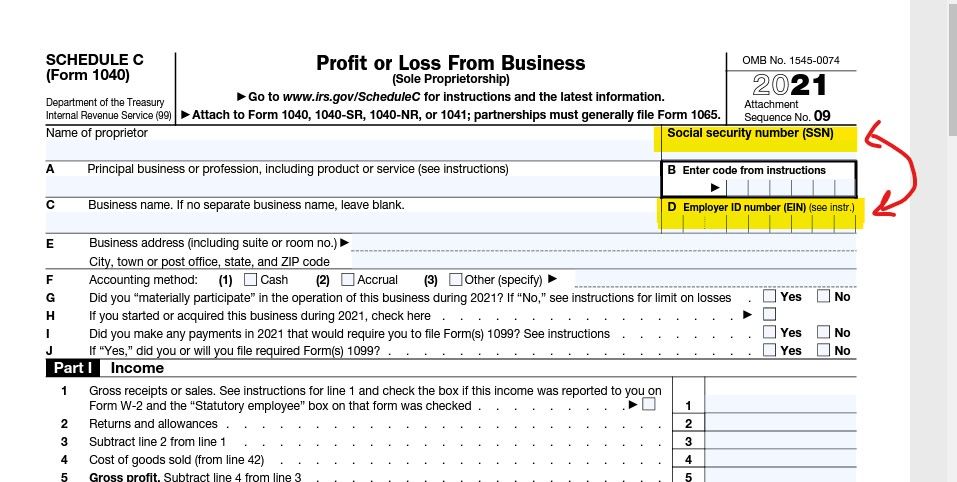

LOOK at the Sch C ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Since the IRS says to use your SSN or Sole Proprietorship EIN and not your LLC's EIN if you are a single member LLC classified as a disregarded entity what EIN do you use on line D on schedule C? SP EIN or LLC EIN?

Why is the IRS saying to use the SSN or sole proprietorship EIN for a single member LLC on w9s?

For federal income tax purposes, a single-member LLC classified as a disregarded entity generally must use the owner's social security number (SSN) or employer identification number (EIN) for all information returns and reporting related to income tax. For example, if a disregarded entity LLC that is owned by an individual is required to provide a Form W-9, Request for Taxpayer Identification Number (TIN) and Certification, the W-9 should provide the owner’s SSN or EIN, not the LLC’s EIN.

The reason there are 2 EINs is because the first one was for the sole proprietorship version of the business and the new one is for the LLC version of the business.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Since the IRS says to use your SSN or Sole Proprietorship EIN and not your LLC's EIN if you are a single member LLC classified as a disregarded entity what EIN do you use on line D on schedule C? SP EIN or LLC EIN?

This area is confusing for many:

- By default, a SMLLC is a disregarded entity. As such, the IRS is indicating that it is not necessary to obtain an EIN and the owner should just use their SS#.

- Based on your facts, your sole proprietorship and SMLLC are the same for federal income tax reporting (and state since most if not all follow federal); both filed on Schedule C.

- If the SMLLC has employees, then the IRS requires a separate EIN for payroll reporting requirements.

- On your Schedule C, just report both your SS# and EIN if you have one. This will avoid any potential matching issues.

- Many individuals get an EIN for their SMLLC to use when providing information to vendors. In this day and age of ID theft, many prefer to provide the EIN instead of their SS#.

- You are correct in that the IRS indicates to use your SS# on the W-9, but many use their assigned EIN for the reason noted in bullet 4.

- I believe the IRS is concerned with a SMLLC obtaining an EIN, providing this EIN to a vendor and then not using the EIN when reporting their information on Schedule C; possibly in an attempt to avoid reporting income. The IRS will eventually be able to match the EIN to the owner's SS# but this may take time and effort, notices, letter writing, collection efforts, etc.

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Since the IRS says to use your SSN or Sole Proprietorship EIN and not your LLC's EIN if you are a single member LLC classified as a disregarded entity what EIN do you use on line D on schedule C? SP EIN or LLC EIN?

Thanks. So even though the IRS says to use the SP EIN or SSN on w9s, it seems like it might be better to use the LLC EIN so it matches up to the EIN entered on the tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Since the IRS says to use your SSN or Sole Proprietorship EIN and not your LLC's EIN if you are a single member LLC classified as a disregarded entity what EIN do you use on line D on schedule C? SP EIN or LLC EIN?

If your SMLLC has an EIN and you provide that EIN to your vendors / customers, then "yes" make sure you indicate the EIN on your Schedule C along with your SS#.

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Since the IRS says to use your SSN or Sole Proprietorship EIN and not your LLC's EIN if you are a single member LLC classified as a disregarded entity what EIN do you use on line D on schedule C? SP EIN or LLC EIN?

Given the numerous questions you have asked on this forum, you might benefit from a local tax pro consultation.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Auxmed

New Member

parachem

Level 2

Wonderwoman49

Level 2

ponies2100112

Level 2

Gordo5

Level 1