- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

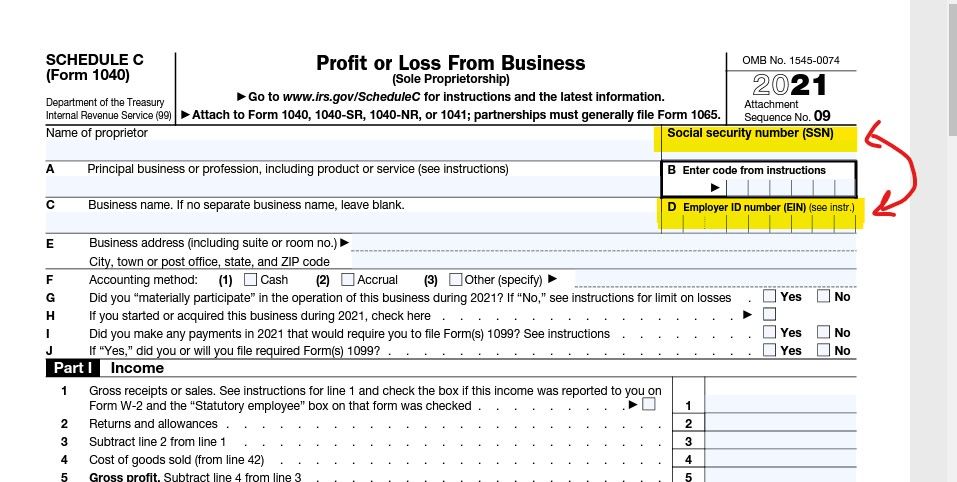

Not sure where you are confused ... if you sole prop LLC has an EIN then it goes on the Sch C along with the SS# so any income reported in either number will be joined up on the same Sch C form by the IRS ... it is just that simple. You cannot have an EIN for the sole prop and a different one for the LLC for the SAME business. Not even sure how you could get 2 numbers for the same entity.

When you fill in a W-9 to get an EIN for the business then please use the EIN after all that is one of the reason's you got an EIN so you didn't have to give away your SS# everywhere.

LOOK at the Sch C ...

June 24, 2022

5:56 AM