- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Rental farm qualifying for QBID

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental farm qualifying for QBID

Our trust rents a farmland out (has depreciable tile). We report the farm income on the 1040E. It is showing qualifies for QBID. How could that be if reporting on the 1040E? It is also stated to be passive income.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental farm qualifying for QBID

Box 14 on the k-1 is showing a number for I, E and F?

We have no income in box 6. Only in box 7 and little bit in Box 1 and 2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental farm qualifying for QBID

This IRS website states:

Many owners of sole proprietorships, partnerships, S corporations and some trusts and estates may be eligible for a qualified business income (QBI) deduction – also called the Section 199A deduction – for tax years beginning after December 31, 2017.

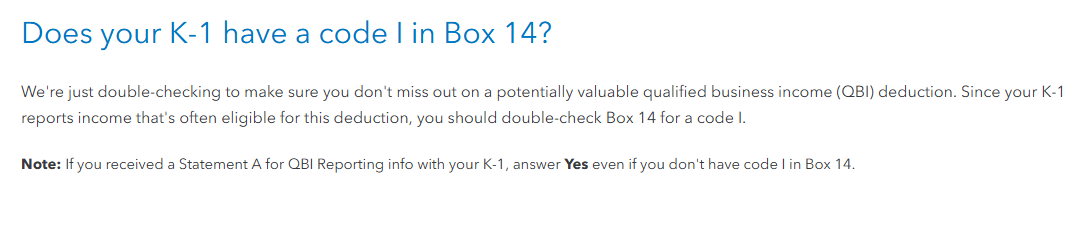

If Box 14 reports a code I, answer Yes to the question at the screen Does your K-1 have a code I in Box 14?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental farm qualifying for QBID

Thank you. Yes it does. It also has Farming and Fishing income in Box 14 but it isn't reported anywhere else.

So is box 14 something I have to put on my tax return or pay taxes on any of it?

The only income I show is in Box 7 with a little in box 1 and 2.

It also has code E for Net investment income and it seems to match my box 7.

What is also confusing is the trust kept all the depreciation and amortization and it wasn't suppose to and I believe that affected all in box 14?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

business mileage for rental real

New Member

expattaxquestions

Level 1

AvaChiu

New Member

Farmgirl123

Level 4

loriprl64

Level 3