- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

This IRS website states:

Many owners of sole proprietorships, partnerships, S corporations and some trusts and estates may be eligible for a qualified business income (QBI) deduction – also called the Section 199A deduction – for tax years beginning after December 31, 2017.

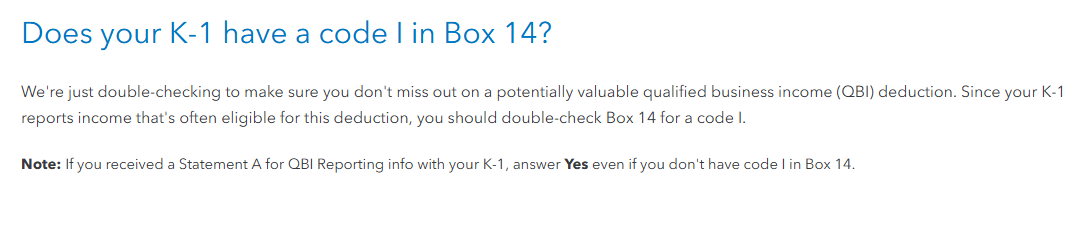

If Box 14 reports a code I, answer Yes to the question at the screen Does your K-1 have a code I in Box 14?

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 7, 2025

8:10 AM