- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Part landlord/part renter

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part landlord/part renter

In 2008, I rented the property and took part of the depreciation. Decided to move back and live in the rental property in 2010. Then in July 1 2020, i was a landlord again until the remainder of the year. I also rented an apartment from July 1 2020 till December 2020. I rented my apartment for $1,600 a month while I paid rental $1,220 a month.

How do I enter depreciation if I bought the property for $155k?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part landlord/part renter

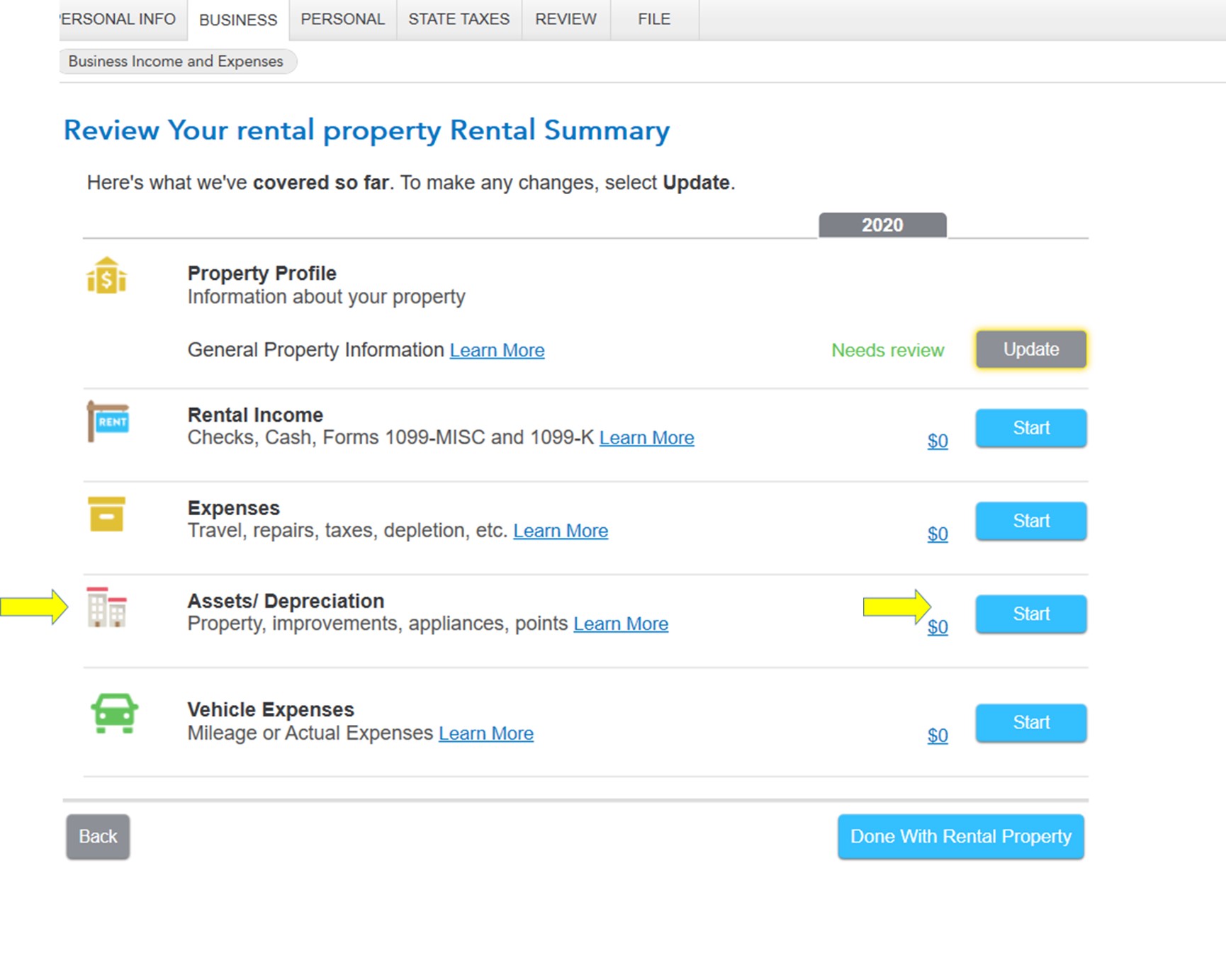

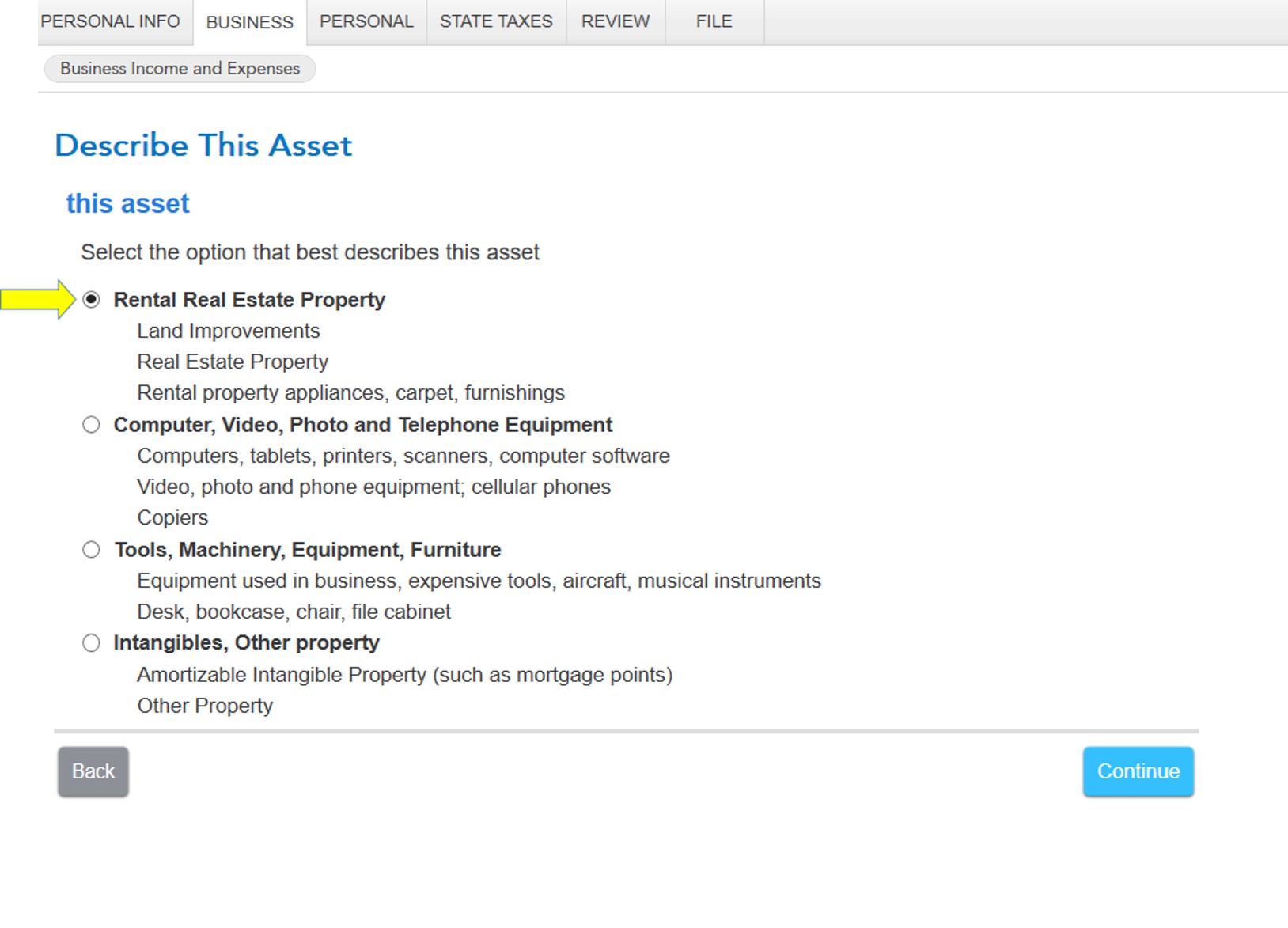

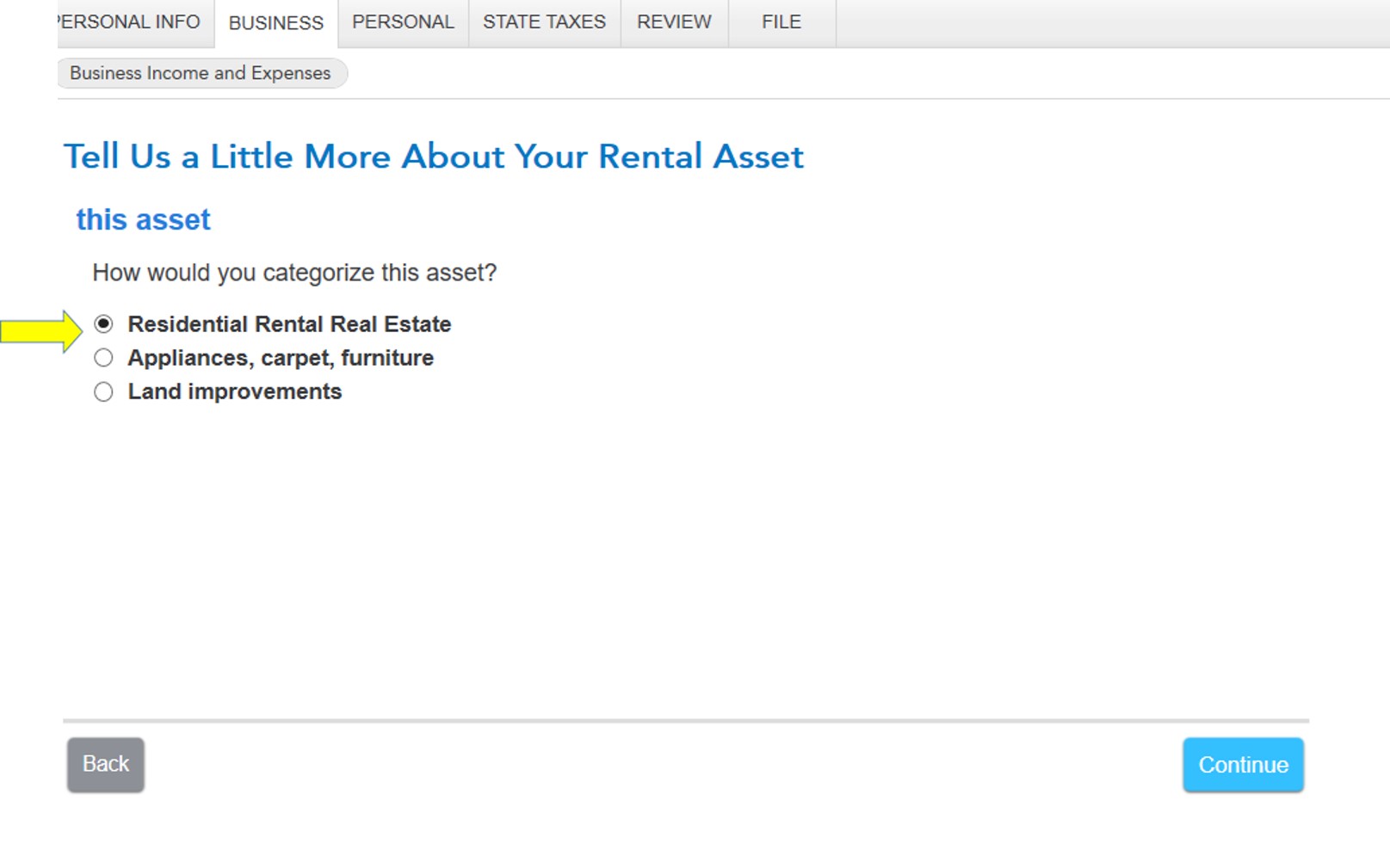

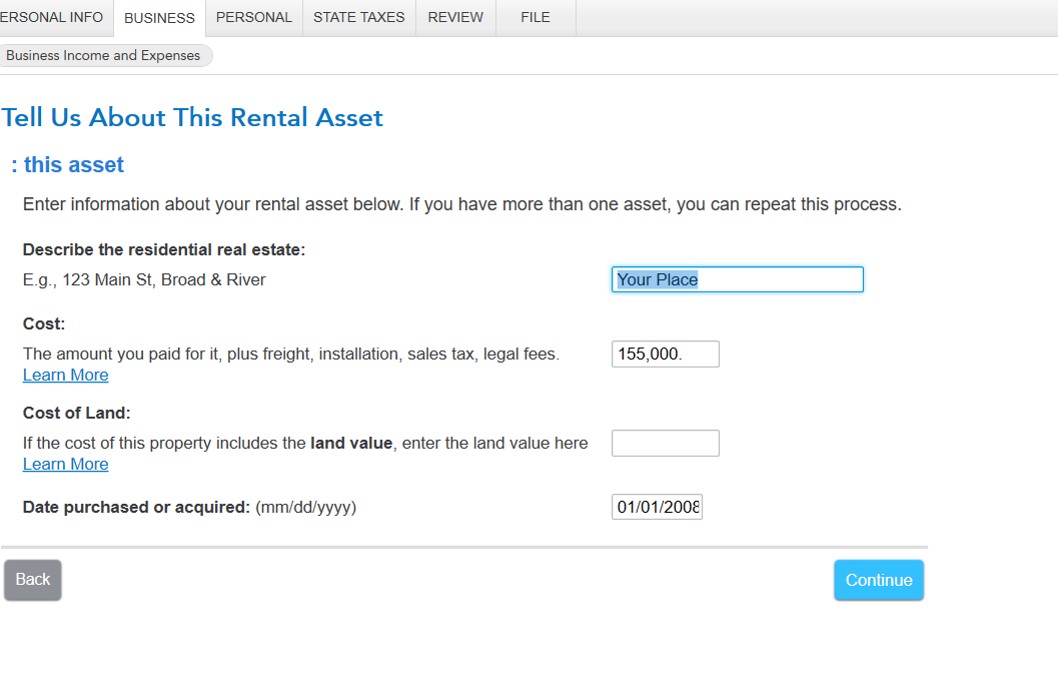

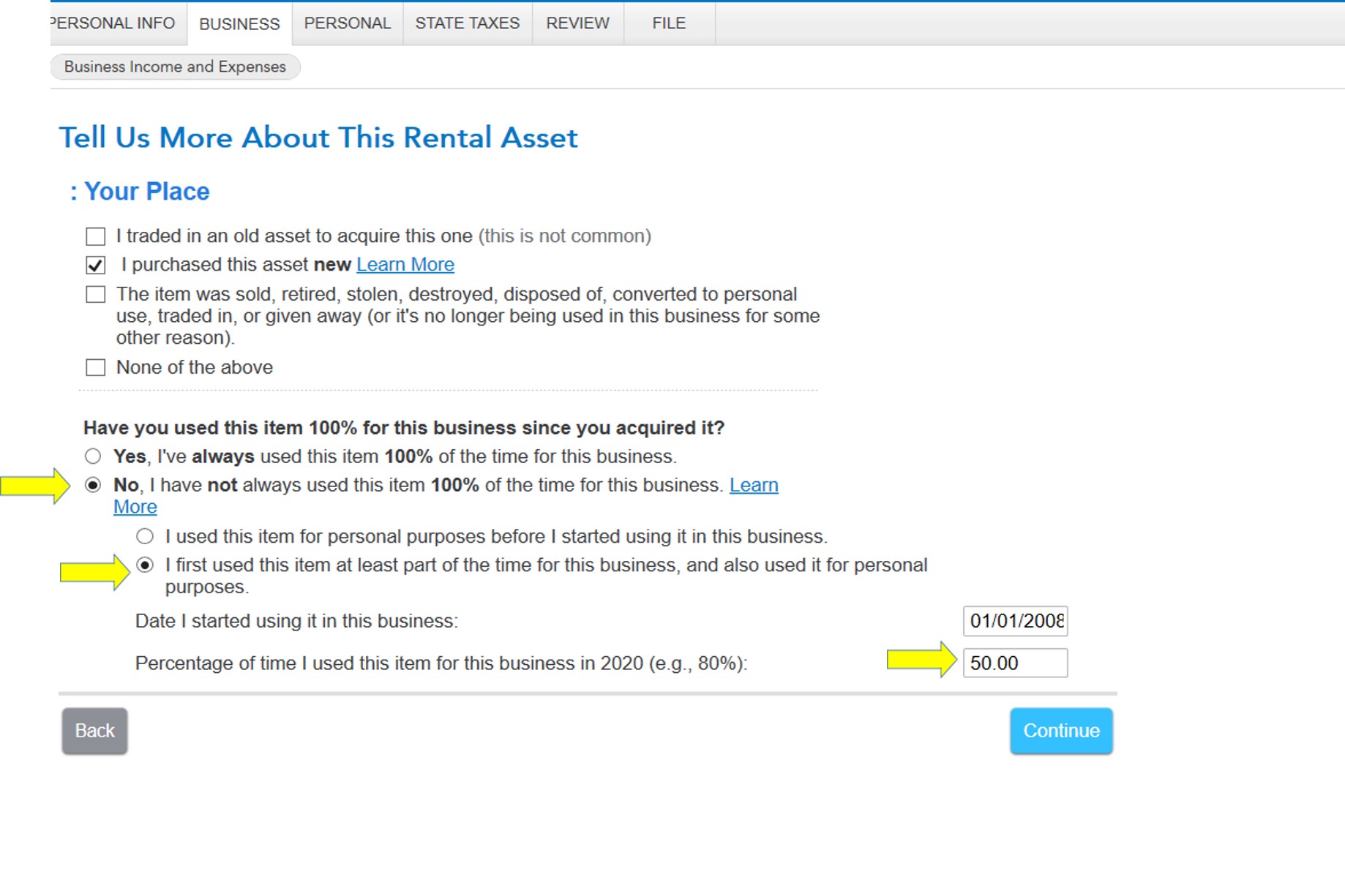

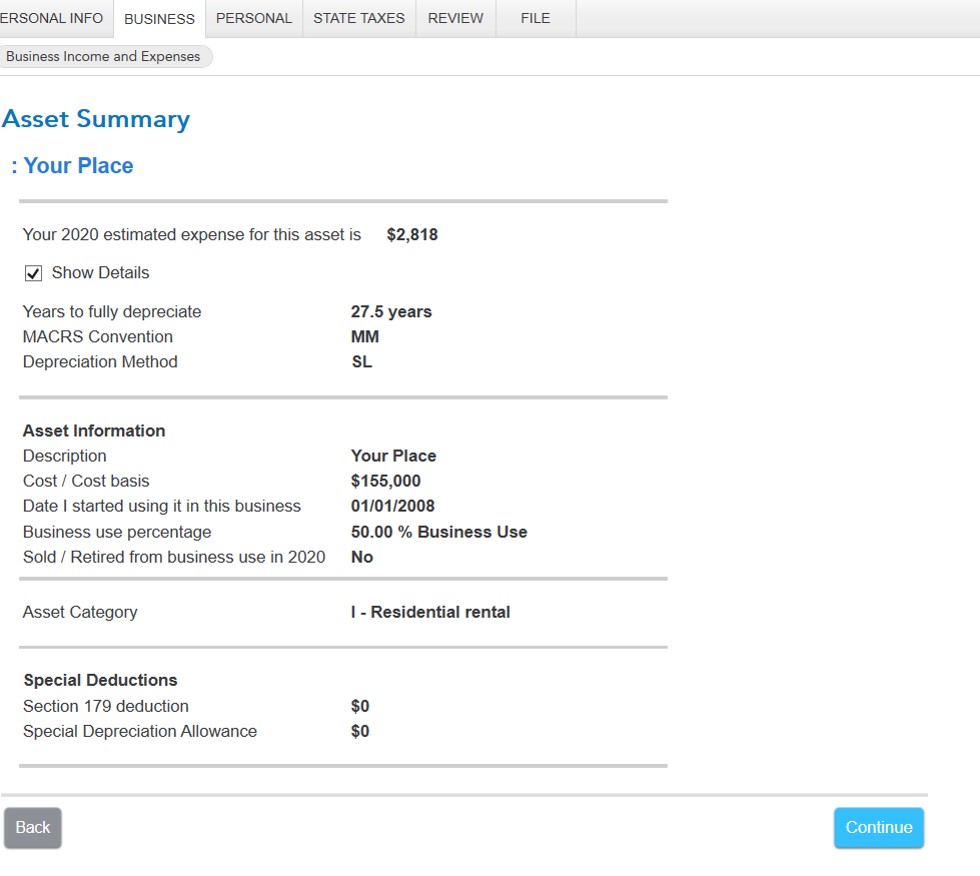

It depends. Please clarify what type of property this is. If there is any land value you reduce your purchase price by the value of the land to determine the depreciable basis. You should be depreciating the property at its basis, which would be the original purchase price, less any land value plus the value of any improvements you made to the property while you were living in it prior to renting it out again in 2020. In TurboTax Self-Employed or Home and Business you will add the property as an asset:

On the next screen, enter the current basis you calculated from you original cost less any land value plus any improvements you have made since acquisition and the date when you actually purchased the property.

On the next screen in is important you enter when you began first renting the property back in 2008.

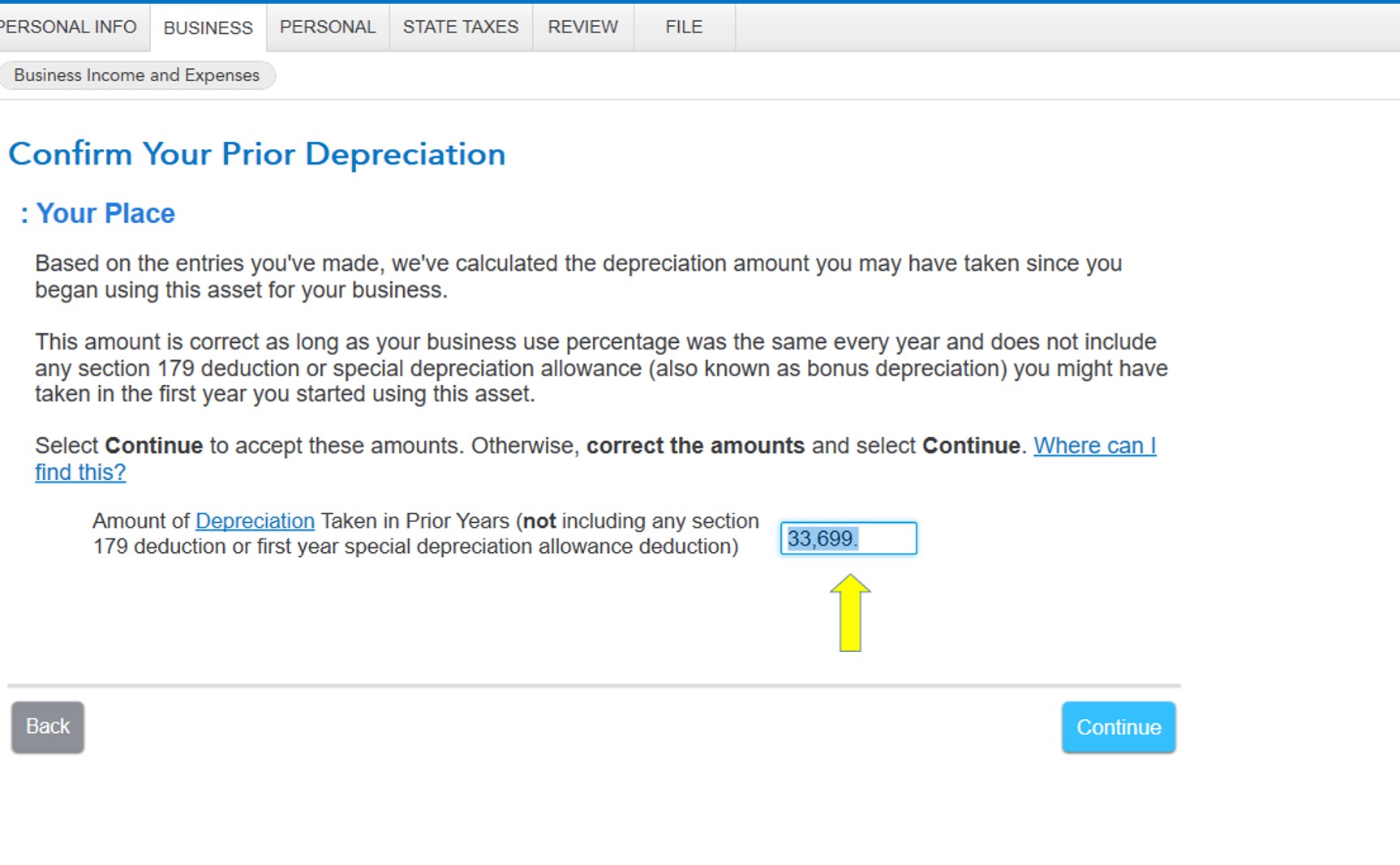

On the next screen you should enter the depreciation that was claimed while the property was rented before. That would be from your 2009 or 2010 tax return depending when you moved back into the property. If this information isn't available, the depreciation rate is 3.63% per year it was rented before. The estimated prior depreciation would be $155,000 x .0363 x #of months rented divided by 12.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part landlord/part renter

It's a condo that I rent out. On the tax records, it says, "65,000 for the land and 70,400 for the improvements." This was under an LLC in January 2008 when I bought this with me maintaining 1/2 ownership. Under the LLC, we filed under a pass through entity so we each got our K-1. Unfortunately, I don't have the tax I filed since it's been awhile back. I bought it out right for the same price and am now the sole owner since 9/2014.

Thank you for such detailed response.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part landlord/part renter

Thank you for the additional information.

You can disregard the prior rental period as that was a different entity.

The historical deprecation should have been addressed in the sale of the property from the LLC to you as a individual.

There is no prior depreciation and your date in service begins in 2020.

For 2020 your basis for depreciation is the $70,400 plus any improvements you made since you purchased the condo in 2014.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Jolmp

Level 1

cj5

Level 2

abarmot

Level 1

zenmster

Level 3

user17558730698

New Member