- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

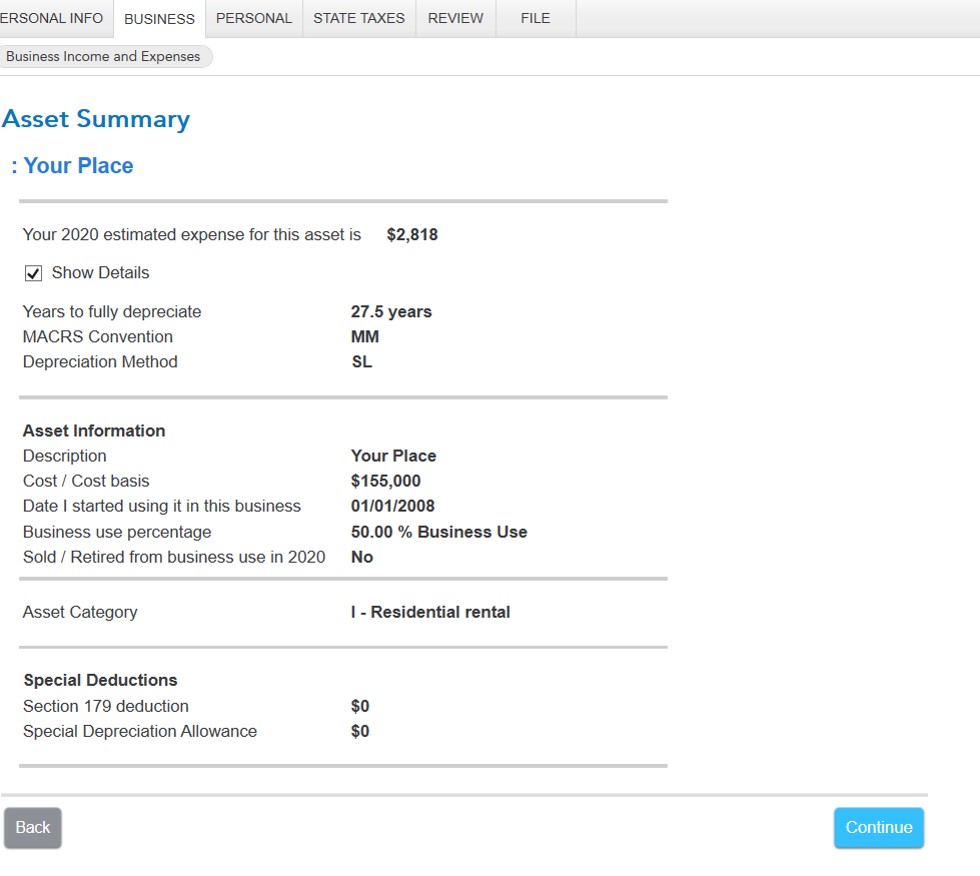

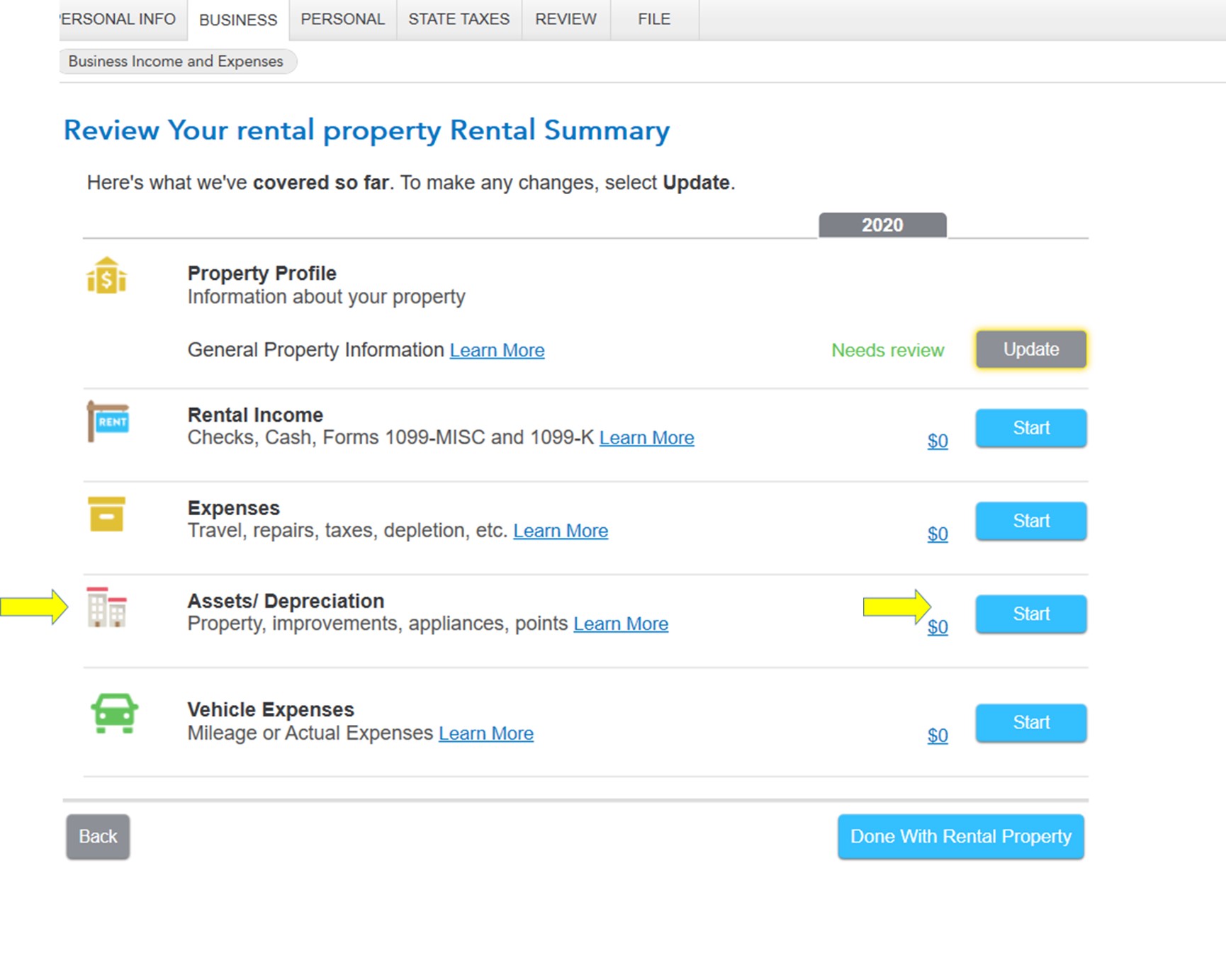

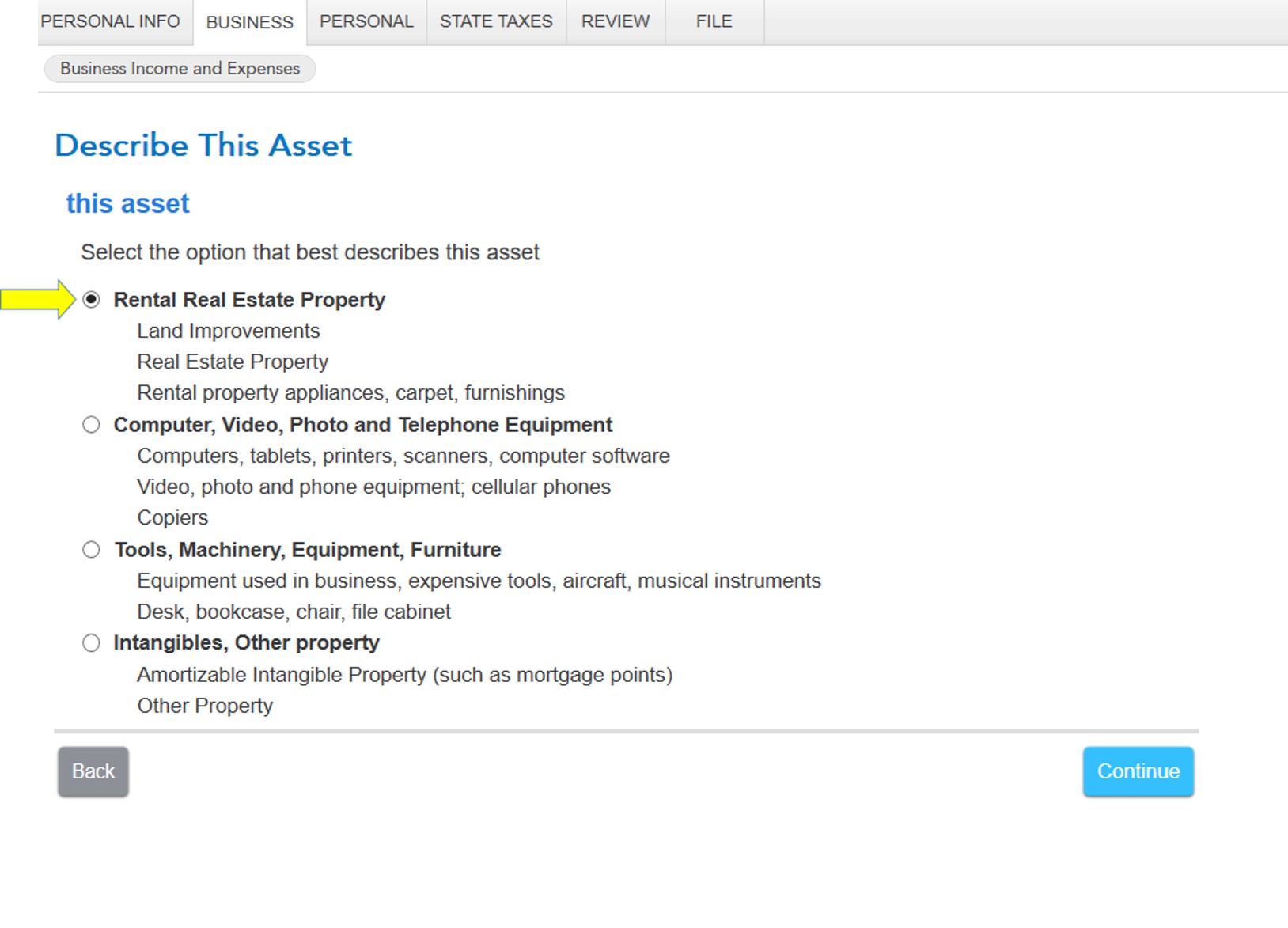

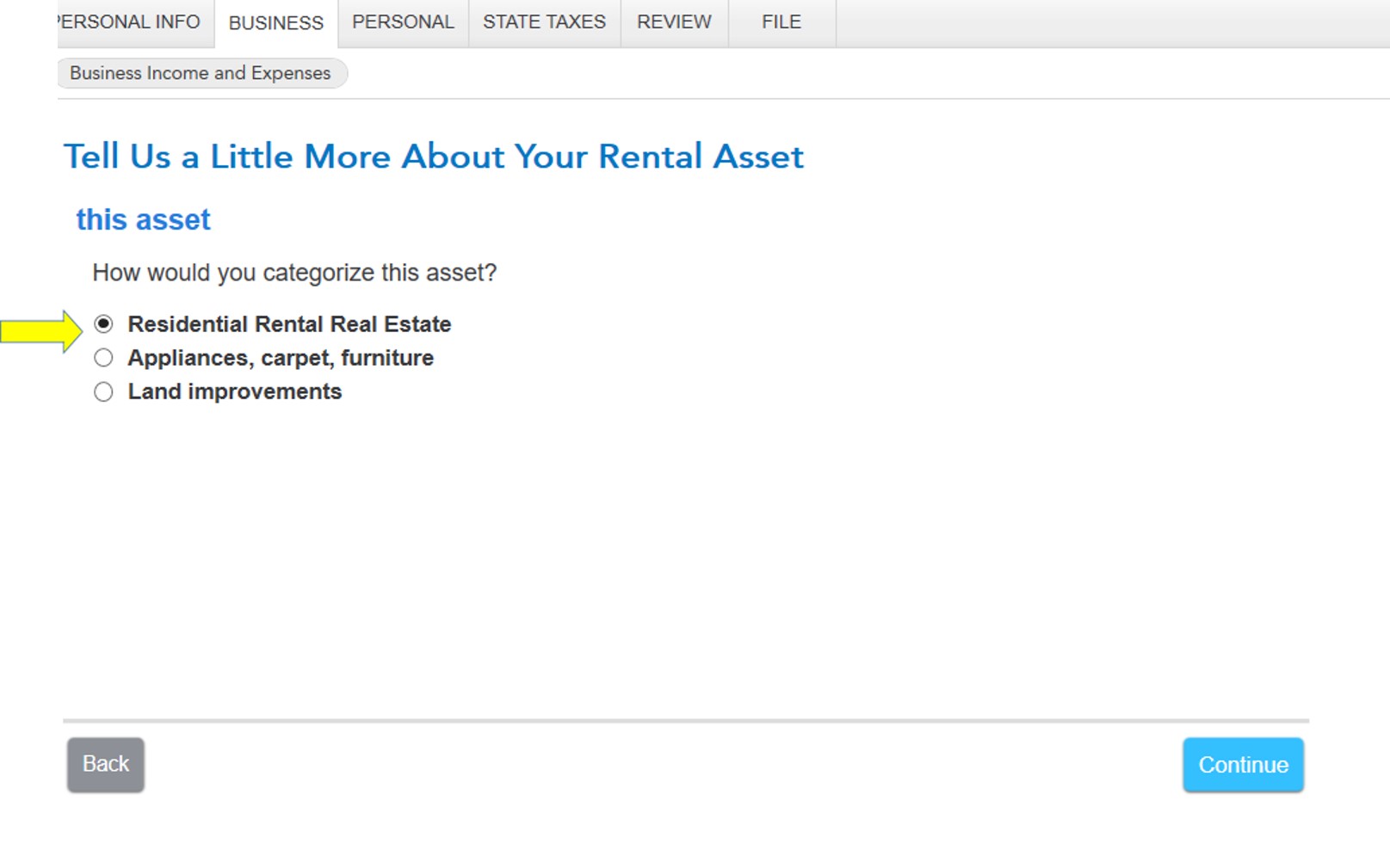

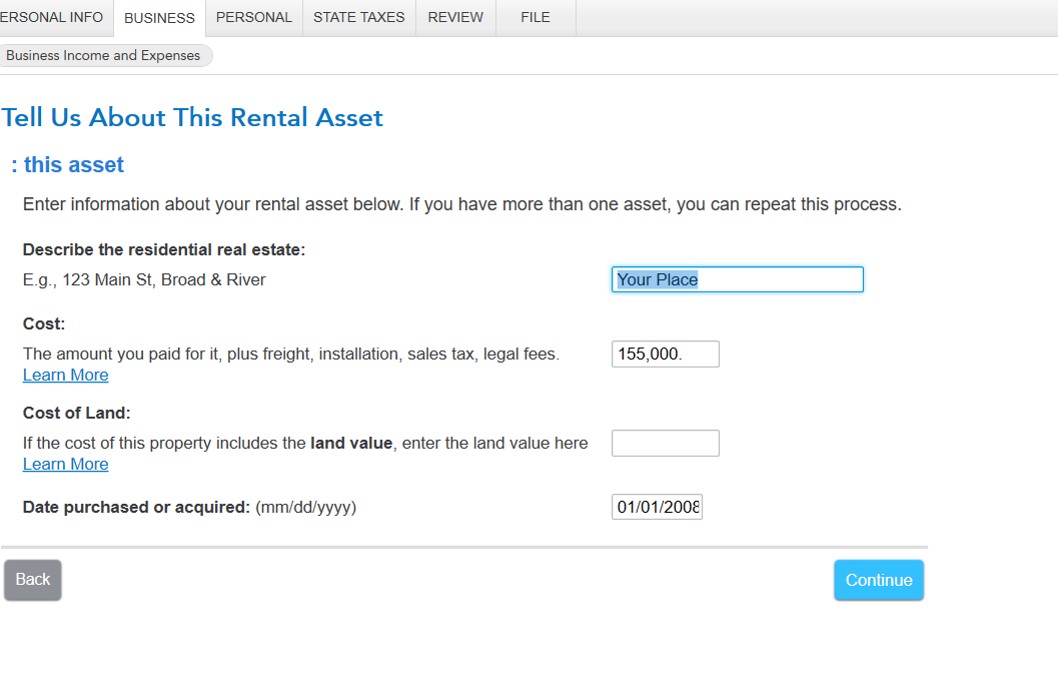

It depends. Please clarify what type of property this is. If there is any land value you reduce your purchase price by the value of the land to determine the depreciable basis. You should be depreciating the property at its basis, which would be the original purchase price, less any land value plus the value of any improvements you made to the property while you were living in it prior to renting it out again in 2020. In TurboTax Self-Employed or Home and Business you will add the property as an asset:

On the next screen, enter the current basis you calculated from you original cost less any land value plus any improvements you have made since acquisition and the date when you actually purchased the property.

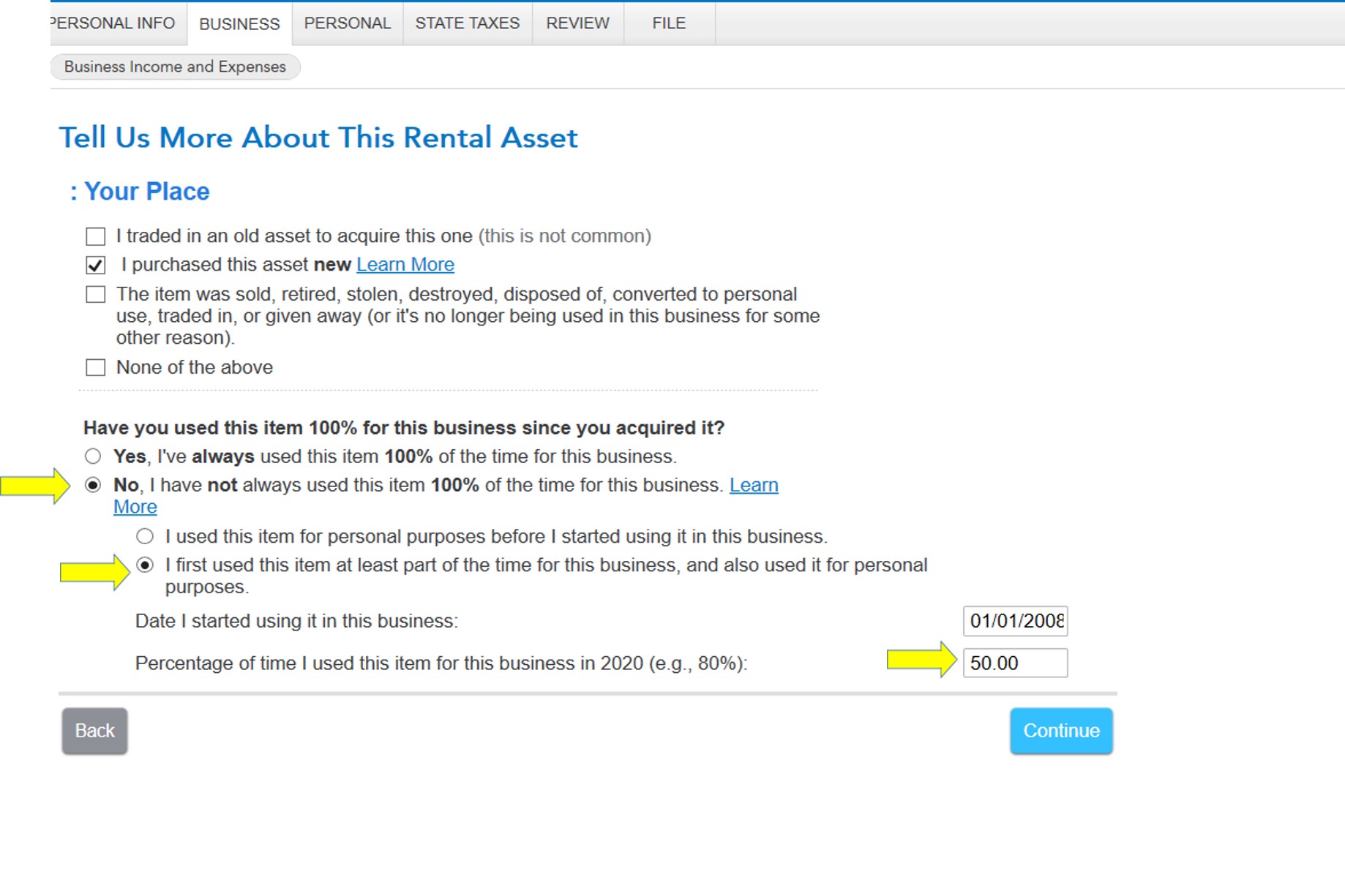

On the next screen in is important you enter when you began first renting the property back in 2008.

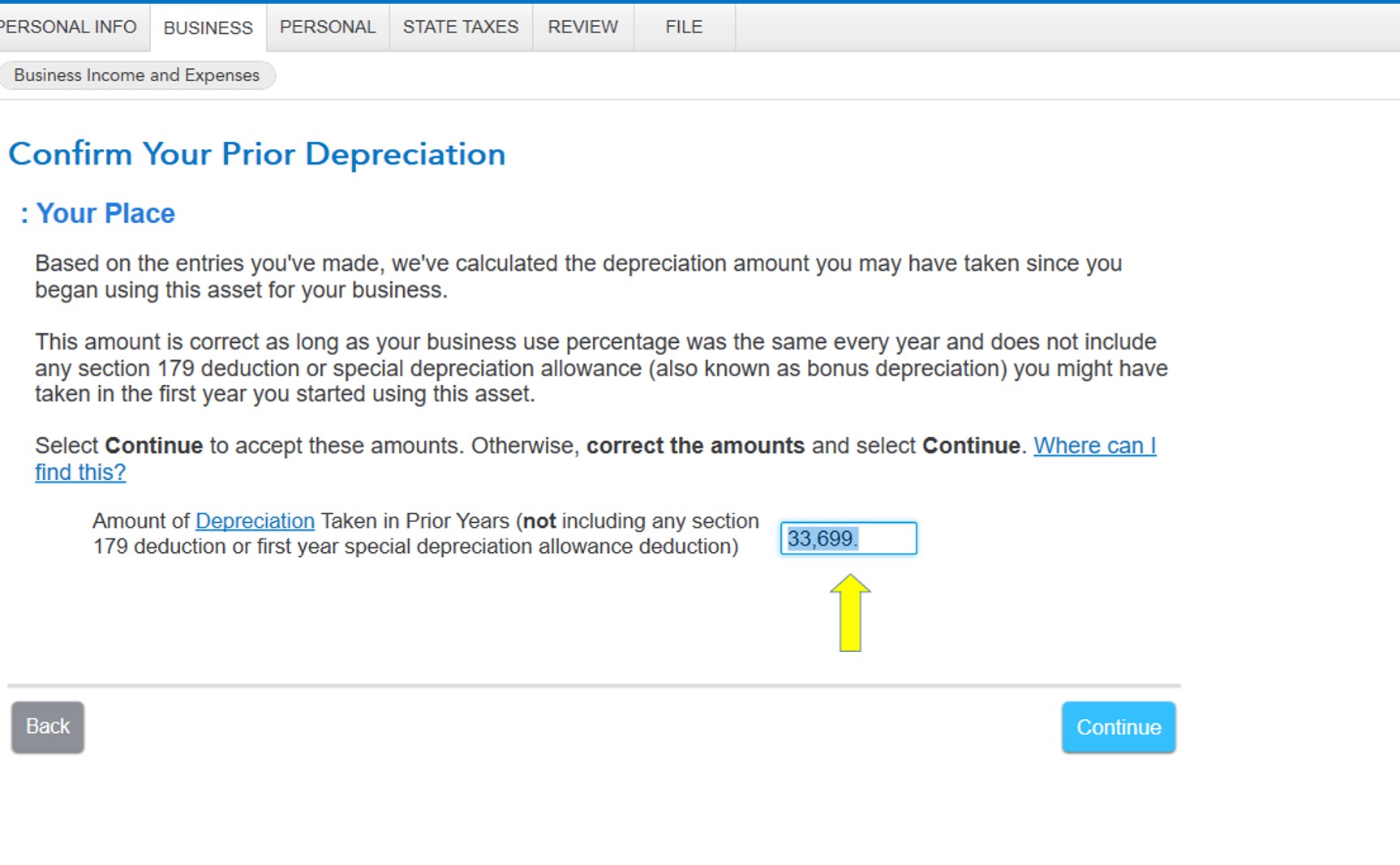

On the next screen you should enter the depreciation that was claimed while the property was rented before. That would be from your 2009 or 2010 tax return depending when you moved back into the property. If this information isn't available, the depreciation rate is 3.63% per year it was rented before. The estimated prior depreciation would be $155,000 x .0363 x #of months rented divided by 12.