- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: No code Z on menu for K-1 line 20

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No code Z on menu for K-1 line 20

I have line 20 code Z 199A info on a K-1 that needs to transfer to a second 1065 but 2023 business Turbotax does not have code Z on the menu for line 20. Why not? What code would I use instead?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No code Z on menu for K-1 line 20

When you enter the 1065 K-1 into your return you will be prompted to enter the information from the first three boxes of the K-1. After you have entered that you will come to a screen that asks if you have any information in any of the other boxes in the K1. Check the box next to line 20 and it will take you to the screen to enter the information in that box. There is a pulldown menu for that that has code Z as an option.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No code Z on menu for K-1 line 20

The pulldown menu does not have code Z as an option.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No code Z on menu for K-1 line 20

I am on the Desktop/CD version of TurboTax and there is a code Z in the dropdown of Box 20.

- On the 1095-A after entering Ordinary Income or Loss

- The screen Check boxes that have an amount or are checked on the form will come up.

- Select Box 20

- The screen Enter Box 20 info will come up.

- Select the drop down under Enter Code.

- You will have to use the side bar to scroll down to see Z Section 199A information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No code Z on menu for K-1 line 20

I am using 2023 Turbotax Business (Partnerships,Corporations, LLCs, Trusts & Estates). There is no code Z for line 20 in the dropdown menu when entering K-1 info. This is a problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No code Z on menu for K-1 line 20

In TurboTax Business, check the box for Section B1 (Qualified Business Income Deduction) rather than Box 20. You will need to complete Section A (QBI) of the K-1 worksheet, which may be easier using Forms Mode.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No code Z on menu for K-1 line 20

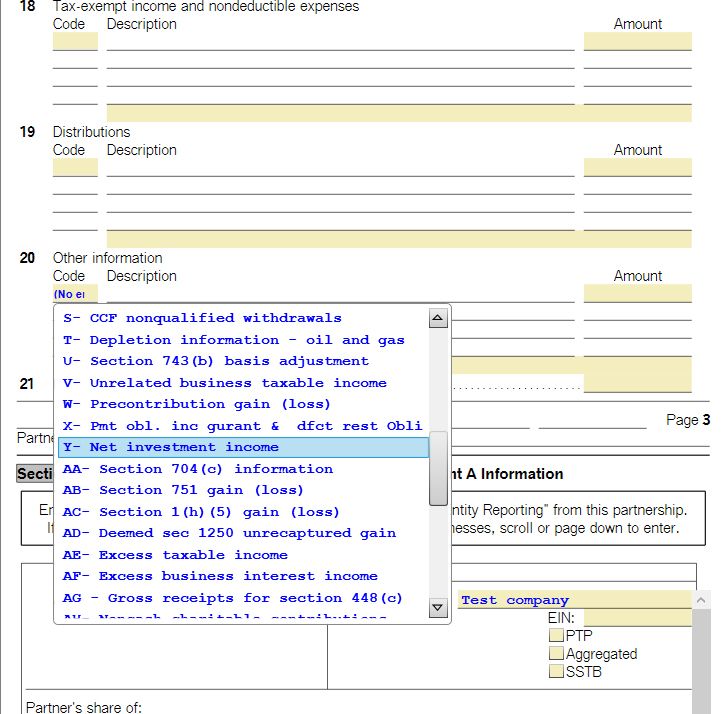

I have the same issue in Turbotax Business 2023. There is no Code Z in the drop-down list (see attached photo). It goes from Y to AA. Code Z was present in prior years. I spent 3 hours on the phone with tech support and they had no solutions. They gave me another version of the software and it had the same problem. Is this something that is being worked on? If not, can you explain in more detail what you mean by selecting the box in Section B1? Perhaps send a photo to show what you mean? Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No code Z on menu for K-1 line 20

Yes, box 20 code Z is just an indicator that there is a Qualified Business Income (QBI) statement. Most likely what you have on your paper Schedule K-1 is just box 20, code Z - "STMT" or "See Statement".

What you need to do to enter the QBI deduction is to enter the information from your statement in Section A, which shows in the screen shot you sent. It's behind the dropdown menu.

You should have a box 20 statement with your K-1 which shows some of the information shown in the image below. Enter the items that match your statement and leave the rest blank.

As Patricia V mentions above, it may be easier to enter it in Forms mode.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No code Z on menu for K-1 line 20

Hi Julie,

Thank you so much for your detailed and thoughtful reply. I now see that by entering information directly into the Section A form, TurboTax generates the appropriate schedules on the individual K-1s for the partners. (Entering code Z in the K-1 forms received from other entities is not really necessary. And since that entry is now missing from the dropdown menu, it has become impossible anyway.)

I don't see a way for TurboTax to generate schedule AG. The K-1 I received from other entites shows the following:

Schedule K-1, Line 20 - Other Information

AG Gross Receipts for 2022 $18,345

AG Gross Receipts for 2021 $17,984

AG Gross Receipts for 2020 $17,892

It would be nice if I could include this information on each partner's K-1, however I don't see an automated way to do so. I see that for each partner there is a "Supplemental Information Smart Worksheet." Should I do the math, allocating each partner's share of the AG Gross Receipts, and enter the result in each partner's supplemental worksheet? Or should I just ignore it since, from what I gather, AG only applies if the entity grosses $25 million or more per year, which mine certainly does not.

Again, thanks for taking the time to answer my question(s).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No code Z on menu for K-1 line 20

You can enter Box 20 Code AG in TurboTax Business using Forms Mode as follows:

- Open your return and click the Forms icon in the TurboTax header.

- In the list of Forms in My Return on the left, find Form 1065 p5-6.

- Click the form name to open it in the large window.

- Scroll down to Other Information, Line 20 E.

- Use the drop-down in the small box to select code AG for each year and enter the amount in the adjacent box.

- You will see a detail line added below this section with the full description.

- To check this entry, open any Schedule K-1 [Partner Name].

- Scroll down to Line 20. You should see AG* and STMT. The information for this code appears under Line 23 and will be on a separate page with the K-1. The amount is allocated by ownership percentage.

- Click Step-by-Step in the header to return to the main screens.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No code Z on menu for K-1 line 20

What specific line of the Section A QBI deduction form (partially shown) is used to enter the amount from line 20Z on the K-1? Seems like it would be easier for user experience if Intuit would fix the code issue outlined in the original question to auto populate the schedule A form. Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No code Z on menu for K-1 line 20

When you report Box 20 in the K-1, pick Z from the drop down and press continue. A series of questions will follow such as is your investment at risk and so on and so forth.

Then a screen will appear that will ask additional information that is listed in a supplemental disclosure form that accompanied your k-1. Reporting this information will determine your QBI deduction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No code Z on menu for K-1 line 20

IN the business edition of turbotax, these is no option to enter a code Z on line 20. So I checked the "section B1" box in the K-1 form interview, and then entered amount from the K-1 20Z in section A by selecting PTP and entering the amount on the ordinary business income (loss) line of section A. I am now getting an error on page 2a(i) 6 the error stsates: "Analysis of Net income is incomplete by $xxxx. There may be partners for whom no entity type has been selected on the K-1 worsheet, or guaranteed payments have not been allocated...." I do not see where an entity type is entered in the K-1 worksheet. Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No code Z on menu for K-1 line 20

The K-1 worksheet was added at the entity level and tht resolved all the errors.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No code Z on menu for K-1 line 20

I am in download version of desktop and there is NOT a 20 Z

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

nickjwang

New Member

user17718157531

Level 1

Jack_M

Level 1

love-the-irs

Level 2

user17716156551

Level 1