- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: IRS Form 1065 Schedule K - Analyses of Net Income - Error with TurboTax Business defaulting to Limited Partners?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Form 1065 Schedule K - Analyses of Net Income - Error with TurboTax Business defaulting to Limited Partners?

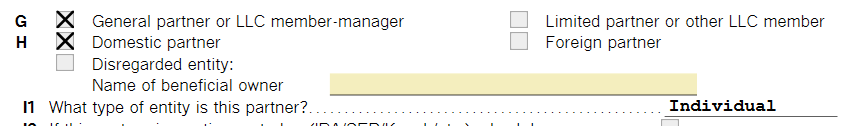

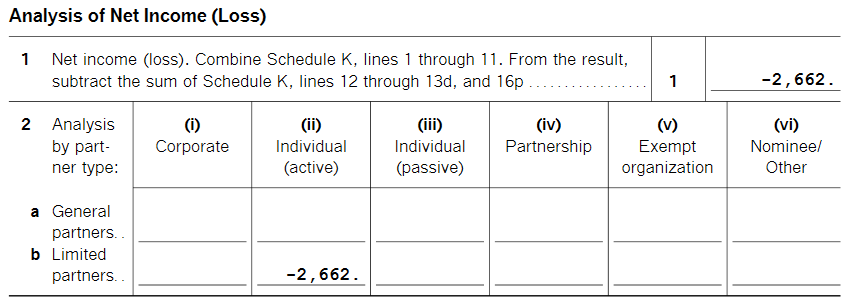

All partners are General Partners and indicated this way on the respective K-1's. However, when reviewing Form 1065 Schedule K, the net profit/loss is entered on the "Limited Partners" line (b) instead of "General Partners" line (a). Is this an error with TurboTax Business 2019? If so, is there a plan to correct this, or should I manually correct the "form view"?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Form 1065 Schedule K - Analyses of Net Income - Error with TurboTax Business defaulting to Limited Partners?

I did a quick test and cannot seem to replicate that error. However, I may be misinterpreting what you are seeing in Forms Mode (see screenshot).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Form 1065 Schedule K - Analyses of Net Income - Error with TurboTax Business defaulting to Limited Partners?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Form 1065 Schedule K - Analyses of Net Income - Error with TurboTax Business defaulting to Limited Partners?

I did another test return with 4 partners; the screenshots appear below. Note that I got that result with a net loss (as shown on your return).

Which entity type did you choose? It may not make a difference but, then again, it may. I am using a GP for this purpose.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Form 1065 Schedule K - Analyses of Net Income - Error with TurboTax Business defaulting to Limited Partners?

Very strange - yes, I have all 4 as general partners and individual entities, but it's putting them on the limited partner line. The only thing that I can think of that is different is that this is a final 1065 with final Schedule K-1's.

I was actually going to ask a separate question about final schedule K-1's because the program only marks the "Final K-1" box if you select that the partner "left" the company this year, and then you have no option to enter partnership percentages and the end result will be 0% ownership. So, you have to set up all partners like they are continuing, add their GP checkmark, domestic partner checkmark, percentages, THEN go back in to edit the partner and mark that they left the company. I wonder if this strange dependency cases the loss to fall on the limited partner line of the schedule K. I can't think of any other special circumstances.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Form 1065 Schedule K - Analyses of Net Income - Error with TurboTax Business defaulting to Limited Partners?

did you find the solution? I am having the exact same problem. I cannot figure out how to get the amount to show under General partners instead of Limited.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Form 1065 Schedule K - Analyses of Net Income - Error with TurboTax Business defaulting to Limited Partners?

Semi Solution: The only way I have found so far is to go to Business Info > Introduction > Type of Partnership - Edit > choose U.S. General Partnership. Which of course is not a solution but it works. Maybe someone can figure out the solution based on this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Form 1065 Schedule K - Analyses of Net Income - Error with TurboTax Business defaulting to Limited Partners?

Hi @pirate1122 ,

No, I was never able to fix it and just filed with the information on the Limited Partners line. The strange thing was that the prior year we'd hired a tax professional for our return, and upon reviewing the prepared return, I'd pointed out this same mistake. He agreed that is was strange but that it was a flaw in TurboTax and filed it as-is anyway. So, the bug has been present for at least the 2018 & 2019 years.

Thankfully, last year was my final partnership return! I would not want to attempt another 1065 Form with TurboTax Business ever again.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

chrisauditore

New Member

saunderstomr

Level 2

hqat1

Level 2

zapyoo

Returning Member

user17580046064

New Member