- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: How Long does the California E-File Waiver Take for Approval?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How Long does the California E-File Waiver Take for Approval?

I have a Form 568 that has to be mailed in because Turbo Tax has refused to support e-filing for it for years. So before I can print and mail it, I have to request a waiver here: https://www.ftb.ca.gov/tax-pros/efile/business-eFile-waiver-request.asp?WT.mc_id=akBEWaiver

But it says it has to be approved first, is it instant?

Also, is this e-waiver step still required for single member LLC? The TT phone support agent was telling me it's only needed for multi-member llc's, I think he is wrong?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How Long does the California E-File Waiver Take for Approval?

Yes, the waiver is instant.

Yes, you do need the waiver if you are not e-filing Form 568. You still have to file the 568 even if you are a SMLLC that is considered a disregarded entity for federal tax purposes. You are not disregarded for CA state purposes, even if you are for federal.

TurboTax Home & Business will e-file your Form 568 if you only have one LLC and you do not use Schedule R to apportion or allocate your income between states. If you have more than one LLC or apportion income on Schedule R, you will have to file the 568 by mail and use the waiver request.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How Long does the California E-File Waiver Take for Approval?

Okay. I did the waiver.

I only had ONE LLC, and No I did not use Schedule R.

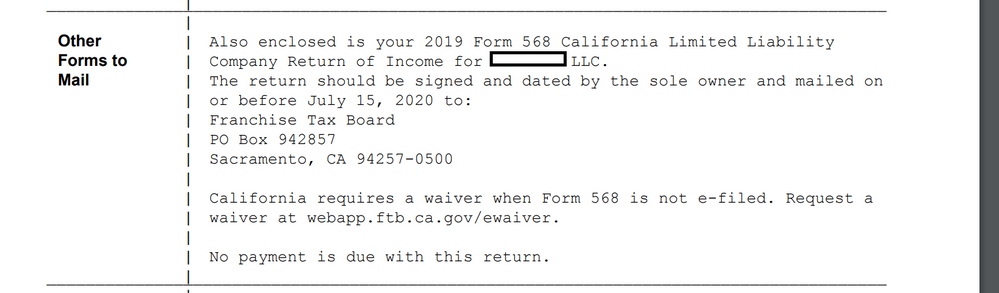

But I just printed out and mailed my form 568, because the TT agent on the phone told me it had to be mailed, AND the instructions from turbo tax after filing said to mail it, see below, this is from TT:

You are saying I did not need to mail it after all? This is so much conflicting info on this from TurboTax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How Long does the California E-File Waiver Take for Approval?

There are a few other items that would cause you to have to mail the 568. But when you are in Forms Mode, look at the bottom of the Form 568 - Is there a check-mark in the box? If the box is not checked, the Form should e-file.

This is something new that was added to the 2019 CA state software and I know users that did not have to mail the Form 568. But there are exceptions.

It is not going to hurt anything if you mailed it also and it may have been necessary.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hapagirllv

New Member

user17539892623

Returning Member

astan2450

New Member

markmuse120

New Member

mckiverm

New Member