- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: How do I enter data on Schedule 1 line 4 of the 1040. No step by step section and the form is...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter data on Schedule 1 line 4 of the 1040. No step by step section and the form is non-editable

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter data on Schedule 1 line 4 of the 1040. No step by step section and the form is non-editable

Gains and losses from Form 4797 are entered in the business section. Search for sale of business property, copy and paste the phrase in the search bar if necessary. Use Form 4797 to report:

- The sale or exchange of property.

- The involuntary conversion of property and capital assets.

- The disposition of noncapital assets.

- The disposition of capital assets not reported on Schedule D.

- The gain or loss for partners and S corporation shareholders from certain section 179 property dispositions by

partnerships and S corporations. - The computation of recapture amounts under sections 179 and 280F(b)(2) when the business use of section 179 or listed property decreases to 50% or less.

- Gains or losses treated as ordinary gains or losses, if you are a trader in securities or commodities and made a mark-to-market election under Internal Revenue Code section 475(f).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter data on Schedule 1 line 4 of the 1040. No step by step section and the form is non-editable

slightly more complicated than that unfortunately.

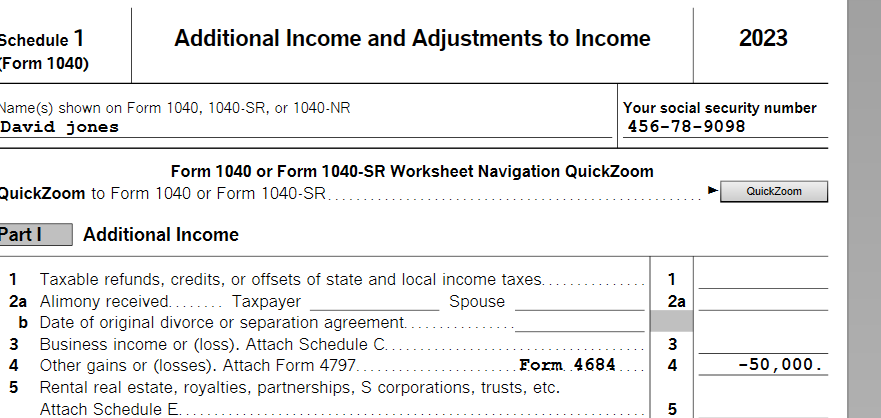

I completed form 4684. I need to copy row 31 from that form to Sch 1 line 4 and note '4684' in the column (per IRS instruction Instructions for Form 4684 (2023) | Internal Revenue Service (irs.gov))

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter data on Schedule 1 line 4 of the 1040. No step by step section and the form is non-editable

You don't enter 4684 data on the form itself if you are working in Turbo Tax. Here is how to enter.

- Go to Federal

- Deductions and Credits

- Other Deductions

- Causalities and Thefts

- As you proceed through the interview, you have two choices, personal or Income Producing Property.

- Proceed through the interview.

- Once reported and entered correctly, the entry will be made in Line 4 Schedule just like it is illustrated in this screenshot.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter data on Schedule 1 line 4 of the 1040. No step by step section and the form is non-editable

actually found the issue the deductions are showing on Schedule A not Schedule 1

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Bradley

New Member

mellynlee1

Level 3

mana1o

New Member

justine626

Level 1

ramster_2010

New Member