- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: "How do I attach multiple 1099B pdfs to a 1041 return" T...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I attach multiple 1099B pdfs to a 1041 return

TurboTax Business (download to Windows)

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I attach multiple 1099B pdfs to a 1041 return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I attach multiple 1099B pdfs to a 1041 return

Last year I was able to attach the 8453 signature form and the 1099 B statement as two separate files, what changed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I attach multiple 1099B pdfs to a 1041 return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I attach multiple 1099B pdfs to a 1041 return

I am using Turbo Tax Business form 1041, last year I was able to attach 2 pdfs one for signature and one for 1099 B, this year there is no prompts to add the 1099 B.

The instructions state " your attaching a statement and have only summary entries for thois account " Trying to find out why I cannot attach the 1099 B, it worked last year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I attach multiple 1099B pdfs to a 1041 return

This may be able to assist you for the TurboTax personal preparation products. After you finish entering the sales for the first broker, continue through the interview until you get to the screen that says "Here's the investment sales info we have so far." On that screen, click the button that says Add More Sales. That will take you back to the beginning of the investment sales interview. A couple of screens later it will ask you for the name of the brokerage, and you can enter the second broker's name. Then continue to enter the sales for that broker. Repeat this as many times as needed to enter all the brokers.

Please let us know if this helps.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I attach multiple 1099B pdfs to a 1041 return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I attach multiple 1099B pdfs to a 1041 return

This is what Turbo Tax states............If you are e-filing your tax return, you will need to attach a PDF copy of your 1099-B or broker statement(s) when you transmit your return. We will guide you through this process at that time......................

Last year I was able to attach 2 pdfs , signature and details for form 8949 ( 1099 B ). I don't recall how I did it but I am guessing I followed some kind of prompts..... They said they will guide you , but I cannot find any such guidance for the 1099 B. The attachment drop down shows it can have additional pdfs, so there appears to be a issue on inserting more than one.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I attach multiple 1099B pdfs to a 1041 return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I attach multiple 1099B pdfs to a 1041 return

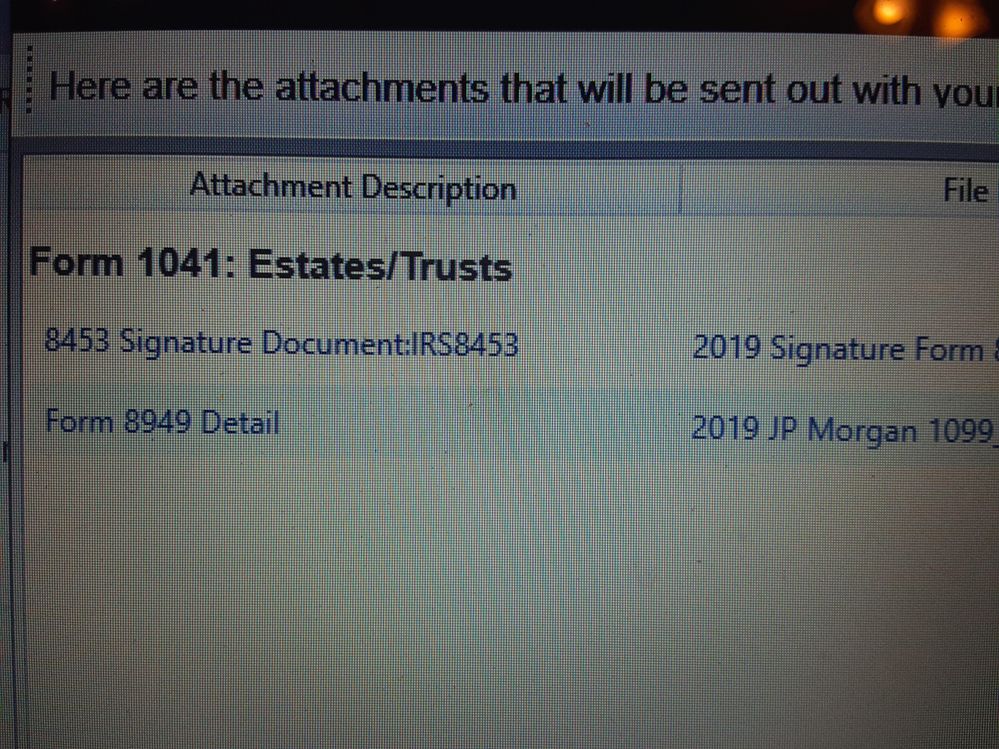

I have to disagree with you as you can see , I had 2 pdf files entered as attachments in my 2019 return on my 1041. So there has to be a way to insert additional attachments vs just a signature pdf.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I attach multiple 1099B pdfs to a 1041 return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I attach multiple 1099B pdfs to a 1041 return

Why does the system give me the option to add a summary and attach the 1099-B statement if the program later will not let you add the attachement?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I attach multiple 1099B pdfs to a 1041 return

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Mary625

Level 2

abarmot

Level 1

gavronm

New Member

emberrbiss

New Member

carolynmkendall509

New Member