- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Home Business Deduction

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Business Deduction

I have a home business for consulting work and I sold leggings. This past year I sold the remainder of my inventory of leggings at a loss, about 1/2 of my cost. Where do I account for this under the expenses of my home office? And how do you label it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Business Deduction

You report them as the cost of goods sold.

- Your beginning inventory is your ending inventory from last year.

- Any purchases of leggings in 2019 is added as purchases.

- Then ending inventory, (if any), is subtracted to arrive at the cost of goods sold.

If you already deducted the cost of the leggings in a prior year, then your beginning inventory is zero. You can't deduct the expense twice.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Business Deduction

I have not deducted anything previously.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Business Deduction

Ok. So you can deduct the cost of the leggings as Cost of Goods Sold on Schedule C.

You don't need to track inventory, or report end of year inventory if you claim it all as Cost of Goods Sold for the year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Business Deduction

So, where within my expenses do I account for this, a schedule C is created when I itemized my deductions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Business Deduction

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Business Deduction

I'm sorry! It won't take me to Schedule C, when you search it tells you to open or continue your return or search for Schedule C!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Business Deduction

It goes in the same area where do you report your income and expenses for your home business.

That is your Schedule C. It is actually called self-employment income and expense in Turbo Tax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Business Deduction

Yes, that is what I thought! However, under what Expense category does it go and how do you label it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Business Deduction

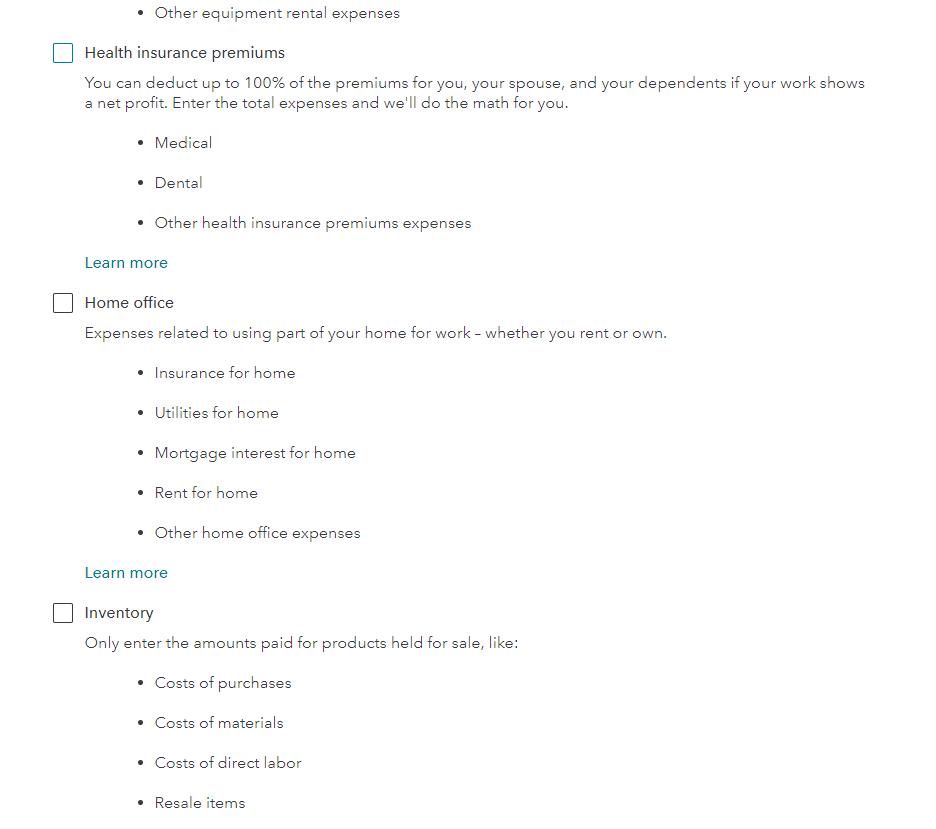

Please see the screen shot below. Inventory is under "Less Common Expenses".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Business Deduction

Ahh, got it...ok now I need some help! The first thing it asks is beginning/ending inventory, is this the value? If so, let's say $6,000 beginning and $500 at the end. Then it asks in the next page Cost of Purchases is again, $6,000 spent on the original inventory, but then it gives strange numbers for the deduction like total sales $9,600, COGS $11,500 and GP -$1,900. I am so not understanding what and how this is figured!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Business Deduction

Also, I just noticed that my 'Home Office' deduction went from roughly $2,200 down to $956, how did this affect this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Business Deduction

Ok, nevermind the first question...got it all figured out! I needed to 'add another line of work' and that will solve my issues. But, it is still showing my home office deduction incorrectly...this new added line of work is not a 'home office'. It is stating that I will have a carry-over into 2020 for $1,446. Why is it a carry-over?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

eshwar_s

New Member

user17675539749

New Member

SusanROA

New Member

noursaleh98

New Member

waltertheofrancis33

New Member