- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Can I claim business expenses even if the business produced no income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim business expenses even if the business produced no income?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim business expenses even if the business produced no income?

Yes, getting a business off the ground takes time, and the IRS recognizes this. In your first few months or year of operation you may not bring in any income. Even without income, you may be able to deduct your expenses, as long as you meet certain IRS guidelines. Your business loss can offset other income on your tax return and lower your overall tax bill. The test for being able to deduct your expenses is whether you are operating a true business and not practicing a hobby.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim business expenses even if the business produced no income?

I wanted to ask something a little more specific about your answer: "In your first few months or year of operation you may not bring in any income."

I have been going at my side business as a videographer and acquiring skills and equipment for the last 2 years (2018-2019) and I thought most businesses reported losses as much as 5 years out in some cases. If I am still not making a profit but it is definitely not a hobby should I be concerned about the write-offs if I have all of my receipts? And, when is the turning point where a person/sole proprietor needs to let go and convert it to a hobby in the mind of the IRS?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim business expenses even if the business produced no income?

There is a difference between not having a profit and making no income. I assume people have paid you for your service at some point in the last two years? I think the original questions was if you literally received no income during the year (No one paid for your goods or service) can you still take deductions for that business. A true business can go three of five years of losses until the IRS "might" reclassify you as a hobby at some point. I wouldn't be concerned until your 5+ years in. At that point you would want to consider continuing of making a go of a business regardless of what the IRS says if you are continually losing money (not taking depreciation into consideration).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim business expenses even if the business produced no income?

If you are in business to make a profit and you behave that way, you should continue to claim business income and expenses regardless of how many years you show a loss.

According to the IRS:

"In making the distinction between a hobby or business activity, take into account all facts and circumstances with respect to the activity. A hobby activity is done mainly for recreation or pleasure. No one factor alone is decisive. You must generally consider these factors in determining whether an activity is a business engaged in making a profit:

- Whether you carry on the activity in a businesslike manner and maintain complete and accurate books and records.

- Whether the time and effort you put into the activity indicate you intend to make it profitable.

- Whether you depend on income from the activity for your livelihood.

- Whether your losses are due to circumstances beyond your control (or are normal in the startup phase of your type of business).

- Whether you change your methods of operation in an attempt to improve profitability.

- Whether you or your advisors have the knowledge needed to carry on the activity as a successful business.

- Whether you were successful in making a profit in similar activities in the past.

- Whether the activity makes a profit in some years and how much profit it makes.

- Whether you can expect to make a future profit from the appreciation of the assets used in the activity."

How do you distinguish between a business and a hobby?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim business expenses even if the business produced no income?

It is generally expected that a business will not show a profit in it's first three years of operation *IN GENERAL*. It just depends on what the business is. Depending on that, if you show a loss in the 4th year it may raise a few eyebrows. But nothing that you'll hear about. But in the 5th year (again, depending on what the business does) it will probably raise flags at the IRS that basically say, "lets make sure to check this return next year (year 6 of the business) and see if it shows a profit then."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim business expenses even if the business produced no income?

I started a business in 2019. I have expenses, but no income yet. How do I claim deductions using TurboTax when I can't get past the first step claiming income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim business expenses even if the business produced no income?

When you get to the income section of the Sch C just skip it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim business expenses even if the business produced no income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim business expenses even if the business produced no income?

Thanks!

Okay. I did that. But it won't let me deduct for my home office without adding income. Is there a way around that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim business expenses even if the business produced no income?

You must have POSITIVE income on the Sch C to deduct the Office in Home expenses. Enter them and the unused portion will be carried forward. Review the Sch C and the worksheets to see the inner workings.

You can peek at only the Federal form 1040 and the summary of the state info by going here:

1) lower- Left side of the screen...click to the left side of the "Tax Tools" text selection.

2) then select "Tools"

3) then select "View Tax Summary" from the pop-up

4) then back to the left-side and "Preview 1040"

Then hit the "Back" on the left side to get back to your tax entries.

To view your entire return using the online editions (including the state) before you file, you will need to pay for your online account.

To pay the TurboTax online account fees by credit card, without completing the 2019 return at this time, click on Tax Tools >>> Tools and then Print Center. Then click on Print, save or preview this year's return. On the next page, to pay by credit card, click Continue. On the next screen it will ask if you want Audit Defense, if you do not want this option just click on the Continue button. The next screen will ask for all your credit card information so you can pay for the account.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim business expenses even if the business produced no income?

Thanks for all your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim business expenses even if the business produced no income?

What happens if you incurred business expenses but had no income (side gig) because covid shut down all your business opportunities? I am an AV consultant for medical conferences.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim business expenses even if the business produced no income?

Hello,

I found the location for where to enter in the business expenses / deductions, but as I enter in the information, TurboTax does not adjust the amount owed/due (top left). It should adjust the amount owed / due based. As stated in this thread (discussion), a business does not need to have income to deduct expenses. Example, two jobs, one is w-2 the other is consulting (not w-2). The consulting was profitable last year, not this year ($0). There are (were) expenses related to consulting (marketing / meetings / promoting / travel). The expenses from this should reduce the w-2 income (owed /due) box based on expenses, but it does NOT. Why, even though there is no income from the business in 2021 (there was in 2020), the expenses should be deducted from the

w-2 income. Why does the TurboTax program not do this ????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim business expenses even if the business produced no income?

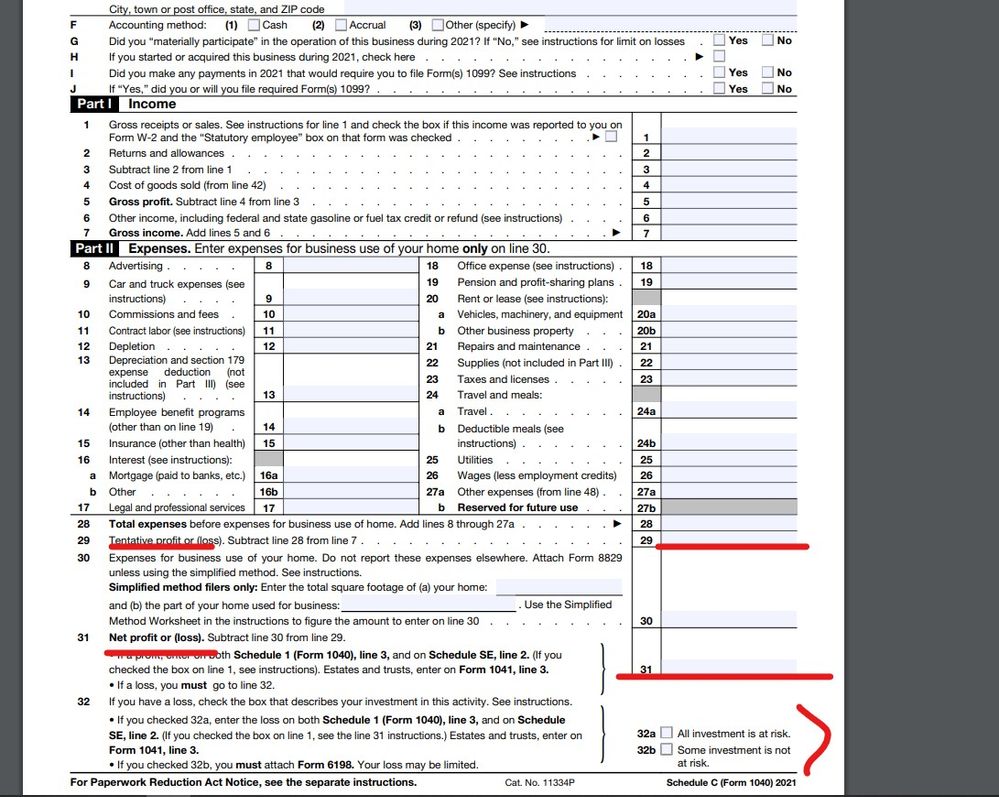

Look at the actual Sch C form ... page 1 lines 29, 31 & 32

You can peek at only the Federal form 1040 and the summary of the state info by going here:

1) lower- Left side of the screen...click to the left side of the "Tax Tools" text selection.

2) then select "Tools"

3) then select "View Tax Summary" from the pop-up

4) then back to the left-side and "Preview 1040"

Then hit the "Back" on the left side to get back to your tax entries.

To view your entire return using the online editions (including the state) before you file, you will need to pay for your online account.

To pay the TurboTax online account fees by credit card, without completing the 2019 return at this time, click on Tax Tools >>> Tools and then Print Center. Then click on Print, save or preview this year's return. On the next page, to pay by credit card, click Continue. On the next screen it will ask if you want Audit Defense, if you do not want this option just click on the Continue button. The next screen will ask for all your credit card information so you can pay for the account.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

RE-Semi-pro

New Member

Bradley

New Member

andredreed50

New Member

user17522839879

New Member

RobertBurns

New Member