- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: A link to schedule C should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked. Can someone notify us via email when this is going to get fixed - ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A link to schedule C should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked. Can someone notify us via email when this is going to get fixed - been working on this for day untill i saw these threads ...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A link to schedule C should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked. Can someone notify us via email when this is going to get fixed - been working on this for day untill i saw these threads ...

You are not required to enter a 1099-MISC specifically into your tax return as long as all the income is reported correctly. You can delete your 1099-MISC Form from your return and re-enter the income to continue filing your return and not have to wait.

To enter your income to your business in TurboTax Online you can follow these steps:

- Within your return, click on Tax Tools in the black menu on the left side of the screen.

- Click on Tools.

- Click on Delete a Form.

- Scroll down to your form and click Delete.

- Under Federal in the black menu bar click Wages & Income to get back into your tax returns.

- Search for self employed income (use this exact phrase, don't add a hyphen) and select the Jump to link at the top of the search results

- Answer Yes on the Did you have any self-employment income or expenses? screen

- If you land on the Your 2022 self-employed work summary page, select Review next to the work you're adding income for

- Answer the questions on the following screens until you arrive at Let's enter the income for your work

- Scroll down to the Income section and click Add income for this work

- Choose Other self-employed income and Continue

- Proceed entering/reviewing your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A link to schedule C should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked. Can someone notify us via email when this is going to get fixed - been working on this for day untill i saw these threads ...

to clarify my situation - this income was from COINBASE for staking crypto. and they reported this to IRS on a 1099-MISC box 3. so wouldn't I have to do the same to match?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A link to schedule C should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked. Can someone notify us via email when this is going to get fixed - been working on this for day untill i saw these threads ...

If your staking income is a one off thing and not something that you're doing regularly then you can enter the income from the 1099-MISC into the miscellaneous income section as just miscellaneous income that wasn't earned with the goal of making money. It will go on the 1040 in line 8z and not subject to self-employment tax.

The IRS is attempting to match the amount from your 1099-MISC, not the specific form. So as long as it is in the correct category then you are fine.

If your staking income is something that you do regularly then it is subject to self-employment tax and you have a business. That is when you will use the steps outlined by @AliciaP1 above. If you have any expenses directly related to earning the staking income you will be able to deduct those as well. The staking income in this case is subject to self-employment tax because you're doing it as a side gig to make money. Again, the IRS is looking for the amount from the 1099-MISC on your return, not a linked form.

Here is some more guidance on staking and crypto in general.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A link to schedule C should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked. Can someone notify us via email when this is going to get fixed - been working on this for day untill i saw these threads ...

Since this will be a recurring event year after year - doing it AliciaP1's way - now i get these errors

Form 1099- MISC worksheet ( COINBASE :( A link to schedule C should not be linked when the MWP qualifying as difficulty of care of payments exclusion box has been checked

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A link to schedule C should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked. Can someone notify us via email when this is going to get fixed - been working on this for day untill i saw these threads ...

Some TurboTax customers may be experiencing an error when entering a 1099-MISC: “A link to Schedule C should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked.”

See this TurboTax Help.

If you are wanting to report the 1099-MISC as income in the Schedule C, you may be able to delete the original 1099-MISC.

Depending upon how the 1099-MISC was entered, you may be able to remove the 1099-MISC by following these steps:

- Down the left side of the screen, click on Tax Tools.

- Click on Tools.

- Click on Delete a form.

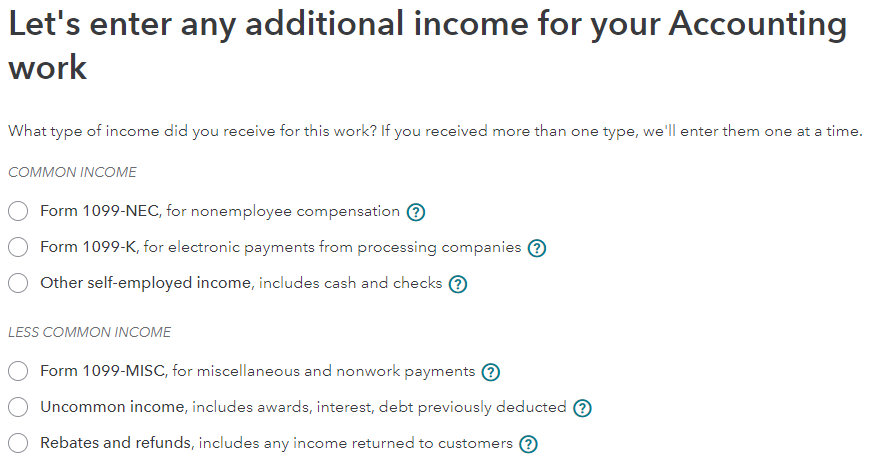

Then enter the income directly in the Schedule C at the screen Let's enter any additional income for your work.

You may select Form 1099-NEC or Other self-employed income, includes cash and checks.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A link to schedule C should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked. Can someone notify us via email when this is going to get fixed - been working on this for day untill i saw these threads ...

Looks like the last update fixed the issue

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cfreeman244

New Member

drahcirpal

Level 2

dhburton

New Member

mainiac68

New Member

LangdonAlger

Level 1