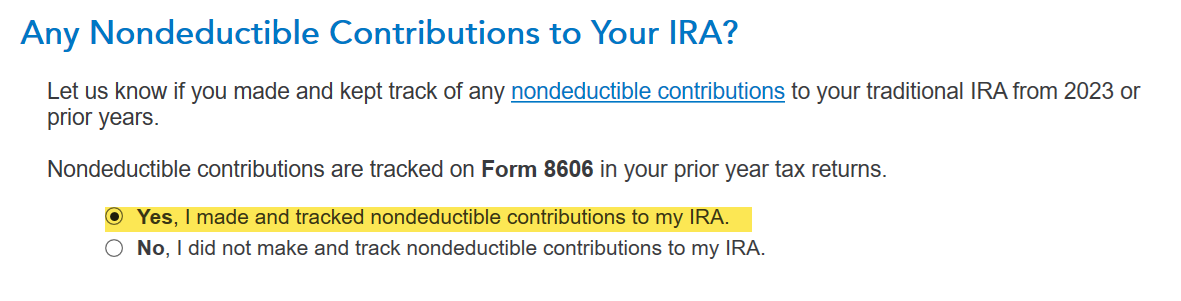

You will find those screens in the section where you enter your Form 1099-R reporting your RMD in 2024. After you enter your Form 1099-R, look for the screen that says Any Nondeductible Contributions to Your IRA?:

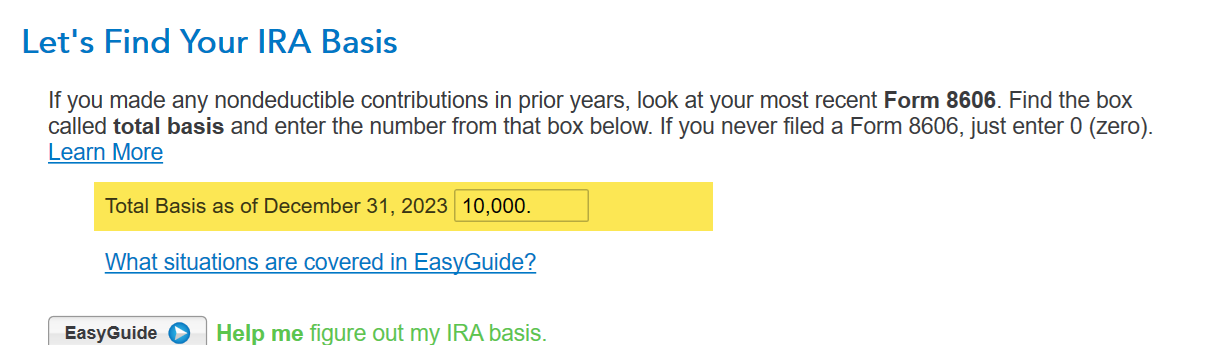

Then you'll see a screen that says Let's Find Your IRA Basis:

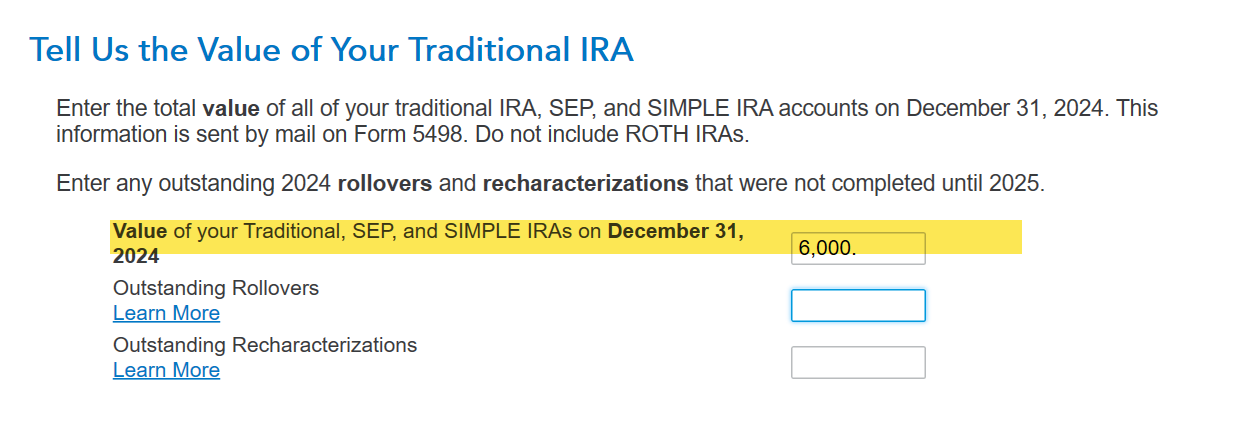

Then you'll see the screen that says Tell Us the Value of Your Traditional IRA:

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"