- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Payments to a contractor

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Payments to a contractor

My LLC remodeled the condo we are renting out. How do I claim the amount we paid the contractor on my LLC taxes?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Payments to a contractor

You don't say what kind of LLC. Multi-member LLC? Single member LLC?

Either way, *ALL* income and *ALL* expenses for residential rental real estate are reported on SCH E *no* *matter* *what* kind of tax return you are preparing.

If a personal 1040 tax return, it's reported on SCH E as a physical part of that 1040 personal tax return.

If a 1065 Multi-member LLC/Partnership, then it's still reported on SCH E as a physical part of that 1065 tax return.

Property improvements are reported in the Assets/Depreciation section of the SCH E and depreciated over time. They are not "deducted" per-se. Sounds like your renovations would be classified as "Residental Rental Real Estate" and therefore depreciated over 27.5 years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Payments to a contractor

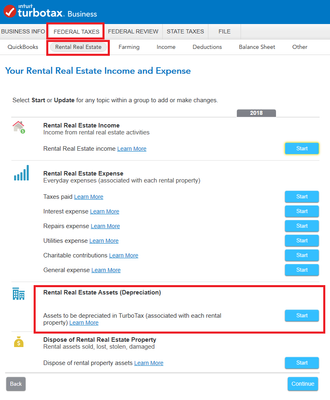

If you are using TurboTax Business (as indicated in your profile), you will enter the payment as a Rental Real Estate Asset located under the Federal Taxes tab in the Rental Real Estate section (see screenshot). Your income and expenses related to your rental property(ies) will be reported on Form 8825.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

needtaxhelp808

New Member

acumbo1980

New Member

mrallenzdeutsch

New Member

beanorama

Level 3

seemabimran123-g

New Member