- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- NYPFL refers to premiums paid for New York Paid Family Le...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On this year's New York State W-2 in Box 14 there is "NYPFL" and “NYDBL”. What category description should I choose for these box 14 entries?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On this year's New York State W-2 in Box 14 there is "NYPFL" and “NYDBL”. What category description should I choose for these box 14 entries?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On this year's New York State W-2 in Box 14 there is "NYPFL" and “NYDBL”. What category description should I choose for these box 14 entries?

Can I get the answer for this for 2020? The category options for box 14 look slightly different.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On this year's New York State W-2 in Box 14 there is "NYPFL" and “NYDBL”. What category description should I choose for these box 14 entries?

The NYC Payroll website offers the following explanations of the codes for Box 14 of the W-2:

New York IRC 125 /SEC 18

These are the payroll deductions covered under the Internal Revenue Code Section 125 for flexible spending account programs.

These include:

- Health insurance premiums

- Dependent Care Assistance Program (DeCAP)

- Health Care Flexible Spending Account (HCFSA)

If you added a domestic partner to your health insurance, a portion of the amount paid by the City is taxable and is included in Box 14.

The amount in the IRC125 box is treated on a pre-tax basis for federal income purposes. It reduces your taxable wages (Box 1) and social security and Medicare wages (Boxes 3 and 5). The reduction in year-to-date earnings shows in your W-2, not in your pay statement.

This amount is subject to state and City taxes and must be added back to the taxable wages in Box 1 when you file your taxes. The amount for DeCAP is shown in Box 14 and Box 10.

IRC414(h) for Pension Contributions

These are the payroll deductions covered under the Internal Revenue Code Section 414 for pension contributions.

If you are a pension member, your taxable wages in Box 1 are reduced by the amount of your pension contributions. Your contributions shown in Box 14 are not subject to federal income tax, but are subject to FICA (social security and Medicare), state, and local taxes.

To obtain your taxable wages for New York State and City, add the amount in Box 14 to that in Box 1. Only standard pension deductions and certain "buy back" deductions are included in the IRC414H amount. Pension loan repayment deductions are not included.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On this year's New York State W-2 in Box 14 there is "NYPFL" and “NYDBL”. What category description should I choose for these box 14 entries?

Irene, thanks, but your response doesn't appear to address the question. Which option do we select for Box 14 - Category, for the item NY PFL? The 2019 answer doesn't seem to apply to the currently available options in the TurboTax dropdown. There are two "other" options at the end -- one of those?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On this year's New York State W-2 in Box 14 there is "NYPFL" and “NYDBL”. What category description should I choose for these box 14 entries?

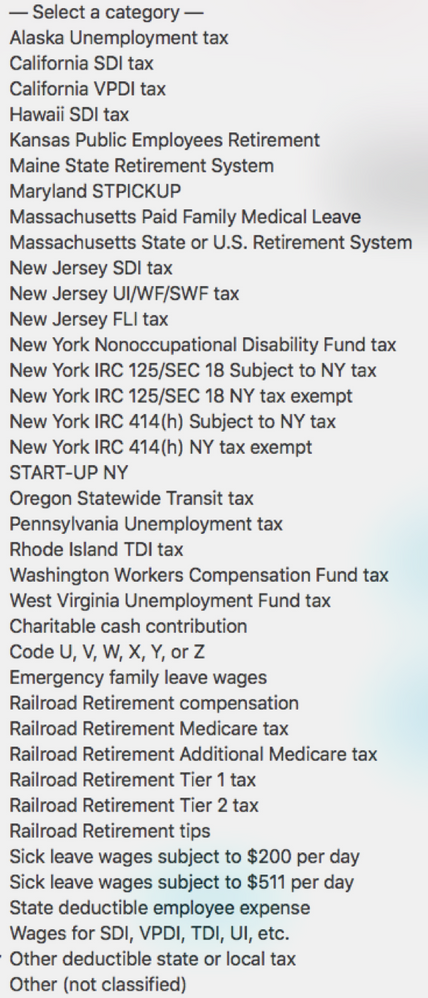

The category description for both the NYPFL and NYDBL box 14 W-2 entries should be entered as "Other - not on the list above". I've highlighted the category you should choose in the picture below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On this year's New York State W-2 in Box 14 there is "NYPFL" and “NYDBL”. What category description should I choose for these box 14 entries?

@LenaH There is not an option for "Other Not On the List Above"

Only options for "Other" are "Other Deductible State or Local Tax" or "Other Not Classified"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On this year's New York State W-2 in Box 14 there is "NYPFL" and “NYDBL”. What category description should I choose for these box 14 entries?

For NYPFL and NYDBL, please choose Other deductible state or local tax from the drop down list you shared. If you itemize deductions on your federal tax return, these contributions are deductible on Schedule A.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On this year's New York State W-2 in Box 14 there is "NYPFL" and “NYDBL”. What category description should I choose for these box 14 entries?

What if you don't itemize federal? These deductions should be included in the NYS itemized deductions. They aren't included for me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On this year's New York State W-2 in Box 14 there is "NYPFL" and “NYDBL”. What category description should I choose for these box 14 entries?

Whether you itemize or not, you should still enter your W-2 exactly as you received it.

,It won't affect your federal return or ability to e-file, but there is always a chance that the information might affect your state return (not in this case, but still it is the best practice to enter everything on your W-2).

For these two items, enter "Other - not classified" or "Other – not on above list", the last choice on the drop-down list of available categories for Box 14.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On this year's New York State W-2 in Box 14 there is "NYPFL" and “NYDBL”. What category description should I choose for these box 14 entries?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On this year's New York State W-2 in Box 14 there is "NYPFL" and “NYDBL”. What category description should I choose for these box 14 entries?

Either choice is OK. There is no effect on your tax calculation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On this year's New York State W-2 in Box 14 there is "NYPFL" and “NYDBL”. What category description should I choose for these box 14 entries?

What category am I suppose to select on box 14. There is a deduction for NYPFML.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On this year's New York State W-2 in Box 14 there is "NYPFL" and “NYDBL”. What category description should I choose for these box 14 entries?

Enter "Other - not classified" or "Other – not on above list". Your entry here will not affect your ability to e-file or your tax calculation.

Employers can put just about anything in box 14; it's a catch-all for items that don't have their own dedicated box on the W-2.

If you don't see a category in the TurboTax list that matches your W-2 entry (NYPFL or NYDBL), don’t worry. We'll figure out if it impacts your return or not. If we need more information, we'll ask you.

See New York Disability Benefit Law (NY DBL) and Paid Family Leave (NY PFL) for a summary of these two insurance benefits.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On this year's New York State W-2 in Box 14 there is "NYPFL" and “NYDBL”. What category description should I choose for these box 14 entries?

Is the following category in Box 14 correct for NYPFLVP?

"Other deductible state or local tax"

The options mentioned in the community were not exactly specified in TurboTax (e.g. the mention of being deductible or not).

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

abbymadaus

New Member

vjs20

Returning Member

Topangamama

Level 4

dinhtran-jd

Level 1

mc510

Level 2