- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- No basis error for 1099-B Long Term non-covered transactions on Form 8949 Part II with Box F checked

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No basis error for 1099-B Long Term non-covered transactions on Form 8949 Part II with Box F checked

I imported a 1099-B with 11 long term transactions (for .05 cents each! It is .55 cents total!) that say to report on Form 8949 Part II with box F checked (which means no 1099-B received).

The quantity sold is 0.000 and the cost basis is 0.00 with date acquired as various. The additional information column says "Total of 5 transactions" for each of the 11 line entries. The security is O, a REIT.

I am getting an error for not putting a basis. Thoughts on how to proceed?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No basis error for 1099-B Long Term non-covered transactions on Form 8949 Part II with Box F checked

These appear to be fractional shares. The income total will be rounded up to $1.

You may have to refer to your personal records including sales tickets to locate the cost basis information that is needed. Or you may elect to report a cost basis of $0 or $1.

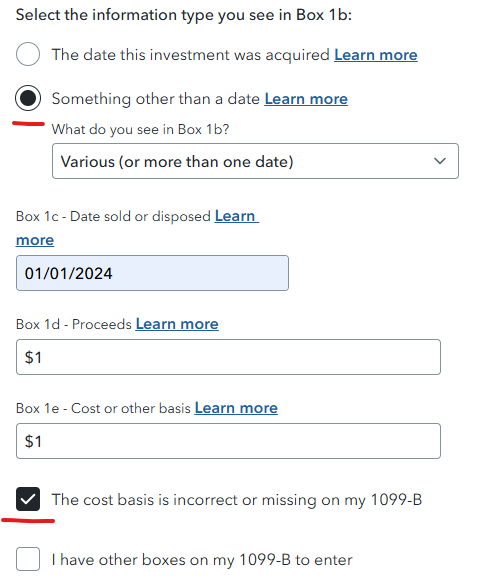

Return to the IRS form 1099-B entry into TurboTax Premium Online. Make the following selections.

- Select Something other than a date and select Various (or more than one date).

- Enter the cost basis information. Select The cost basis is incorrect or missing on my 1099-B. Continue.

- At the screen We noticed there's an issue with your cost basis, select I know my cost basis and need to make an adjustment. Continue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No basis error for 1099-B Long Term non-covered transactions on Form 8949 Part II with Box F checked

Thanks for the reply! I didn't order these sales, apparently they were generated by the internal operations of the security, "O" which is a REIT. So I don't have any records, I did not place any orders for this action and the quantity sold is 0.000. With a quantity of 0.000, I can't even use a general cost basis on total holdings using an average.

I tried to enter 0.00 as the basis (and various as the date acquired) but I am receiving an error implying that a cost basis of 0.00 is not allowed. If I claim some other random value, like a $1, I will generate a capital loss when there isn't any.

In your step 3, if I enter 0.00, I still get an error.

3. "At the screen We noticed there's an issue with your cost basis, select I know my cost basis and need to make an adjustment. Continue."

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

pinguino

Level 2

statusquo

Level 3

Juliaxyw

Level 2

Juliaxyw

Level 2

user17590707650

New Member