- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

These appear to be fractional shares. The income total will be rounded up to $1.

You may have to refer to your personal records including sales tickets to locate the cost basis information that is needed. Or you may elect to report a cost basis of $0 or $1.

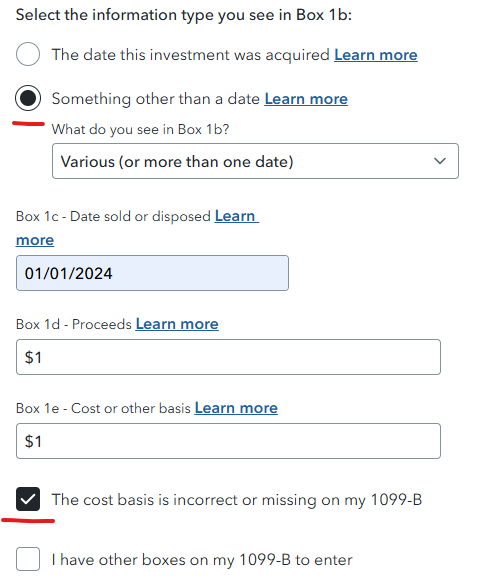

Return to the IRS form 1099-B entry into TurboTax Premium Online. Make the following selections.

- Select Something other than a date and select Various (or more than one date).

- Enter the cost basis information. Select The cost basis is incorrect or missing on my 1099-B. Continue.

- At the screen We noticed there's an issue with your cost basis, select I know my cost basis and need to make an adjustment. Continue.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 30, 2025

11:33 AM