- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Maximum Deferral of Self-Employment Tax Payments

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maximum Deferral of Self-Employment Tax Payments

We received a letter from the IRS stating we owe them an additional $2000 from our 2020 Tax Return.

For clarification, my wife is self-employed. I was not, at the time.

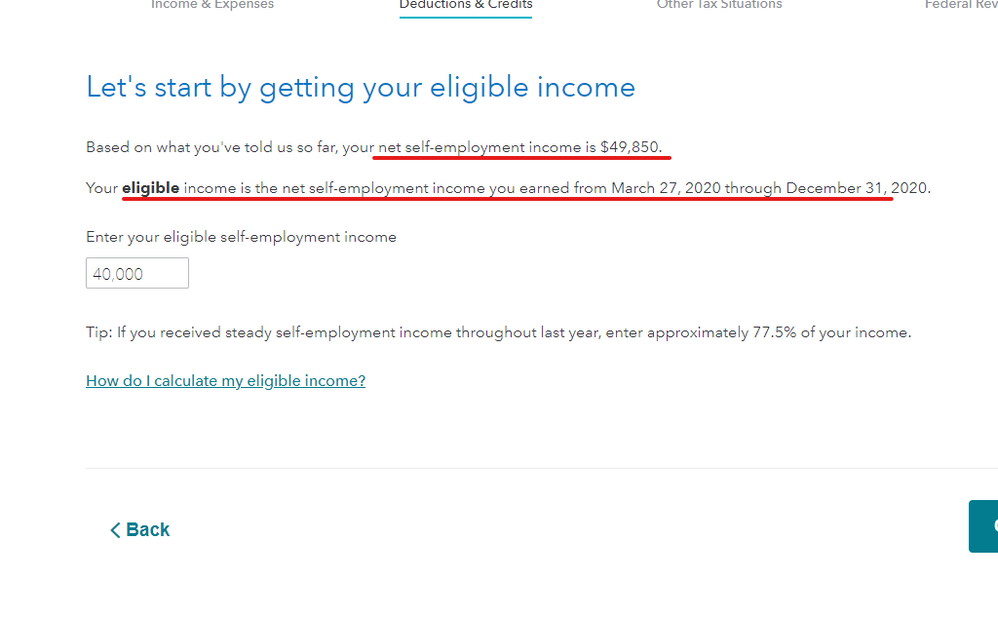

I looked over our 2020 Tax Return PDF and saw that under the Maximum Deferral of Self-Employment Tax Payments, there is an amount of just over $2000 on line 26 under section 3, but when I went back through my Turbotax account (I tried via amendment to see if I could find out where I chose that deferral option), I could not find where I elected to do that. And I don't remember choosing to do that because COVID did not negatively affect our income.

Was this automatic? If so, I had no idea it did that and am quite peeved because we had the money then to pay it all. And I got no kind of data stating I needed to remember to pay it back.

I mean, I could have just forgotten about all that, having COVID-brain and all. Who knows?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maximum Deferral of Self-Employment Tax Payments

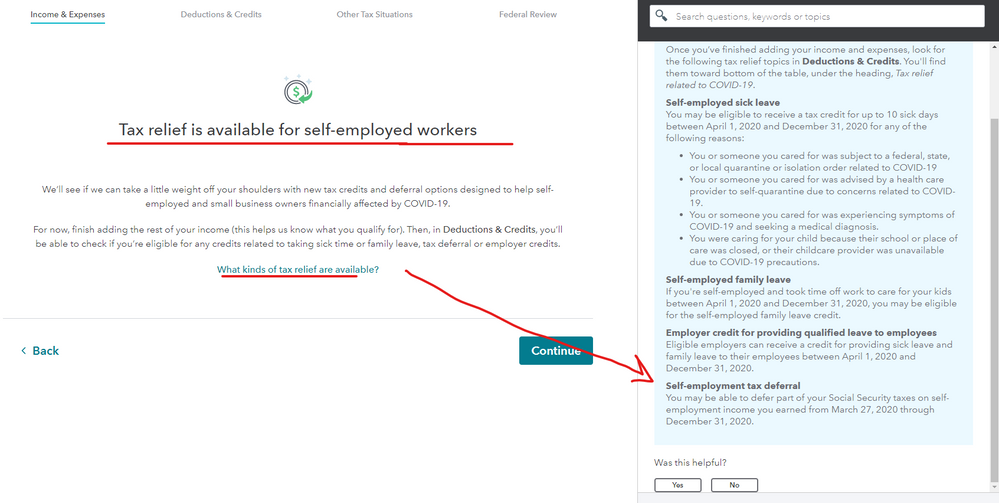

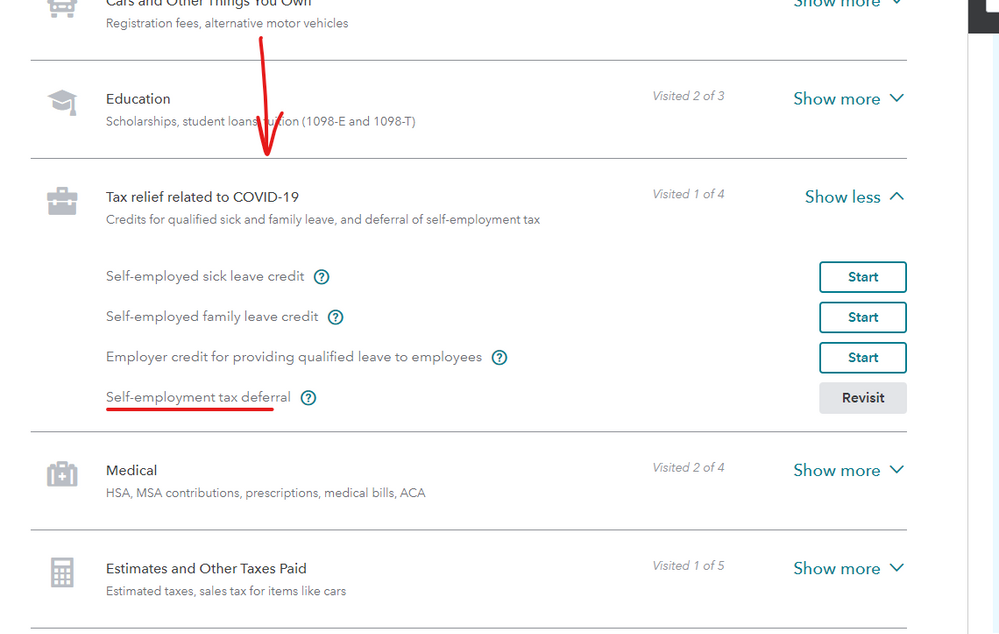

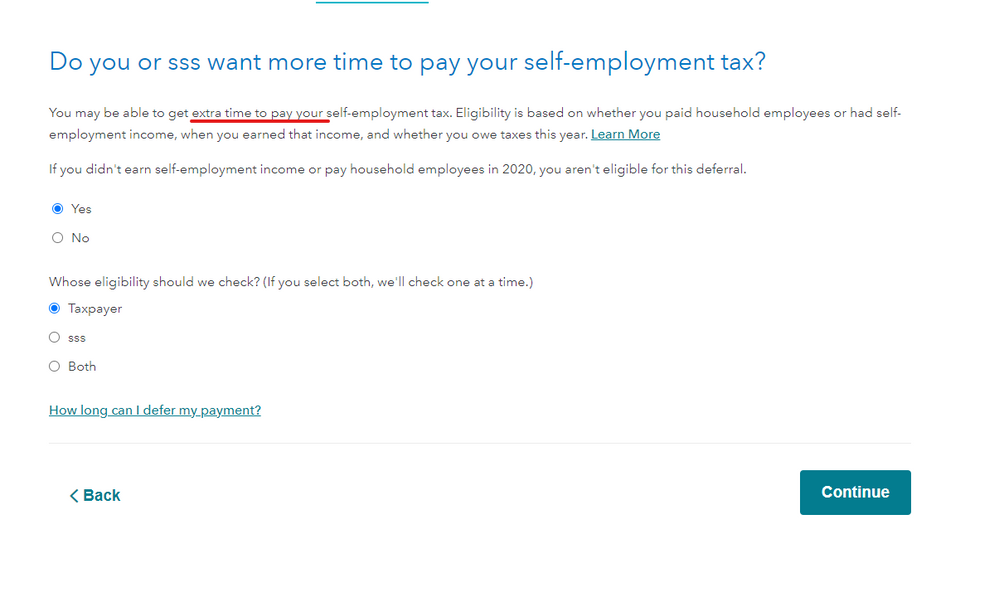

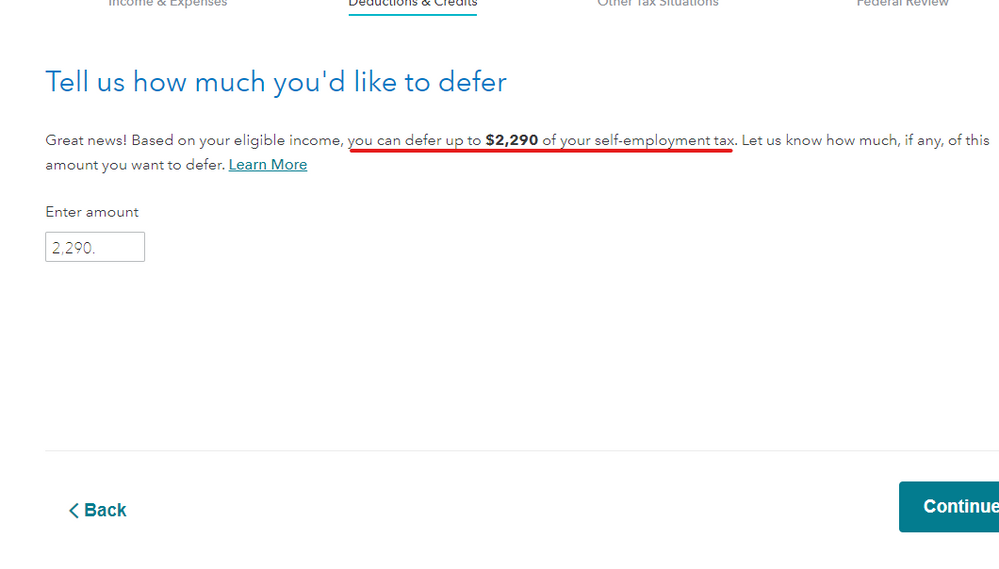

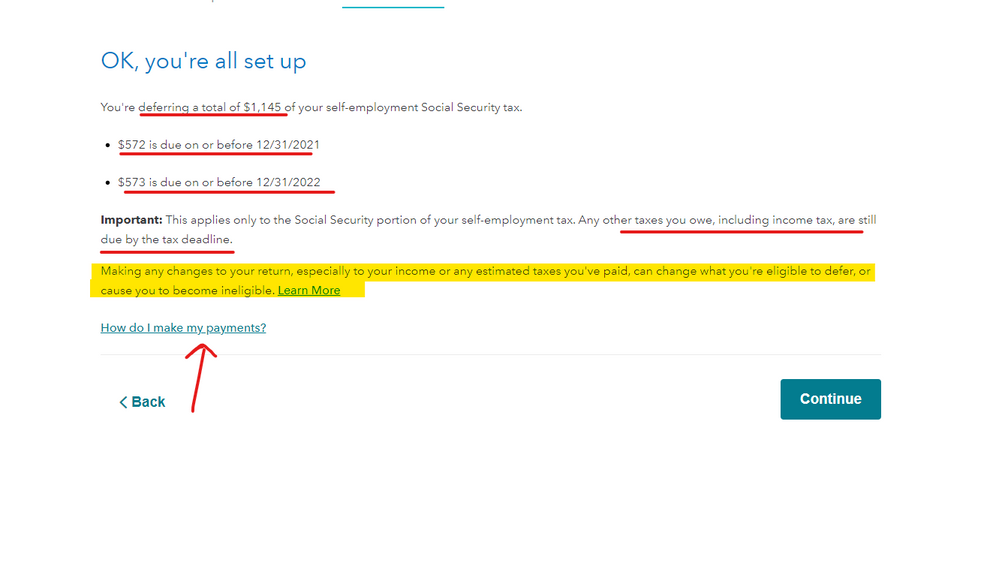

It was not automatic ... you had to choose an amount of SE taxes to defer ... here are the screens you would have seen ... payments were due 12/31/21 & 12/31/22 ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maximum Deferral of Self-Employment Tax Payments

It was not automatic ... you had to choose an amount of SE taxes to defer ... here are the screens you would have seen ... payments were due 12/31/21 & 12/31/22 ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maximum Deferral of Self-Employment Tax Payments

Okay great. I will go back in and take a look at that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maximum Deferral of Self-Employment Tax Payments

Weird, when I go back in to amend my 2020 return, I can't find anything related to Tax Relief Due to COVID-19.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

nediaz1976

Returning Member

virajbdeshpande

New Member

crazy4youth

Level 2

johnny49

New Member

bhuether

Level 3