- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Lyft says I don't need the EIN since I'm not an Employee of them but a subcontractor. so what do I do to get past this portion of needing to pt their EIN down???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lyft says I don't need the EIN since I'm not an Employee of them but a subcontractor. so what do I do to get past this portion of needing to pt their EIN down???

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lyft says I don't need the EIN since I'm not an Employee of them but a subcontractor. so what do I do to get past this portion of needing to pt their EIN down???

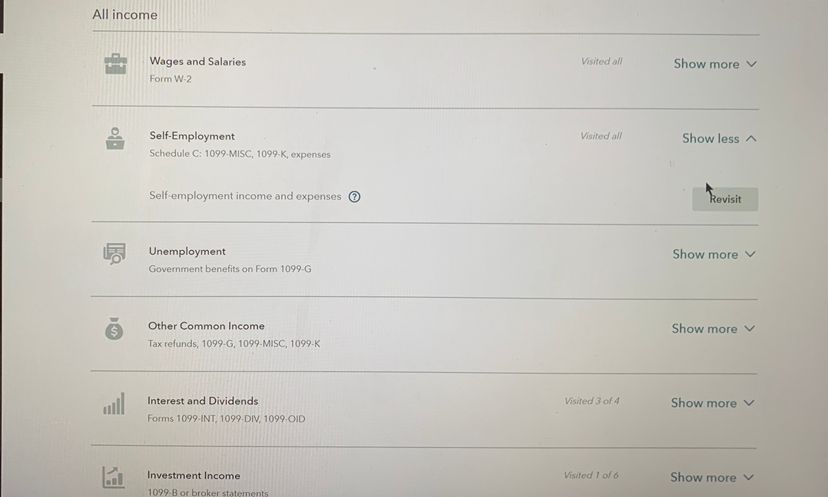

You don't have to enter Lyft's EIN. See the screenshot below.

When you are a Lyft driver, you are self employed.

- Enter your Name as the business name,

- Enter your address as the Business Address and,

- Click on NO when asked if you have an Employer Identification Number.

You are self-employed and have to set up your Uber income as a business on Schedule C, Profit or Loss from Business. You will be able to deduct expenses against the income.

Please note the following :

- The IRS Form 1099-K (and/or IRS Form 1099-MISC) does not have their fees, commissions, safe rider fees or phone rental payments taken out.

- Lyft/Uber drivers need to deduct those as part of your business expenses along with the mileage you drove.

- If you didn't keep track of the mileage or the amounts Lyft/Uber withheld (commissions etc), look on the 2016 Tax Information link on the payments page of your Lyft/Uber driver account. There is a summary sheet linked at the bottom and it shows the fees they took out as well as the mileage for the trips (your mileage may actually be more as you drove around waiting for a hit.)

- As an Lyft/Uber or other self-employed driver, you can deduct work-related expenses.

To enter your income from being a Lyft Driver:

- Type sch c in the search bar and click search.

- Click on Jump to sch c.

- This will take you to where you can enter additional income from your 1099-K.

- You may be asked some general questions about your business.

- On the First, let's confirm your business and address screen, scroll down to Business description.

- After you answer them, you’ll be taken to the Your Business screen where you can enter your 1099-K under Business Income.

- If you are entering income from a 1099-K, remember that it reports the gross amount of the transactions. It doesn't include any adjustments for credits, refunds, discounts, fees, etc.

Related information:

- How do I enter my Lyft Rental fees information?

- How do I enter my Lyft tax information?

- Where do I enter my Lyft/Uber income?

- Where do I enter my Uber or Lyft expenses?

- How does my work in the sharing economy (Uber, Airbnb, etc) affect my taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lyft says I don't need the EIN since I'm not an Employee of them but a subcontractor. so what do I do to get past this portion of needing to pt their EIN down???

Do I leave this blank on my IRS return --

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lyft says I don't need the EIN since I'm not an Employee of them but a subcontractor. so what do I do to get past this portion of needing to pt their EIN down???

Yes, leave it blank if you do not have one.

Since you are a subcontractor of Lyft, you will enter your income into Schedule C for your own self-employed business. When you start to go through this section it will ask for an EIN, but that is referring to the EIN for your business, not the business that paid you.

The answer above by HelenaC addresses this question well. Please take a look at it for more details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lyft says I don't need the EIN since I'm not an Employee of them but a subcontractor. so what do I do to get past this portion of needing to pt their EIN down???

I tried filling up my Section C but it says I need a Business Tax ID and I don’t know what that is. I made under 20,000 so I didn’t qualify for a 1099

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lyft says I don't need the EIN since I'm not an Employee of them but a subcontractor. so what do I do to get past this portion of needing to pt their EIN down???

If you did not get a 1099-misc for the income then SKIP the 1099 input page in the Sch C entry section ... use the next section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lyft says I don't need the EIN since I'm not an Employee of them but a subcontractor. so what do I do to get past this portion of needing to pt their EIN down???

Thanks for the help.

It is not showing me a general income section. Only what is shown. And says a Business ID number is required during the review process.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lyft says I don't need the EIN since I'm not an Employee of them but a subcontractor. so what do I do to get past this portion of needing to pt their EIN down???

Hit the REVISIT button on the Sch C entry ... then click on the INCOME section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lyft says I don't need the EIN since I'm not an Employee of them but a subcontractor. so what do I do to get past this portion of needing to pt their EIN down???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lyft says I don't need the EIN since I'm not an Employee of them but a subcontractor. so what do I do to get past this portion of needing to pt their EIN down???

I did but I am having an issue in state. I figured it out. Thanks for the help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lyft says I don't need the EIN since I'm not an Employee of them but a subcontractor. so what do I do to get past this portion of needing to pt their EIN down???

I'm having issues with state as well. How did you fix it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lyft says I don't need the EIN since I'm not an Employee of them but a subcontractor. so what do I do to get past this portion of needing to pt their EIN down???

An Employer Identification Number (EIN) is a 9-digit number (for example, 12-3456789) assigned to employers, sole proprietors, corporations, partnerships, estates, trusts, certain individuals, and other entities for tax filing and reporting purposes.

Did you work for Lyft one year ago? Would last year's tax return report this number? Is there a friend working for Lyft who may have the number?

A Google inquiry reports an employer identification number for Lyft. Do not know whether or not this is the one that you need.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

easytrak2002

New Member

dfarrell

New Member

bagator1

New Member

dabbsj58

New Member

jcrouser

New Member