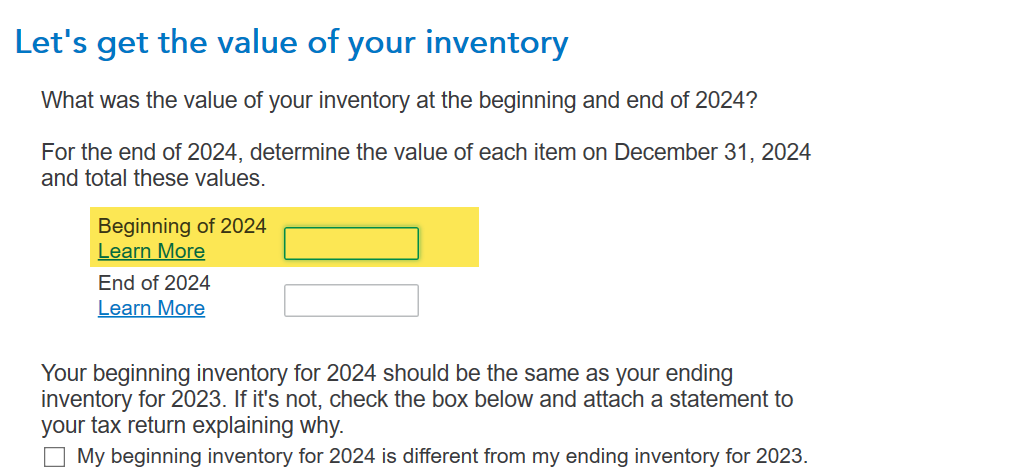

When you go into the Inventory/Cost of Goods Sold section of TurboTax, you will see an opportunity to enter your beginning inventory on the screen that says Let's get the value of your inventory:

Also, if you overstated the value of your ending inventory on the previous year's tax return, that would have artificially decreased your cost of good sold for that year, so you may have overstated your income. If so, you can amend your previous year tax return to account for that.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"