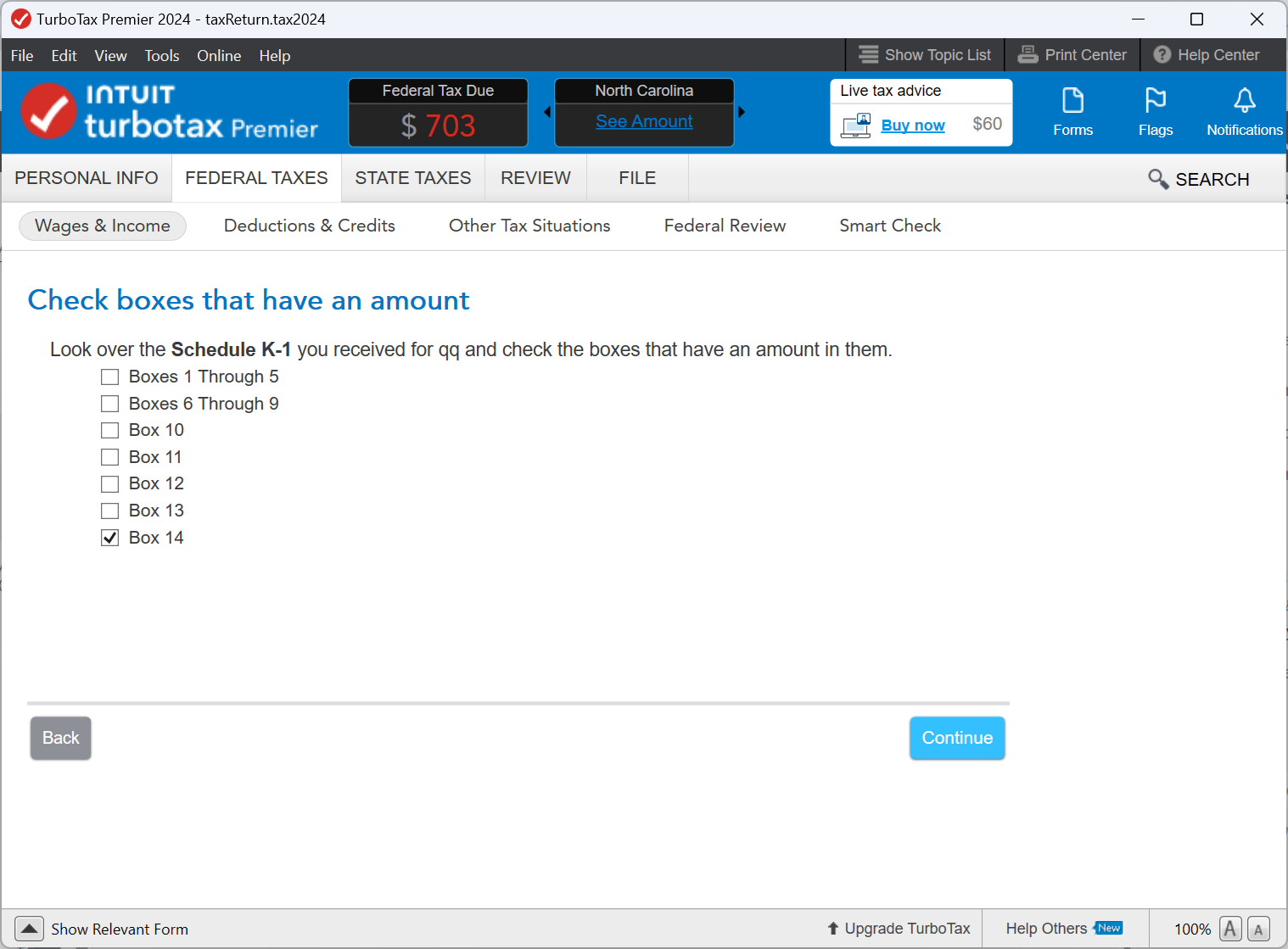

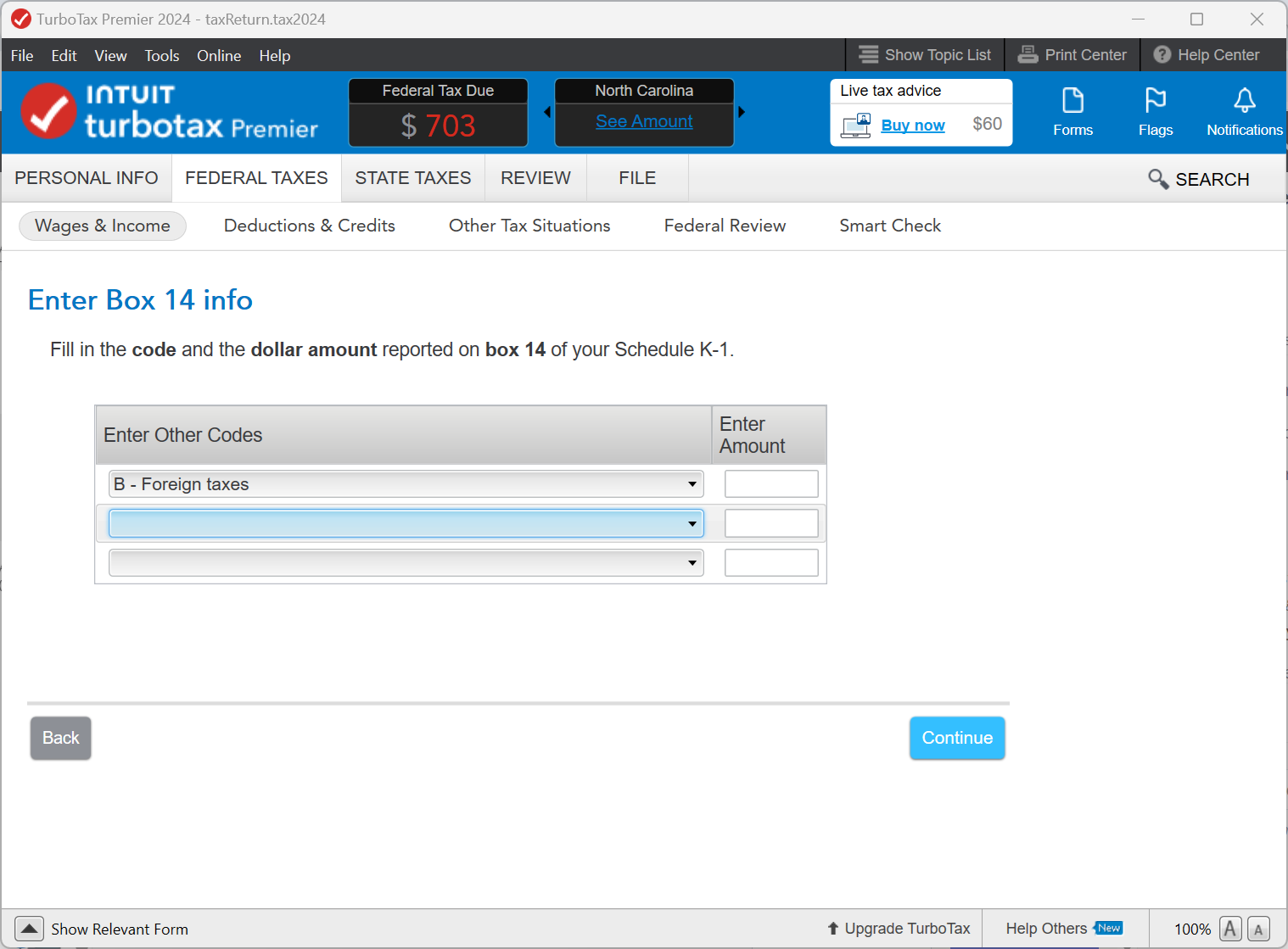

Yes, you would place a check mark if box 14 has an amount recorded in K1. See the first screenshot. After you make this selection, there will be a screen that has a series of drop-downs. Since you said you have foreign income, you would select foreign taxes. See the second screenshot.

You may have other things like passive income, or general income, depending on the source and nature of the income reported by the estate or trust to report in Box 14. This should be disclosed eithe on the K-1 or in addtional disclosure forms that came with your k-1.

You will be asked to fill out additional information about your foreign taxes in a series of followup questions after you record your initial entry in Box 14 . This information will be on a K-3 or in the extra forms that came with your K-1.

Here are the screens that I mentioned above.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"