- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Im having problem with box 14

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im having problem with box 14

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im having problem with box 14

Employers can put just about anything in box 14; it's a catch-all for items that don't have a dedicated box on the W-2.

In TurboTax, enter the description from your W-2's box 14 on the first field in the row. Enter the dollar amount and select the correct tax category that goes with that description.

If none of the categories apply, scroll to the bottom of the list and choose Other–not on above list. TurboTax will figure out if it impacts your return or not. If TurboTax needs more information, the program will ask you a question.

If box 14 is blank, just skip over it. Don't enter a 0 for any blank boxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im having problem with box 14

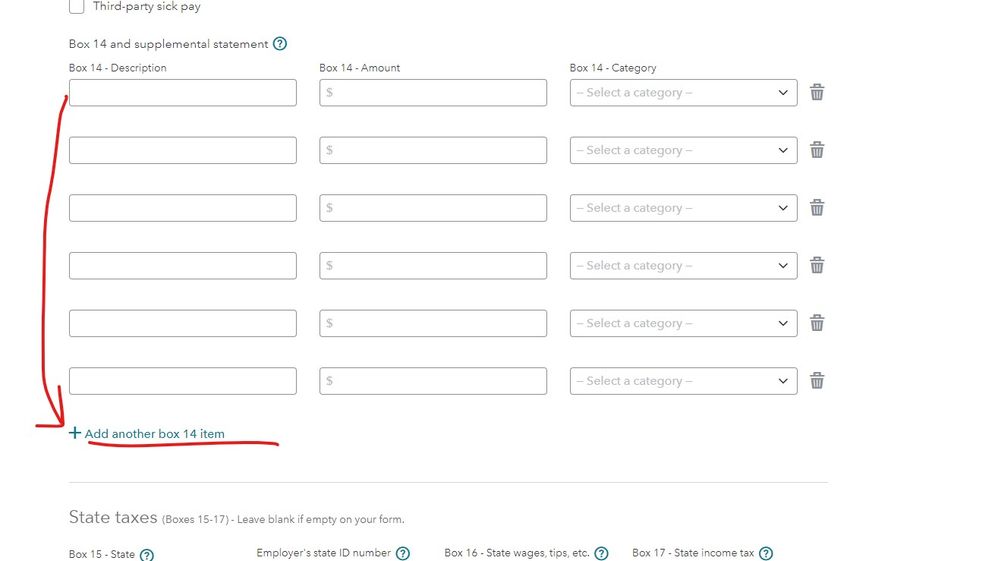

Box 14 does not provide enough spaces for me to include the information from my W-2. Should I add the amounts that are listed. For ex: Fringe Benefits, add the amounts listed, then add the amounts together for Pre-Tax Contributions, and so on.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im having problem with box 14

You can add additional rows in Box 14 if you are using Turbo Tax online. If you are using the software product, there are four available spaces but when you populate the 4th space, an additional box will open up. You should have enough spaces for your entries and you made need to truncate the description. It's the code that you enter in the drop- down that is crucial in the reporting this information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im having problem with box 14

In the 2021 version of the online program there are only 3 rows to add Box 14 items. No additional rows appear when I fill in those 3 rows and I do not see an option to add a row. Am I missing something or is there a work around for this issue?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im having problem with box 14

Maybe clear your cookies and/or switch browsers ... I have many lines and can still add more ...

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jackkgan

Level 5

oyadinalatoyia36

New Member

jonathandavisbeck

New Member

user17695732073

New Member

jackkgan

Level 5