- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Im filing my taxes and its asking for my to enter the code in box 12, yet my w-2 form says "See instructions for box 12" i read the instructions can someone help me?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im filing my taxes and its asking for my to enter the code in box 12, yet my w-2 form says "See instructions for box 12" i read the instructions can someone help me?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im filing my taxes and its asking for my to enter the code in box 12, yet my w-2 form says "See instructions for box 12" i read the instructions can someone help me?

A TurboTax employee posted this:

. On January 8, 2024 (i.e., about two weeks ago) the IRS released a notice describing many changes required to implement the Secure Act 2.0 - I believe that this is what "We're updating how SEP and simple plan contributions are reported on the tax return based on new guidance from the IRS." is referring to.

Indeed, Section 601 of the Secure Act 2.0 refers specifically to Simple and SEP Roth IRAs. Code S in box 12 refers to how to handle a SIMPLE plan.

These last minute IRS (and law) changes inescapably cause delays on the part of TurboTax and other tax processors.

It will take time for TurboTax to understand all the ramifications of this IRS Notice and then code and test the changes. The IRS is not open for filing until January 29th so you have some time to wait.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im filing my taxes and its asking for my to enter the code in box 12, yet my w-2 form says "See instructions for box 12" i read the instructions can someone help me?

Where in TurboTax are you being asked to enter a code from box 12? In general, you should enter the information from your W-2 as is into TurboTax.

Or are you having some other issue?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im filing my taxes and its asking for my to enter the code in box 12, yet my w-2 form says "See instructions for box 12" i read the instructions can someone help me?

Hello,

I am having this same issue, but it is now the 30th. Do you know what the problem is?

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im filing my taxes and its asking for my to enter the code in box 12, yet my w-2 form says "See instructions for box 12" i read the instructions can someone help me?

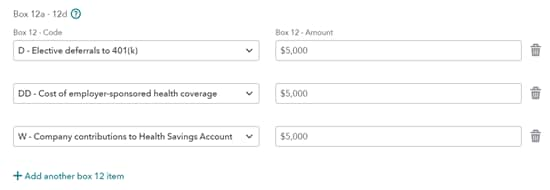

Here are the instructions for Box 12 for TurboTax. How Do I Fill out Box 12?

The W-2 you got from your employer will have four lines for box 12—labeled 12a, 12b, 12c, and 12d.

Any amount on a box 12 line will also have an uppercase (capital) letter code associated with it. (If there aren’t any capital letter codes in box 12, skip it and move on to box 13.)

In each box 12 line, select the capital letter code from the dropdown and enter the corresponding amount.

Important: Don't confuse the lowercase box 12 letter (for example, the a in box 12a) with the capital letters in the dropdown. So, if your box 12a has the letter code D in it, select D (not A) from the dropdown. And if 12a is blank, leave it blank—don't select A.

To enter multiple box 12 amounts, select +Add another box 12 item.

Example

In this fictitious (and somewhat unrealistic) example, the W-2 shows these box 12 amounts:

- $5,000 in box 12a with code D

- $5,000 in box 12b with code DD

- $5,000 in box 12c with code W

- Box 12d is blank

Here's what the entries would look like in TurboTax Online:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im filing my taxes and its asking for my to enter the code in box 12, yet my w-2 form says "See instructions for box 12" i read the instructions can someone help me?

My question is in regards to why I'm unable to file because of the changes by the IRS. A previous response to the original question was made by another employee. That is what I'm encountering.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im filing my taxes and its asking for my to enter the code in box 12, yet my w-2 form says "See instructions for box 12" i read the instructions can someone help me?

Any update?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im filing my taxes and its asking for my to enter the code in box 12, yet my w-2 form says "See instructions for box 12" i read the instructions can someone help me?

They are still working on updating the program for box 12 code S. You just have to wait.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im filing my taxes and its asking for my to enter the code in box 12, yet my w-2 form says "See instructions for box 12" i read the instructions can someone help me?

Still getting this message to wait until February 7th. Any news as to when this issue will be solved??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im filing my taxes and its asking for my to enter the code in box 12, yet my w-2 form says "See instructions for box 12" i read the instructions can someone help me?

I am not able to file my return because I am getting an error for box 12. I entered S as the code and the amount in box 12 and it keeps telling me "should not be greater than the value in box 12 with code S for this W-2." I am entering the code and amount that is on my W-2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im filing my taxes and its asking for my to enter the code in box 12, yet my w-2 form says "See instructions for box 12" i read the instructions can someone help me?

Still waiting....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im filing my taxes and its asking for my to enter the code in box 12, yet my w-2 form says "See instructions for box 12" i read the instructions can someone help me?

FIGURED IT OUT. REDDIT GROUP ADDRESSING THIS SPOKE WITH SUPPORT AND THEY SAID TO DROP THE CENTS FROM THE DOLLAR AMOUNT AND IT SHOULD GO THROUGH. WORKED FOR ME.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im filing my taxes and its asking for my to enter the code in box 12, yet my w-2 form says "See instructions for box 12" i read the instructions can someone help me?

That worked! Thank you so much:)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im filing my taxes and its asking for my to enter the code in box 12, yet my w-2 form says "See instructions for box 12" i read the instructions can someone help me?

For anyone still experiencing a "Check This Entry" message involving Form W2 Box 12, Code S, please click here to sign up to receive an email notification when the issue has been resolved.

In the meantime, a workaround for this issue is to round your numbers to the nearest dollar and not include the decimal/cents.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im filing my taxes and its asking for my to enter the code in box 12, yet my w-2 form says "See instructions for box 12" i read the instructions can someone help me?

My turbo tax asks me to fill out box 12. I fill out box 12, it then asks me how much of my contribution went to a Simple IRA, I put the total amount. The system is glitching saying” Box 12 code S— should not be greater than the value is box 12 with code S for this W-2”

they’re literally the exact same number. All of my contribution went to a simple ira

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sacap

Level 2

botin_bo

New Member

dc20222023

Level 3

bpscorp

New Member

Kh52

Level 2