- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- I received the $1200 stimulus last year and $600 this january. Do I include the $600 on my taxes where it asks for the 2nd amount. It was in a different tax year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received the $1200 stimulus last year and $600 this january. Do I include the $600 on my taxes where it asks for the 2nd amount. It was in a different tax year

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received the $1200 stimulus last year and $600 this january. Do I include the $600 on my taxes where it asks for the 2nd amount. It was in a different tax year

YES

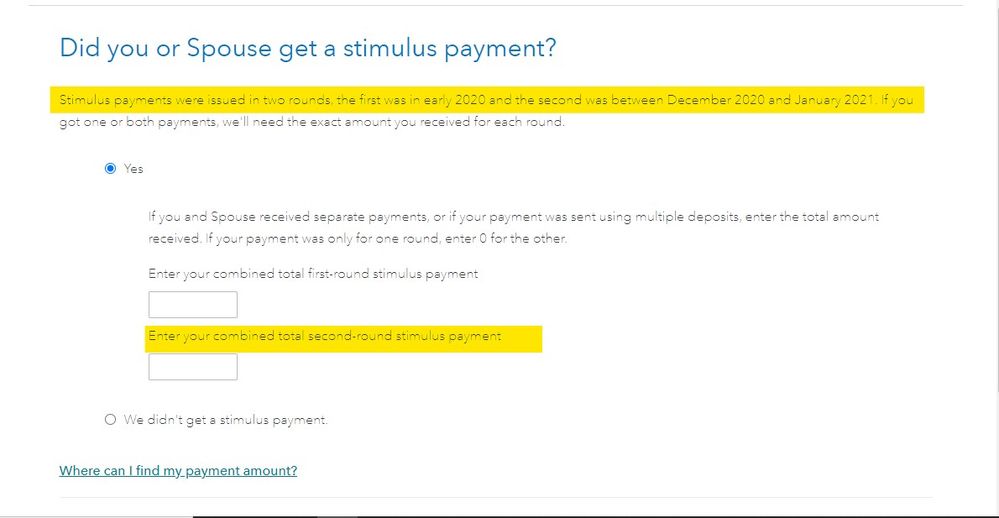

Congress passed the 2nd stimulus bill at the end of 2020. The 2nd stimulus checks started going out at the very end of December 2020 and continued into early January 2021. When you fill out the recovery rebate credit it is important for you to enter the entire total of the amount you have received for yourself, your spouse, and your dependent children so far. Entering the wrong amount might delay your 2020 refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received the $1200 stimulus last year and $600 this january. Do I include the $600 on my taxes where it asks for the 2nd amount. It was in a different tax year

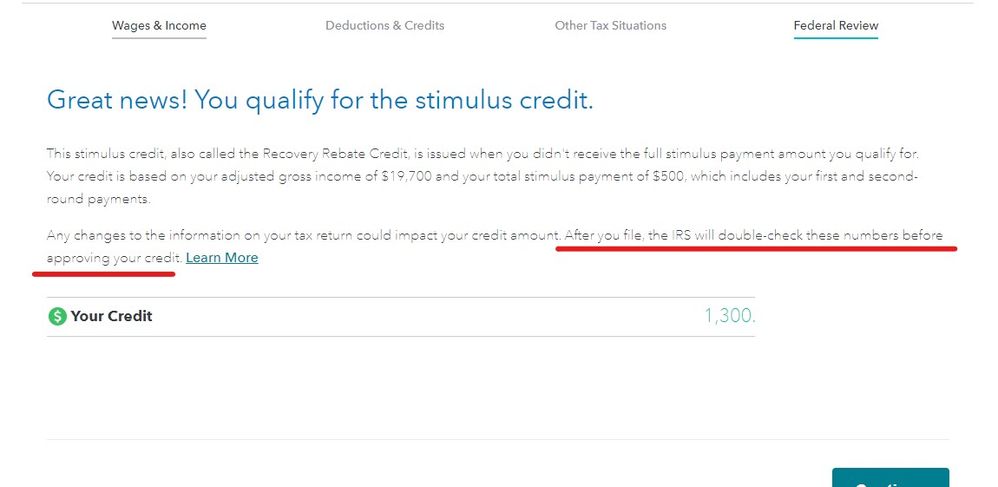

Yes, you have to report both stimulus payments on your 2020 tax return, even if your receive the second payment in January 2021.

In fact, both these payments are advanced payments of the 2020 Recovery Rebate Credit.

Please read this IRS document on the Recovery Rebate credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received the $1200 stimulus last year and $600 this january. Do I include the $600 on my taxes where it asks for the 2nd amount. It was in a different tax year

Individuals are on a cash basis.

Where is it stated by the IRS that the Stimulus Payment received in 2021 must be included on the 2020 Tax Return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received the $1200 stimulus last year and $600 this january. Do I include the $600 on my taxes where it asks for the 2nd amount. It was in a different tax year

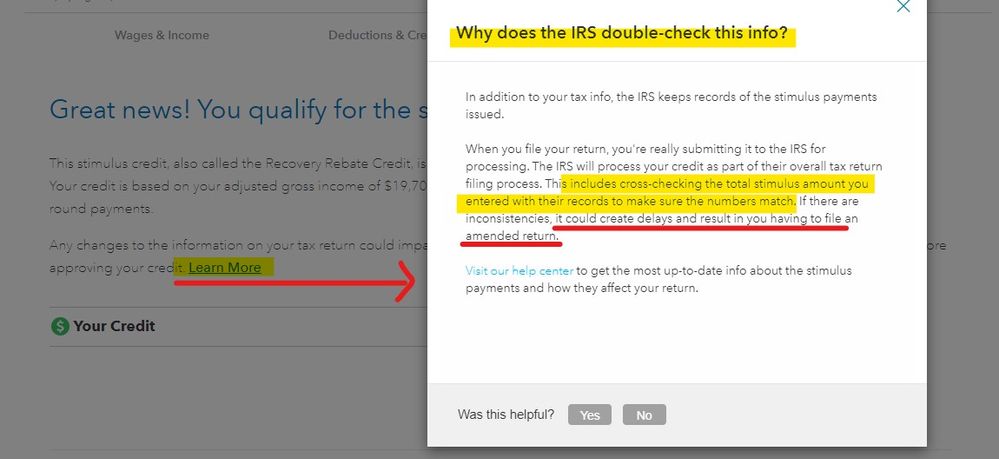

The TT program follows all IRS rules and regulations ... see the screen shots below.

From the IRS: https://www.irs.gov/newsroom/recovery-rebate-credit

Both of the first 2 stimulus payments were an ADVANCE of the 2020 credit and as such both need to be listed on the 2020 return ... they are NOT taxable but are used to RECONCILE the credit against what you already got in advance. Failure to enter the correct amount you received for the first 2 stimulus payments on the 2020 return will delay the processing of the return while the IRS corrects your "math error" and adjusts your bottom line.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

palomino2316

New Member

jpw050

Level 2

Mike6465

Level 1

alexis-tunnell17

New Member

rykcade

New Member