- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

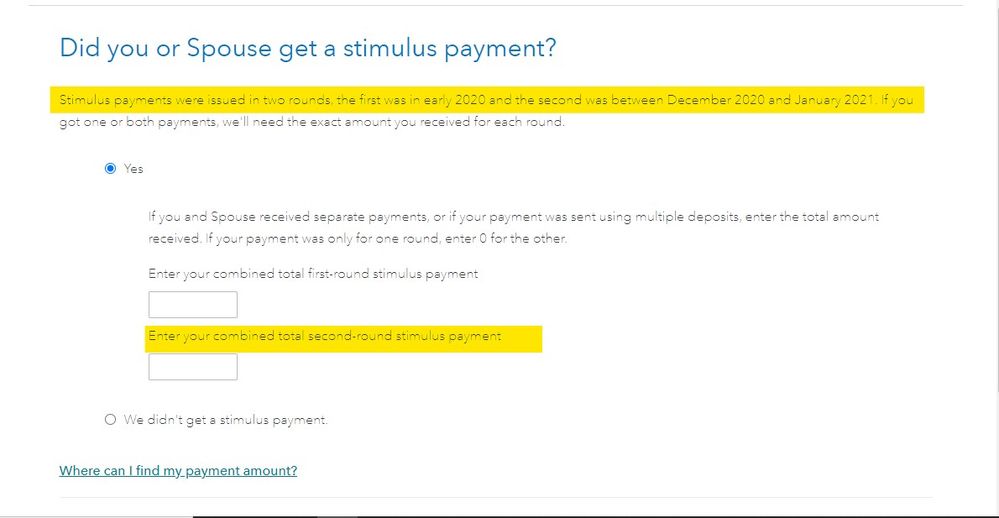

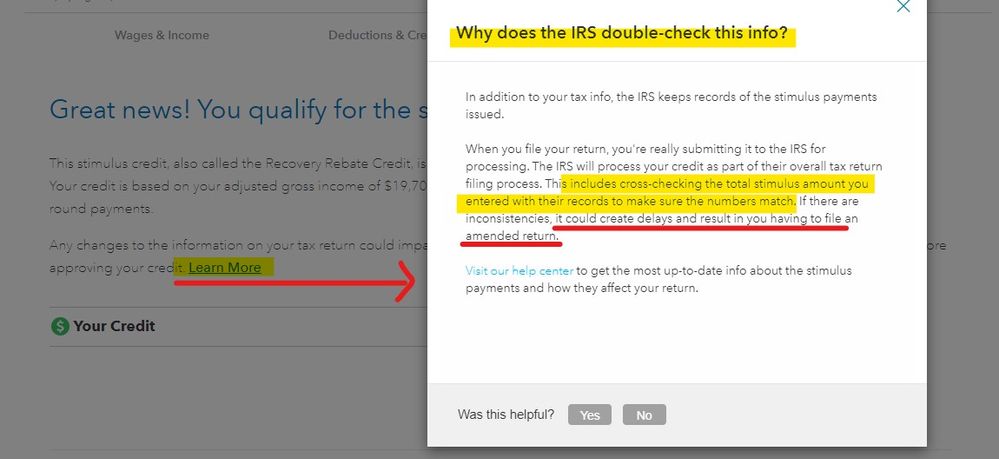

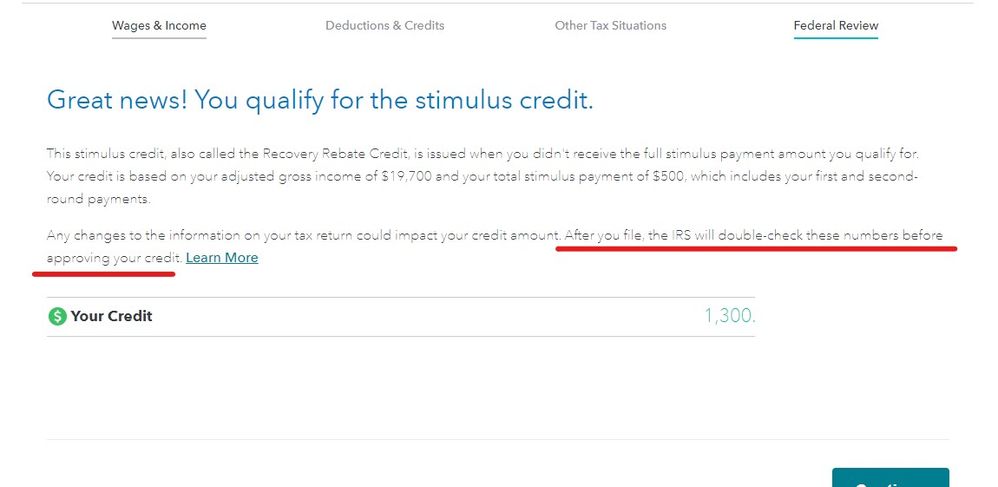

The TT program follows all IRS rules and regulations ... see the screen shots below.

From the IRS: https://www.irs.gov/newsroom/recovery-rebate-credit

Both of the first 2 stimulus payments were an ADVANCE of the 2020 credit and as such both need to be listed on the 2020 return ... they are NOT taxable but are used to RECONCILE the credit against what you already got in advance. Failure to enter the correct amount you received for the first 2 stimulus payments on the 2020 return will delay the processing of the return while the IRS corrects your "math error" and adjusts your bottom line.

March 12, 2021

5:46 PM

1,055 Views