- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- I'm not getting my WI deduction for my Edvest contribution. Schedule CS line 3 is showing 0. Do you know why?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm not getting my WI deduction for my Edvest contribution. Schedule CS line 3 is showing 0. Do you know why?

Please advise how to enter WI Schedule CS in the online version of TurboTax.

We have two dependents for whom we have EdVest accounts.

Dep1: in college...we're drawing on 529...no contributions (I entered a 1099-Q)

Dep2: not yet in college...we're not drawing...and have contributions (no 1099-Q)

There doesn't seem to be a way to enter Dep2 contributions to get the WI tax break.

Something appears to be broken. Any one else have this issue?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm not getting my WI deduction for my Edvest contribution. Schedule CS line 3 is showing 0. Do you know why?

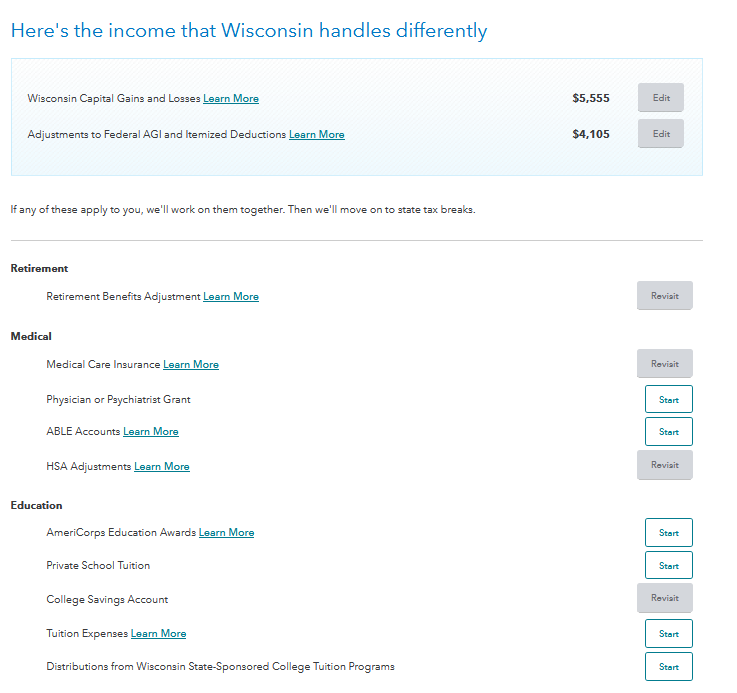

You will find it in the Wisconsin return. Look for the Here's the income that Wisconsin handles differently screen and click on Start or Revisit.

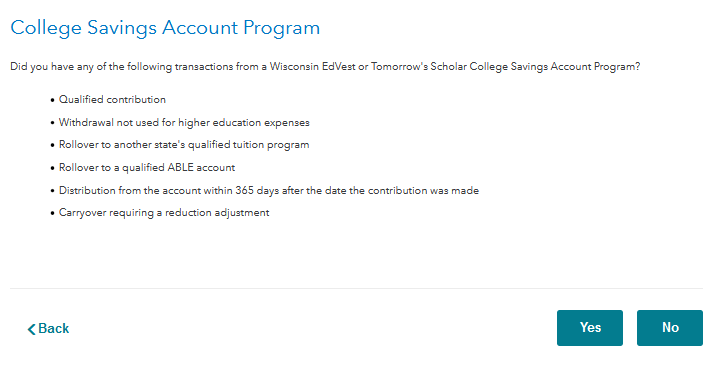

Click on Yes.

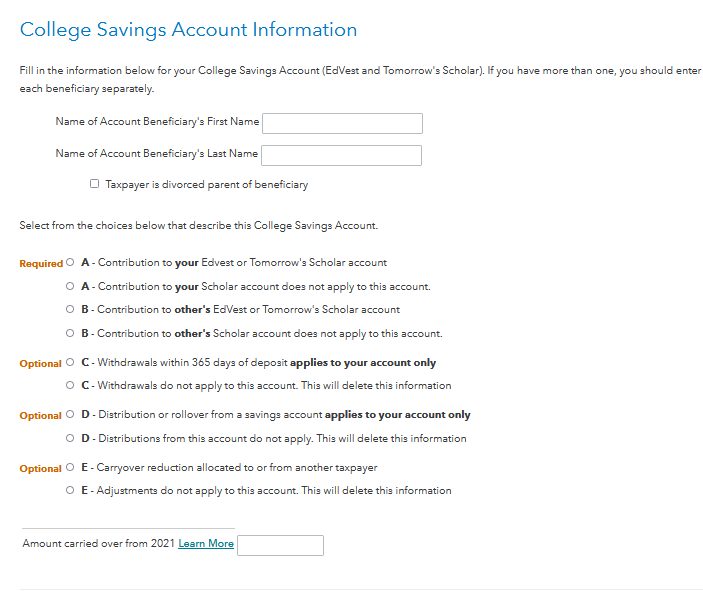

Complete the next screen

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm not getting my WI deduction for my Edvest contribution. Schedule CS line 3 is showing 0. Do you know why?

Ok, this solved my problem. I was looking at deductions and not thinking that a contribution to edvest would be income. It's a little confusing from my chair (and perhaps a WI state filing confusion rather than TurboTax). Regardless, the quick feedback was very much helpful, timely, and appreciated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm not getting my WI deduction for my Edvest contribution. Schedule CS line 3 is showing 0. Do you know why?

When I entered my Edvest contribution in the Federal Return it did not flow to the Wisconsin return and so I had to find the form and enter it myself. Turbo tax must have a missing link.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm not getting my WI deduction for my Edvest contribution. Schedule CS line 3 is showing 0. Do you know why?

For me it's not entering the number I think it's supposed to on Line 7 of Wisconsin Schedule CS. My reading is your supposed to enter $3860 on that line if you're Married Filing Jointly or Single. TurboTax enters 0.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm not getting my WI deduction for my Edvest contribution. Schedule CS line 3 is showing 0. Do you know why?

it depends. Try entering this amount in your state return if you haven't done so.

- Open Turbo Tax

- Go to State returns. Start working on your Wisconsin State return.

- Go to the page that is titled Here is the income Wisconsin handles Differently

- Go to Education

- Go to College Saving Account

- Fill in all information required in the College Saving Account Information

- After entering, you will be brought to the Here is the income Wisconsin handles Differently page. You should a separate listing for College Savings Account and the $3860 total listed.

- $3860 should be listed automatically on line 7 & 8 on Schedule CS. You do not need to enter this on the form if it is filled out correctly in the state interview section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

georgiesboy

New Member

jwicklin

Level 1

djpmarconi

Level 1

rtoler

Returning Member

botin_bo

New Member