- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- I'm having problems with this too

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, how do we take advantage of the section 179 full deduction for a new vehicle used 100% for business? Thanks!

Cathi, your instructions were very helpful, but I'm still not getting the full deduction, either (I'm doing 2019 taxes). I did not have a trade-in so that's not the problem, but TT did ask when I purchased the vehicle and it seems to be reducing the deduction by the proportion of the year prior to purchase (nearly cutting the deduction in half). I think this is wrong and I should be able to deduct 100% of the purchase price even if I bought on the last day of the year. Let me add that I did have another car in business use until I bought the replacement car, so perhaps that is affecting the deduction. Also, the replacement car was used (but I put in the actual purchase price). Can you help?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, how do we take advantage of the section 179 full deduction for a new vehicle used 100% for business? Thanks!

Is your vehicle over 6000 pounds?

Why are you choosing Section 179 rather than using the Special Depreciation Allowance ("Bonus Depreciation")? That can cause problems.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, how do we take advantage of the section 179 full deduction for a new vehicle used 100% for business? Thanks!

Something does not seem correct. I had the same problems last year with getting the full deduction for my vehicle. I am ready this thread and hope to be able to go back and check and correct it all. I have used TT for 25 years, but now I am thinking I need a CPA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, how do we take advantage of the section 179 full deduction for a new vehicle used 100% for business? Thanks!

Our solution was similar. By switching over to "Forms", and navigating to the Car and Truck Worksheet for the vehicle we were trying to get Sect 179 deduction for, we found that the only way to make it work was to check "Yes" for "Have record of personal mileage for full year?" at Line 10a within Part I - Vehicle Information. Also, we noticed that if this was checked as "No", the software would change the "Percent of business use" to 50 percent, even though we used the vehicle 100 percent for farm use. The software seems glitchy with respect to this, and I'd like to suggest Intuit review. Everything I've read suggests that if we use the vehicle 100 percent for business use, we are entitled to the Sect 179 deduction. Why would TurboTax make it so hard for a user to claim it? This software is all about getting the biggest deductions, right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, how do we take advantage of the section 179 full deduction for a new vehicle used 100% for business? Thanks!

The Section 179 can be used for your vehicle if all the entries are entered. Keep in mind that if your business miles are less than your personal miles TurboTax automatically determines the business use percentage per IRS guidelines.

- Sign into your TurboTax account > Select Income and Expenses > Business Income > Select the Farm activity where the vehicle is used.

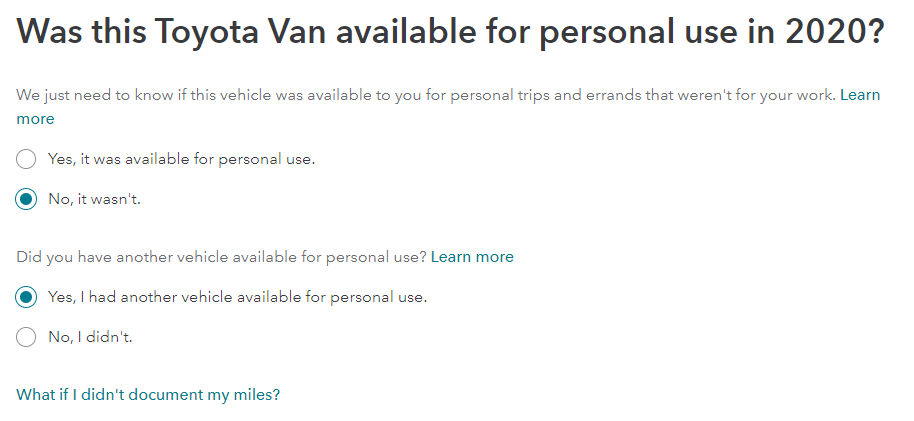

- Select the appropriate response to whether it was used for personal use and if you had another vehicle for personal use

- Select yes for tracked miles for business and/or personal miles

- Enter the total miles driven for the farm and total miles (for 100% use they must equal)

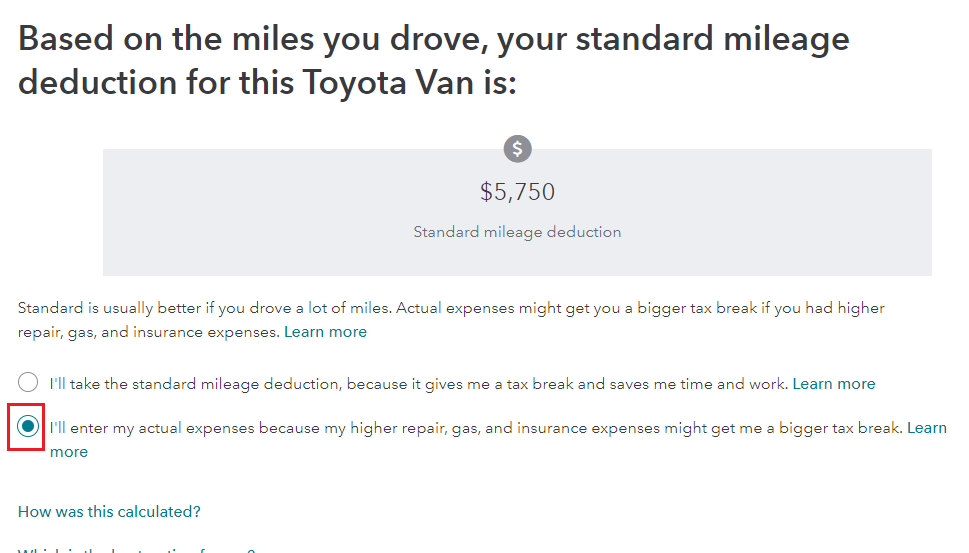

- Continue and select Yes to use actual miles, then continue to answer the questions on each screen

- Enter the date you became the owner of this vehicle (if not 2020, Section 179 is not allowed)

- Continue to enter the cost of the vehicle

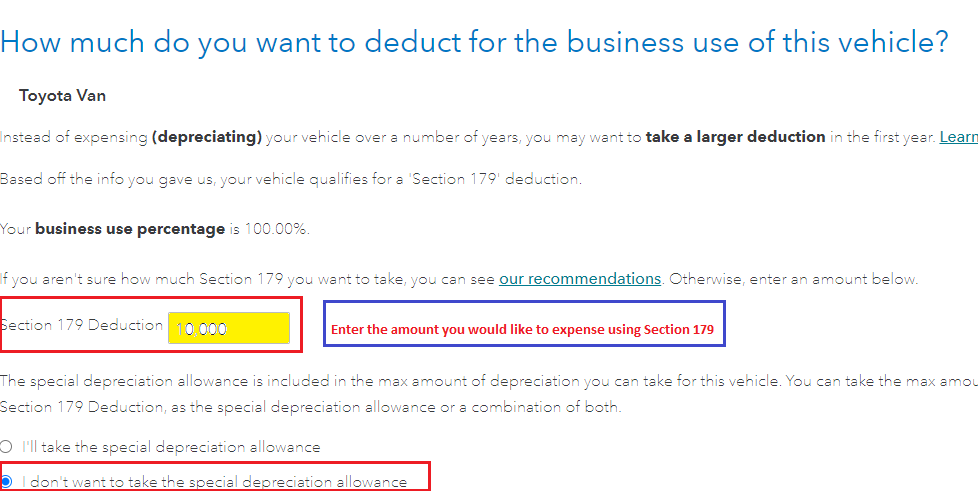

- The next screen will ask how much you want to expense using Section 179

- See the images below for assistance.

Review the images below which appear in both TurboTax Desktop and TurboTax Online.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, how do we take advantage of the section 179 full deduction for a new vehicle used 100% for business? Thanks!

Diane, thanks for the review and additional information.

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Bobbo00

Level 2

Garykl

New Member

julesjag

New Member

erikmetzger412

New Member

tke0020

New Member