- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

The Section 179 can be used for your vehicle if all the entries are entered. Keep in mind that if your business miles are less than your personal miles TurboTax automatically determines the business use percentage per IRS guidelines.

- Sign into your TurboTax account > Select Income and Expenses > Business Income > Select the Farm activity where the vehicle is used.

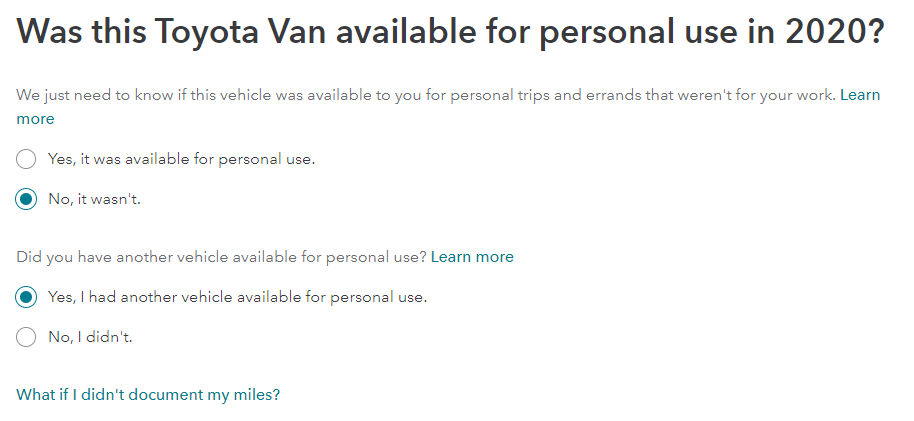

- Select the appropriate response to whether it was used for personal use and if you had another vehicle for personal use

- Select yes for tracked miles for business and/or personal miles

- Enter the total miles driven for the farm and total miles (for 100% use they must equal)

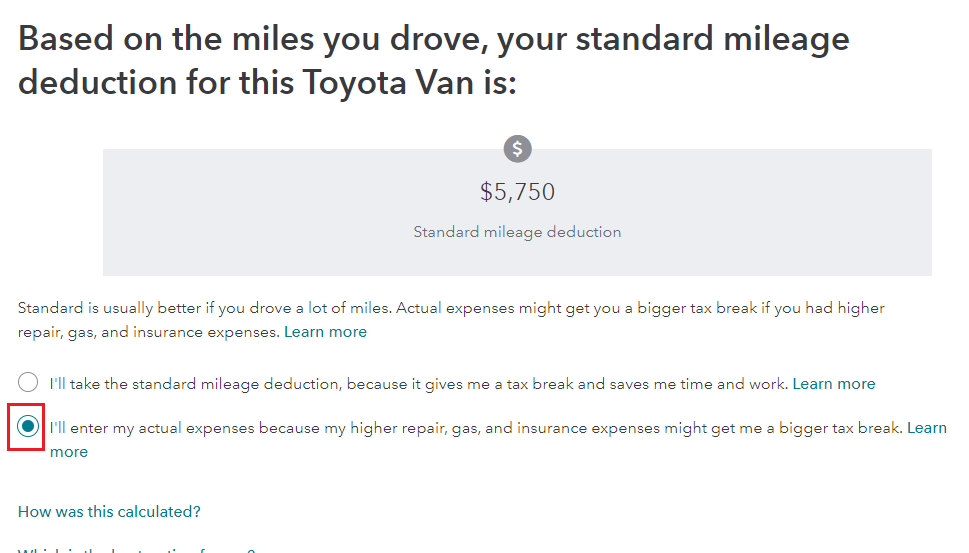

- Continue and select Yes to use actual miles, then continue to answer the questions on each screen

- Enter the date you became the owner of this vehicle (if not 2020, Section 179 is not allowed)

- Continue to enter the cost of the vehicle

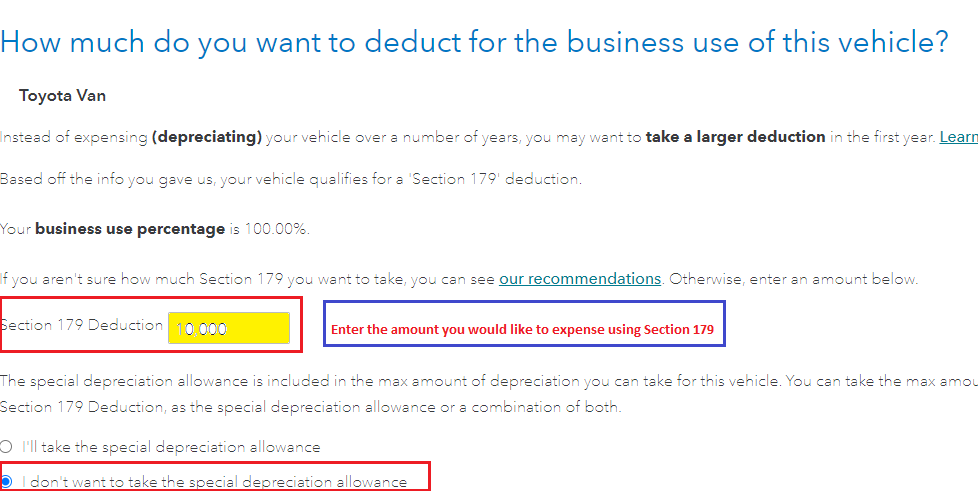

- The next screen will ask how much you want to expense using Section 179

- See the images below for assistance.

Review the images below which appear in both TurboTax Desktop and TurboTax Online.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 2, 2021

9:30 AM