- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- I have rental property with active participation, so losses were allowed on Federal but not CAL taxes--selling the property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have rental property with active participation, so losses were allowed on Federal but not CAL taxes--selling the property

I have rental property with active participation, so each year my losses were allowed to offset income on my Federal tax but not on the California taxes because Cal treats all Rentals as passive income. As such, each year I reached loss limitations on the CAL form that didn't allow any of the losses to offset my income. That's fine. But now I've just sold the property (totally disposed of the property) in a 1031 partial exchange, which generated a taxable event/ gain (boot) for both Federal and Cal taxes. The taxable gain exceeds my CAL accumulated disallowed losses. So, I should be able to claim those accumulated, previously disallowed losses shown on Cal form 3801against the taxable gain incurred, but I don't know how to input that on the Cal form only. If I input this info into my federal info as passive activity losses carried from a previous year, it would give me the deduction on my federal tax twice because it's already being counted/has been counted as a loss based on my active participation as a real estate prof. So, I'm left trying to only input the info into the CAL tax return as a disallowed loss carryforward from form 3801. I guess I could generate the passive loss carryover form in Fed tax to see how it populates the Cal form and then override the info in Federal return, etc. I mail in my returns regardless because of have QBI forms that have to be signed that aren't supported in TT electronic submissions, so I don't mind the override if that's the best solution. Regards.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have rental property with active participation, so losses were allowed on Federal but not CAL taxes--selling the property

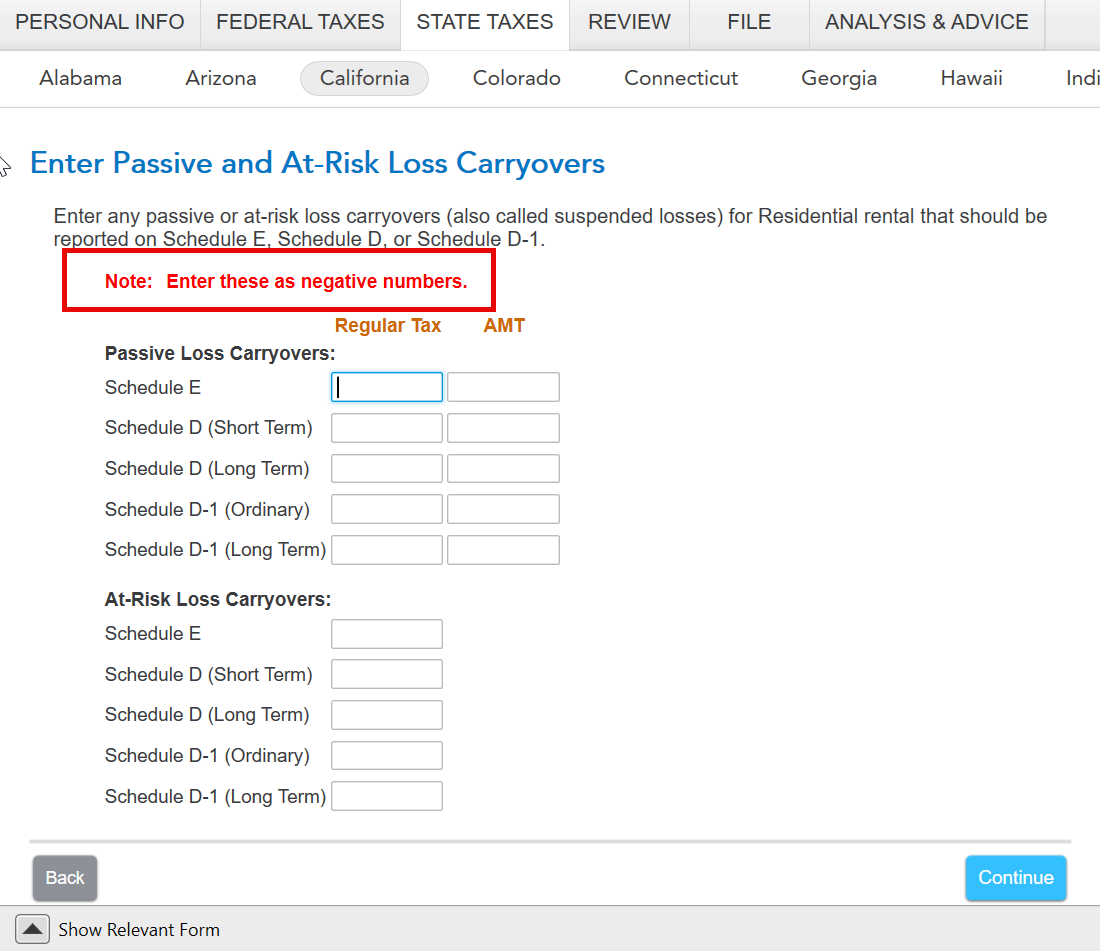

You will need to make sure your prior year passive activity loss is entered in the state interview screen for California. To do this, log back into TurboTax and go to the California interview screens.

Proceed to the summary screen and select edit to the right of Income and adjustments.

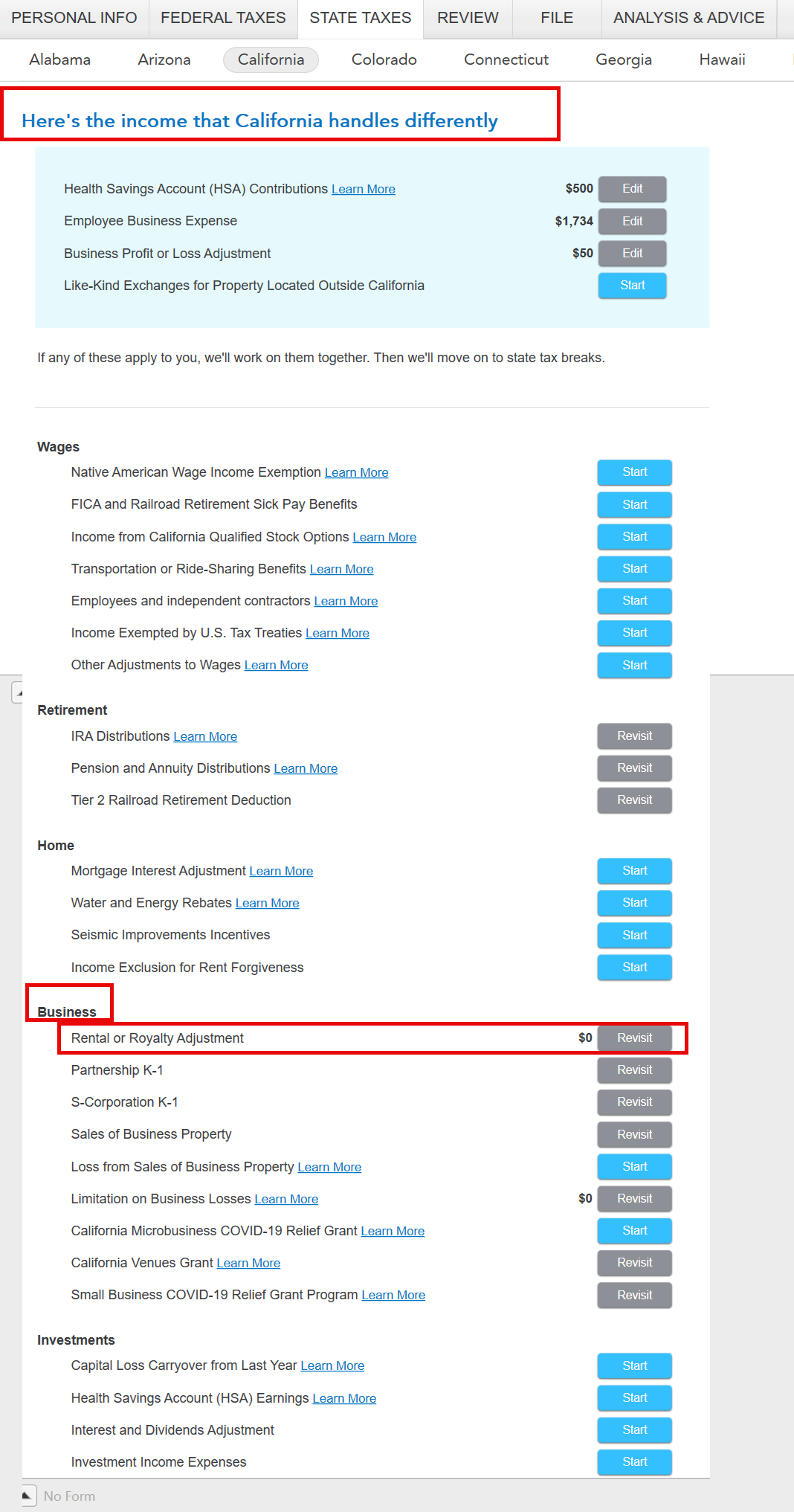

This will take you to a screen titled "Here's the income that California handles differently." Scroll down to the section titled Business. Select revisit/start to the right of Rental or Royalty Adjustment.

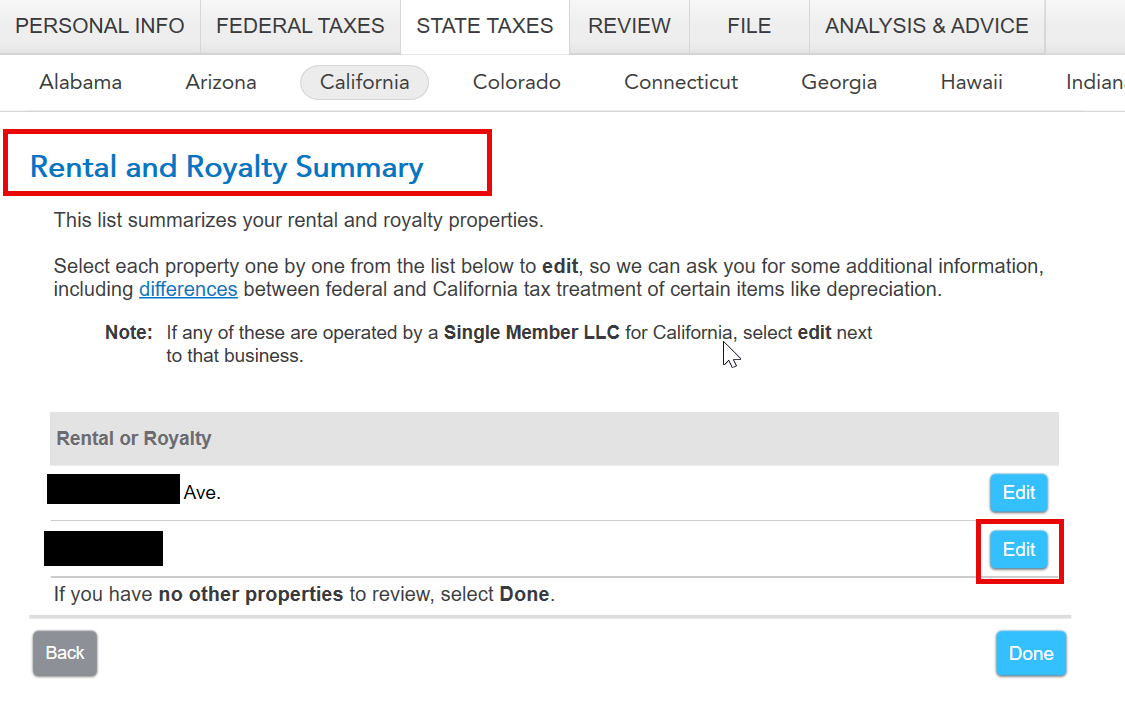

You will be taken a screen titled "Rental and Royalty Summary." Select Edit to the right of the applicable entity.

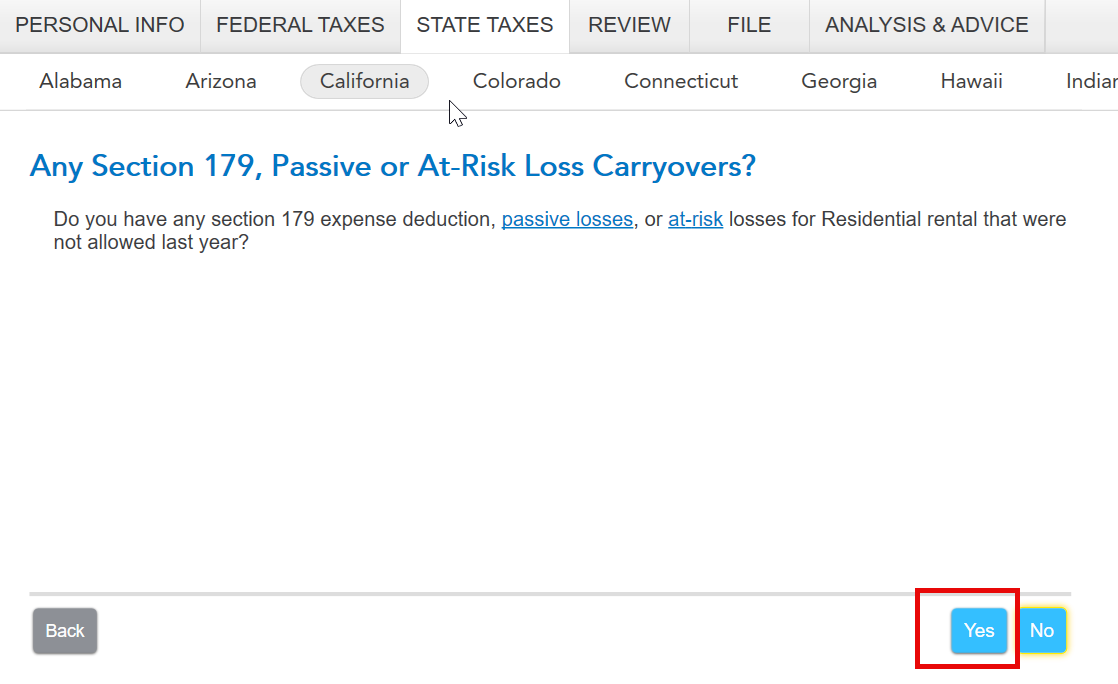

Proceed through the screens until you see a screen titled "Any Section 179, Passive, or At-Risk Loss Carryovers?" Select Yes.

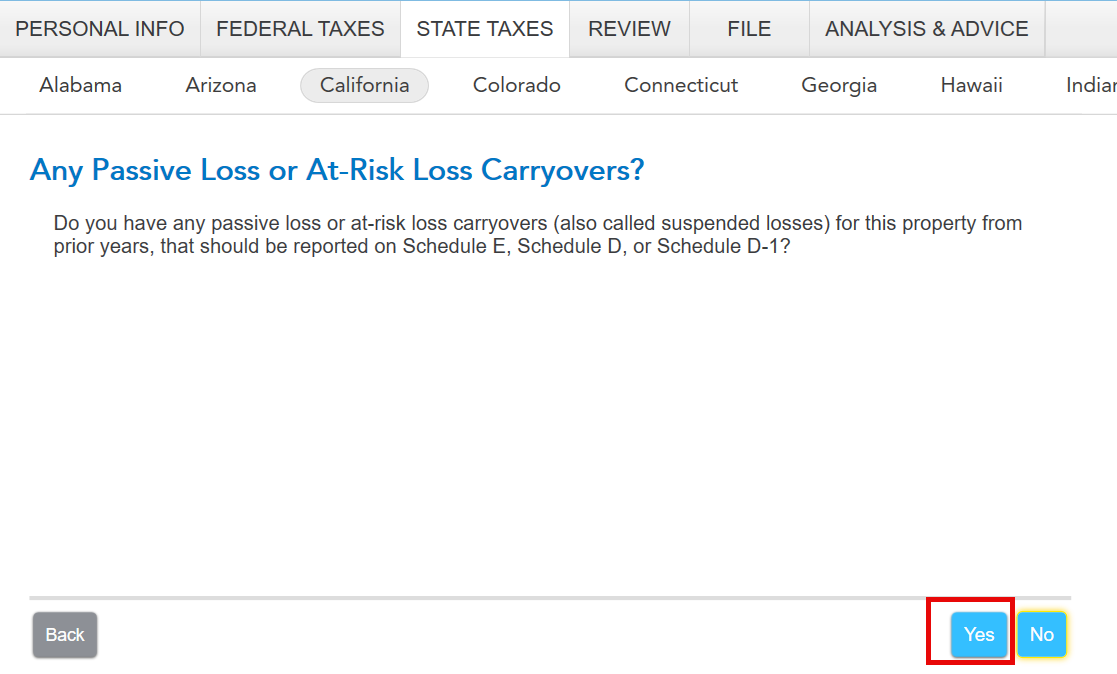

Then, proceed through the screens until you see "Any Passive or At-Risk Loss Carryovers?" Select yes.

You will then see the screen where you can enter your prior year passive activity losses for California. Proceed to enter your amounts here. Note the directions to enter the amounts as negative numbers.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

syounie

Returning Member

ramseym

New Member

DallasHoosFan

New Member

eric6688

Level 2

user17538342114

Returning Member