- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

You will need to make sure your prior year passive activity loss is entered in the state interview screen for California. To do this, log back into TurboTax and go to the California interview screens.

Proceed to the summary screen and select edit to the right of Income and adjustments.

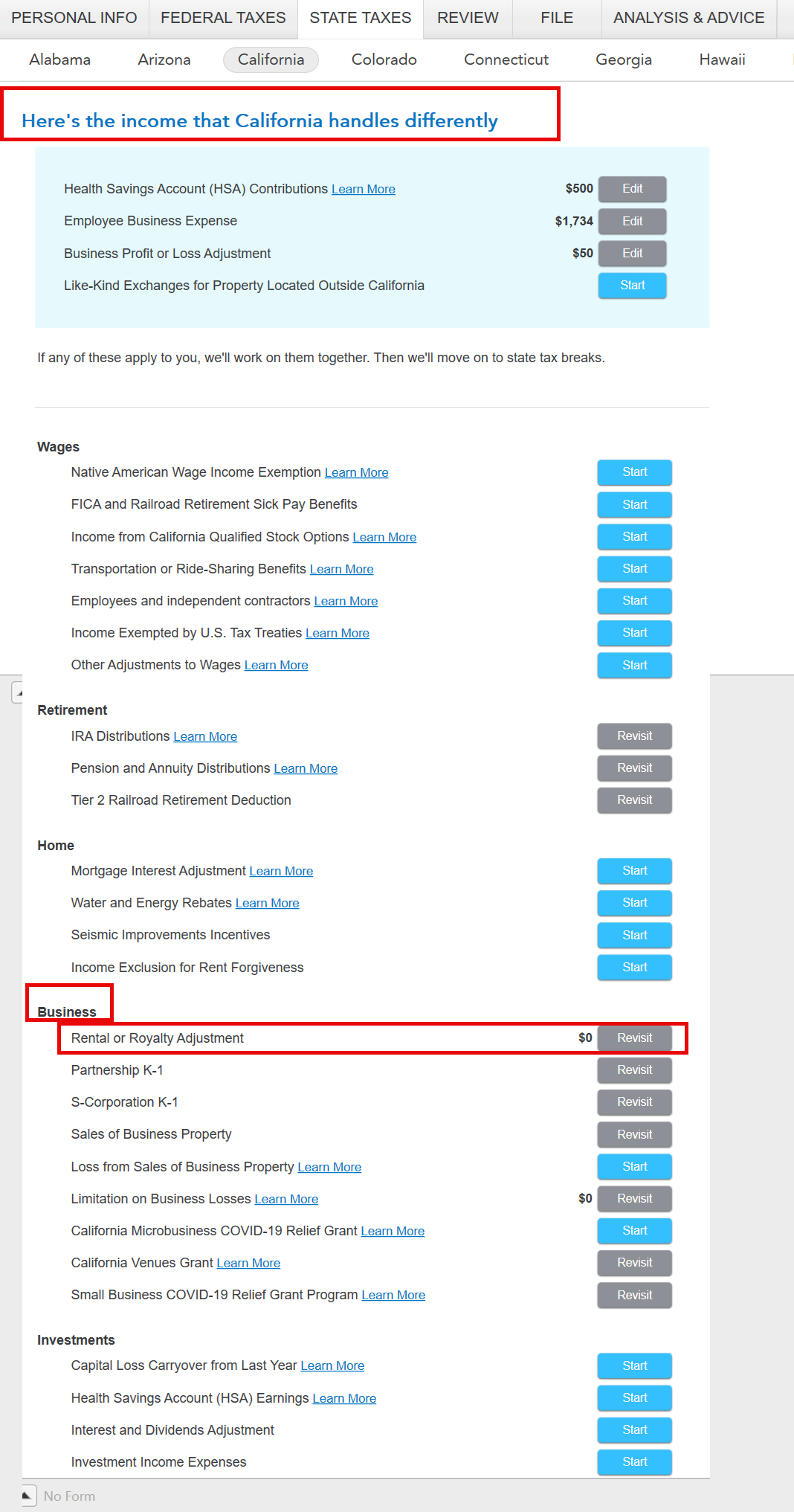

This will take you to a screen titled "Here's the income that California handles differently." Scroll down to the section titled Business. Select revisit/start to the right of Rental or Royalty Adjustment.

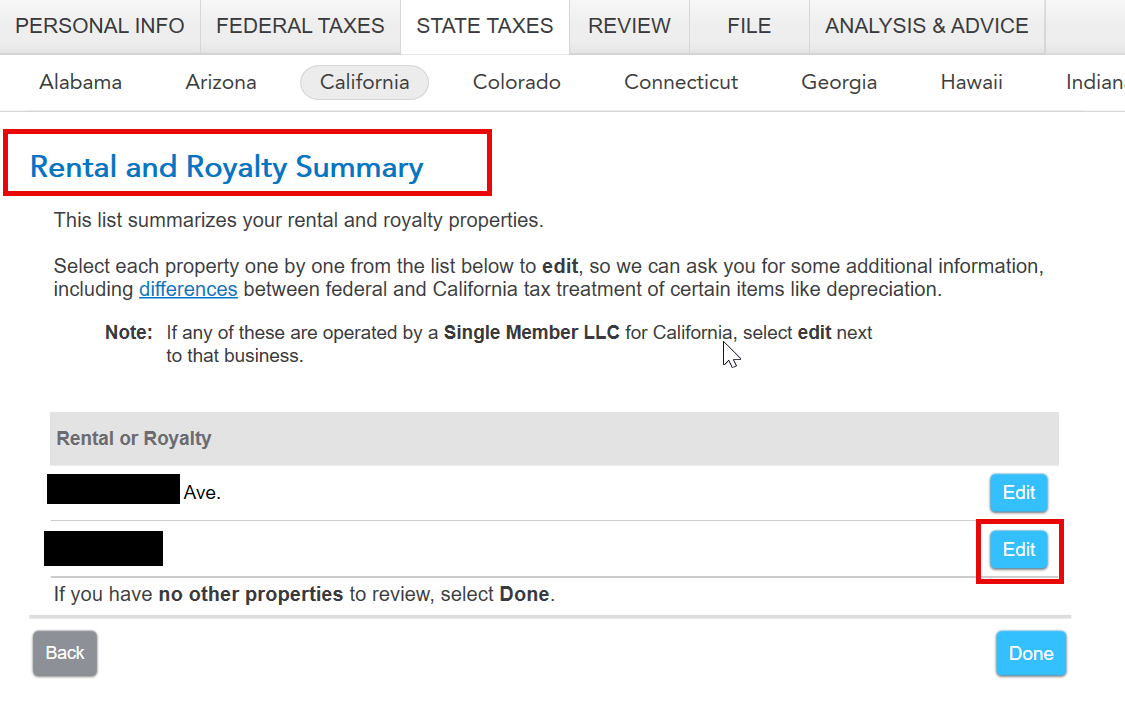

You will be taken a screen titled "Rental and Royalty Summary." Select Edit to the right of the applicable entity.

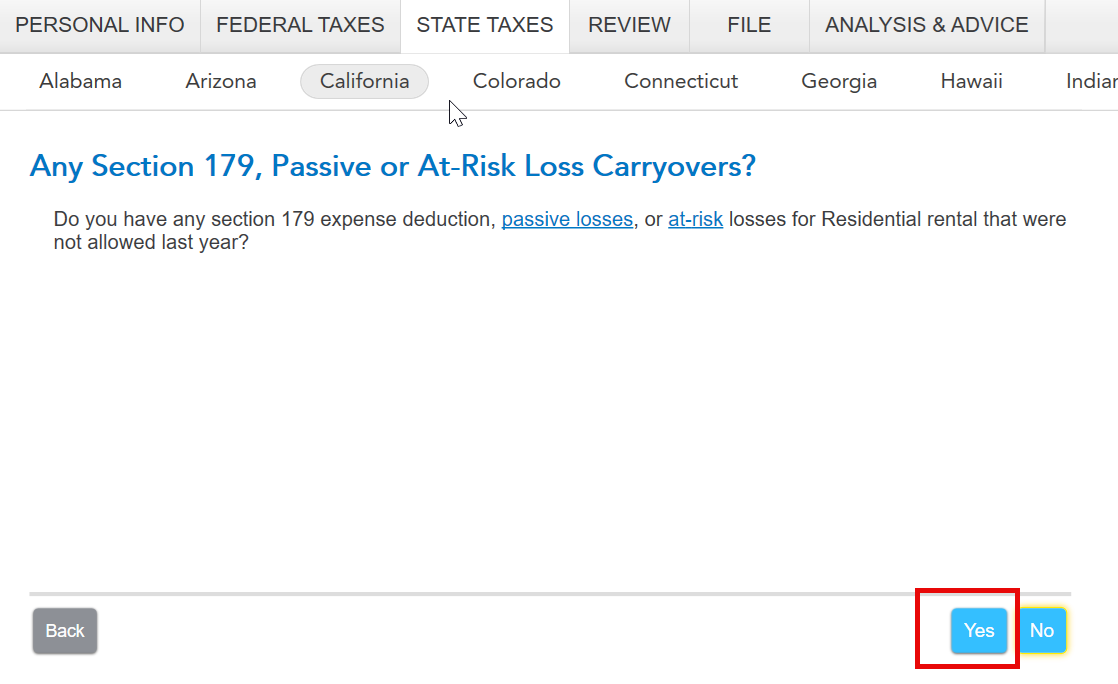

Proceed through the screens until you see a screen titled "Any Section 179, Passive, or At-Risk Loss Carryovers?" Select Yes.

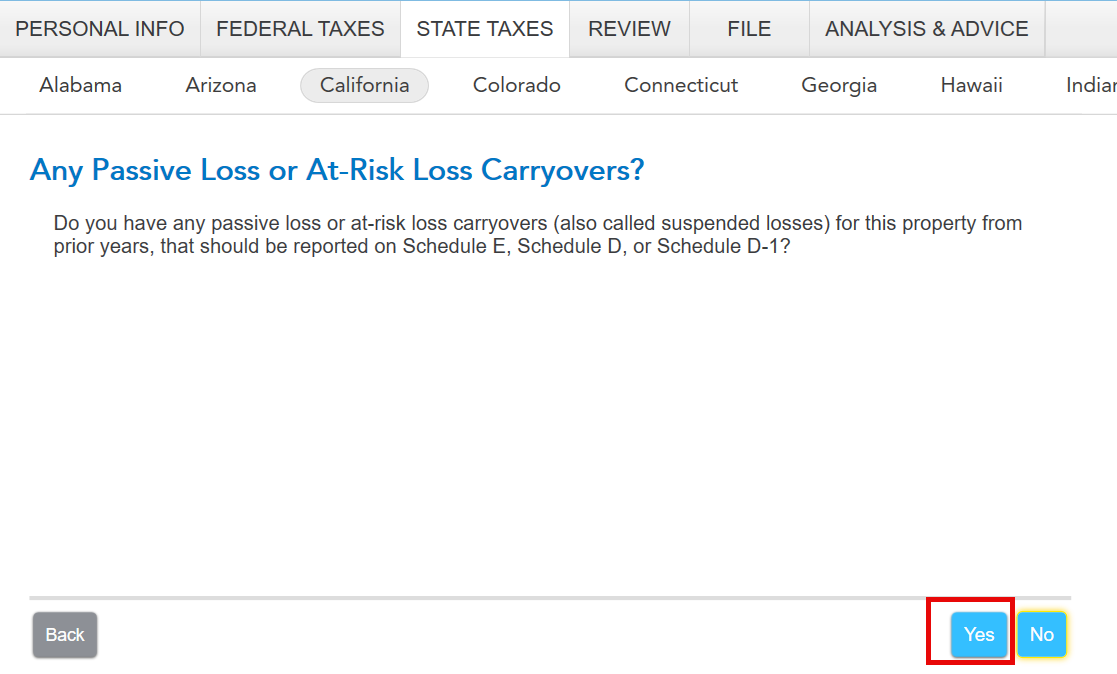

Then, proceed through the screens until you see "Any Passive or At-Risk Loss Carryovers?" Select yes.

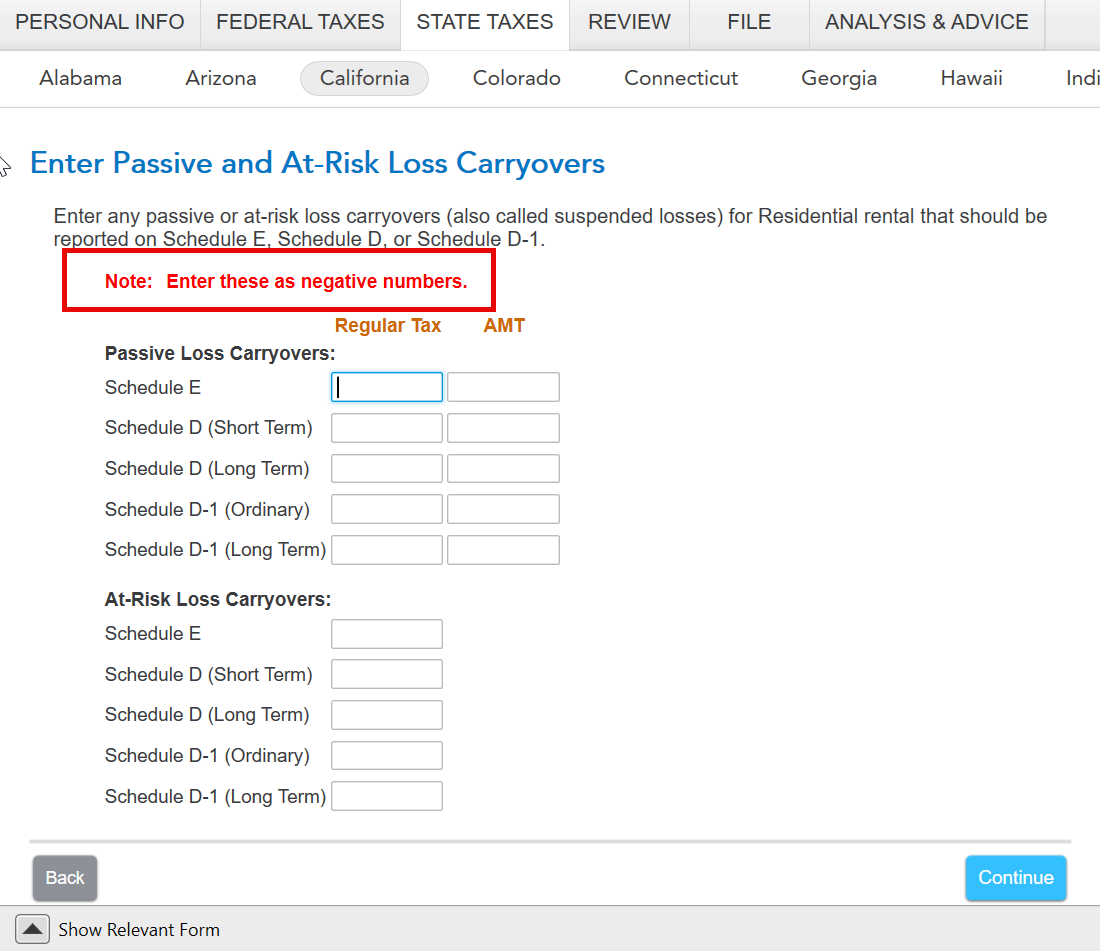

You will then see the screen where you can enter your prior year passive activity losses for California. Proceed to enter your amounts here. Note the directions to enter the amounts as negative numbers.

**Mark the post that answers your question by clicking on "Mark as Best Answer"