- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- I have multiple businesses but only one vehicle. do I answer the questions for the vehicle for the second and third business the same as for the first?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have multiple businesses but only one vehicle. do I answer the questions for the vehicle for the second and third business the same as for the first?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have multiple businesses but only one vehicle. do I answer the questions for the vehicle for the second and third business the same as for the first?

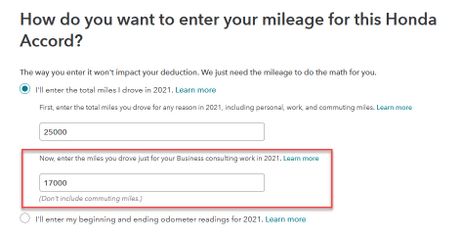

Yes, you would enter the same vehicle for each business. Your total mileage & commuting miles (or beginning and ending odometer readings) would be the same. However, you need to report only the mileage specific to each business. The total business miles would be the sum of your entries for each business.

See red box on screenshot below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have multiple businesses but only one vehicle. do I answer the questions for the vehicle for the second and third business the same as for the first?

how

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have multiple businesses but only one vehicle. do I answer the questions for the vehicle for the second and third business the same as for the first?

where and how

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have multiple businesses but only one vehicle. do I answer the questions for the vehicle for the second and third business the same as for the first?

Business Vehicles are reported under Expenses >> Vehicle for your business.

The easiest way to find this section in TurboTax is to search on "business expenses" and click the "jump to" link in the drop-down list, which will take you to list of business in your return. Start/Edit the related business then scroll down to the Vehicle section to enter or edit your vehicle information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have multiple businesses but only one vehicle. do I answer the questions for the vehicle for the second and third business the same as for the first?

and if I wanted to use the actual expenses method for the same vehicle for each business - would I enter the same "total" expenses for Gas , Oil, Repairs etc in both places, while adding the vehicle for each business?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have multiple businesses but only one vehicle. do I answer the questions for the vehicle for the second and third business the same as for the first?

Yes. Then TurboTax will prorate the total expenses claimed by the percentage of business use of the vehicle for each business. The percentage of business use will be determined by the total mileage driven for the year and the number of business miles driven for each business.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have multiple businesses but only one vehicle. do I answer the questions for the vehicle for the second and third business the same as for the first?

I have one vehicle, 3 businesses. 75% business use, which I figure is 25% of miles for each business. I initially had the full 75% of mileage entered on all 3 businesses. I thought I might be duplicating in error so went back and changed it.

I entered vehicle actual expenses & mileage on first business as 25% & it's saying I only used my vehicle for 25% & is changing lots of subsequent questions to reduce my deduction. So should I change it back & enter total 75% mileage on all businesses?

I also only kept record of mileage on one business. Can I do both ways or must I do either actual costs? I did actual costs for 2023 so its making me continue that for business #1, but not for business #3.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have multiple businesses but only one vehicle. do I answer the questions for the vehicle for the second and third business the same as for the first?

No, entering 75% on every business is not accurate. The net profit should reflect the actual vehicle expense for each business. The business use percentage of 25% is possibly the correct entry for each business based on your information. Technically it is whatever the business use percentage is arrived at when entering the correct business miles for each business. And entering the total miles driven all year in each business (should be the same figure for each business). Once you have done this in each of your three businesses, if you add the actual expenses shown on each business you will have the total amount allowed for the year.

If the standard mileage rate (SMR) was not selected the first year this vehicle was placed in service, it can never be used for this vehicle. Actual expenses only are allowed for this vehicle.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Hypatia

Level 1

VAer

Level 4

bpscorp

New Member

stays

New Member

user26879

Level 1