- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- I have a pass-through entity with business interest expense. Where do I answer: Does not own a pass-through entity with carryover excess business interest expense.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a pass-through entity with business interest expense. Where do I answer: Does not own a pass-through entity with carryover excess business interest expense.

@Smarc Thought abt that option of e-filing now and later amend to just send the Form 8990 later. However, I wasn't too inclined to that option. Also having spent so much time in 8990, just want to have that sent and addressed correctly (hopefully). Sounds ridiculous, but that's what happens after a while. As you see $100 is not a big deal at all, esp against the passive loss from the same entity. I may not even end up using them. Its more of filing it correctly, at least based on what I was aware at that time. Thanks for your help. I am an Engineer as well. Maybe we are wired differently than regular tax people. It's so complex. Either that or I should stay away from K1. Either way, glad its all over - paper filed yesterday. Hopefully, by next year TurboTax adds support for 8990.

Thanks

Richard

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a pass-through entity with business interest expense. Where do I answer: Does not own a pass-through entity with carryover excess business interest expense.

@Smarc - Your information has been very informative. What do you do if you have a interest exp deduction amount on line 30 - where does that number transfer to on the 1040? This is the final K-1 from this partnership as they went private so is there a place where you're allowed to take this deduction?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a pass-through entity with business interest expense. Where do I answer: Does not own a pass-through entity with carryover excess business interest expense.

@Smarc @rich895 Thank you both for your contributions to this thread! I have been struggling with the Form 8990 for a while now and now it makes sense! A true lifesaver.

While I was reading Richard's post of July 13, 2020 at 7:47 AM, I was thinking that I could have written it because it describes my situation perfectly. Then he signed off with my NAME as well!

Steve has done a great job of explaining the form, the process of filling it out. Richard's example screenshots and Steve's critique are priceless.

I believe I found one small typo in Steve's July 13, 2020 5:00 PM reply: I think the reference to Line "20" for entering 30% of taxable income should instead be Line "26". Don't mean to nit pick, just want to clarify for myself and others reading the post.

I am also an engineer, not a tax professional and have also had to educate myself over the years, sometimes by reading the Tax Code. I did find it especially difficult to find good information on Form 8990, so I was elated to find this thread.

Thanks again,

Richard

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a pass-through entity with business interest expense. Where do I answer: Does not own a pass-through entity with carryover excess business interest expense.

In 2019, a 1065 K1 for an LLC that owned an apartment complex provided excess business interest. I used 8990 in 2019 to carry it forward. In 2020, the partnership sold the property it owned, and on the final K1, it reported adequate excess taxable income for the previous excess business interest to now be deductible. Form 8990 was used in 2020 to confirm that.

Now that I'm allowed to deduct the business interest at the partner level, I cannot find anything that tells me on what form or schedule to actually deduct the business interest that was passed through to me as a limited partner in the prior year.

Thoughts?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a pass-through entity with business interest expense. Where do I answer: Does not own a pass-through entity with carryover excess business interest expense.

Did you figure out the solution?

I am facing the same situation.

Greg

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a pass-through entity with business interest expense. Where do I answer: Does not own a pass-through entity with carryover excess business interest expense.

Did anyone figure out where to flow the entry on line 30 to the 1040?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a pass-through entity with business interest expense. Where do I answer: Does not own a pass-through entity with carryover excess business interest expense.

I have not figured it out, and I haven't received any response. Of you figure it out, please let me know.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a pass-through entity with business interest expense. Where do I answer: Does not own a pass-through entity with carryover excess business interest expense.

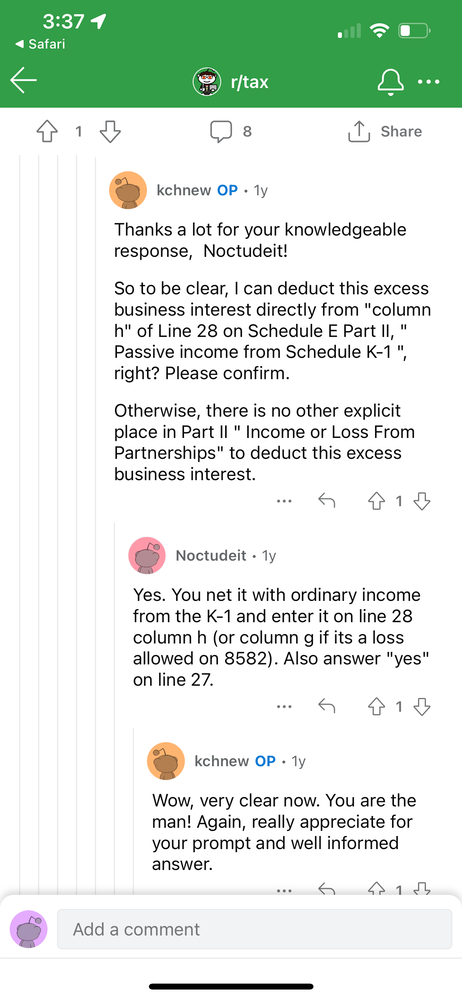

I did some more digging and found the answer on a Reddit question and answer board.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a pass-through entity with business interest expense. Where do I answer: Does not own a pass-through entity with carryover excess business interest expense.

Report the deductible business interest expense from line 30, Form 8990 on Schedule 1, Line 5 (Other income) as a negative number.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a pass-through entity with business interest expense. Where do I answer: Does not own a pass-through entity with carryover excess business interest expense.

note that Turbotax does not support form 8990. you have to manually prepare it.

read the instructions

https://www.irs.gov/site-index-search?search=8990&field_pup_historical_1=1&field_pup_historical=1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a pass-through entity with business interest expense. Where do I answer: Does not own a pass-through entity with carryover excess business interest expense.

Smarc, I also have this issue. I have

$49 listed in K-1, Part III, 13K. Can I leave out the amount making it 0 and not send Form 8990. I do not want to trigger a problem or audit but am not sure I can figure out the Form 8990. I can use and understand TurboTax but not as good with all the tax rules. What do you think I should do? Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a pass-through entity with business interest expense. Where do I answer: Does not own a pass-through entity with carryover excess business interest expense.

It's a deduction. Albeit inaccurate reporting, not claiming a deduction will have less frowing eyes from IRS. It's under-reporting income and over claiming deduction that trigger scrutiny.

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cramanitax

Level 3

abarmot

Level 1

K1 form multiple boxes checked

Returning Member

helen6vankansas

New Member

WorthingtonOH

New Member