- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- I cannot enter 1099s for more than one schedule c business

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cannot enter 1099s for more than one schedule c business

I have used Turbo Tax with multiple Schedule C Businesses for years. 1099 input is BROKEN on my MAC desktop version.

I cannot enter 1099-NECs on more than one Schedule C. For example, I input 1099s for Business A. I open Business B to add 1099s and it forces me to open the 1099 previously entered on Business A and it reassigns that 1099 to Business B.

Also, when I open a business, I do not get a list of the 1099s to work on, I merely get a list of numbers and have to guess which one matches the 1099 I am trying to work on.

I can also usually say if a 1099 belongs to myself or my spouse. This isn't an option this year either.

I have tried deleting all prior year 1099s and entering them from scratch. Still the same problems.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cannot enter 1099s for more than one schedule c business

TurboTax is currently looking into this situation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cannot enter 1099s for more than one schedule c business

Same problem, I have never had this type of problem with Turbo Tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cannot enter 1099s for more than one schedule c business

Yes! Same problem! We need a fix for this!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cannot enter 1099s for more than one schedule c business

We appreciate you reporting this to us. Currently, there is a known issue where the spouse is not connected with the form should this be applicable to your situation. This link will allow you to add yourself to a list so that you can be notified when it is ready for use.

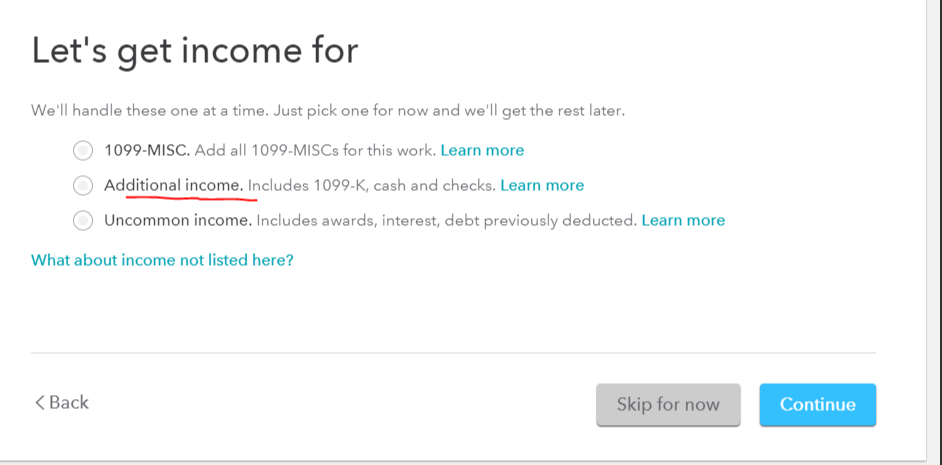

If you choose, you have the option of deleting the form and entering the income without the document. The entry is a convenience and not required by the IRS, you should keep the document with your tax files.

When you are signed into your TurboTax account follow the steps below.

- Search (upper right) for Schedule C > Press Enter > Select the Jump to... link > Review

- Select Business Income > Delete this form using the trash can beside the entry

- Enter this as a cash payment of business income by selecting Other self-employed income, includes 1099-K, cash, and checks

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cannot enter 1099s for more than one schedule c business

Will this issue be repaired this tax season or do I need to switch to a different tax software?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

HNKDZ

Returning Member

kac42

Level 1

binarysolo358

New Member

rtoler

Returning Member

ilenearg

Level 2