- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- I am unable to get the WI Schedule CS form to generate through the application. So my first question is what do I have to enter to get the form to generate?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to get the WI Schedule CS form to generate through the application. So my first question is what do I have to enter to get the form to generate?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to get the WI Schedule CS form to generate through the application. So my first question is what do I have to enter to get the form to generate?

Follow these steps:

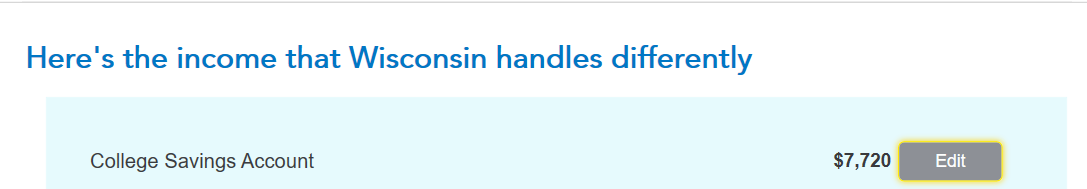

- Go to WI review page

- Edit income,

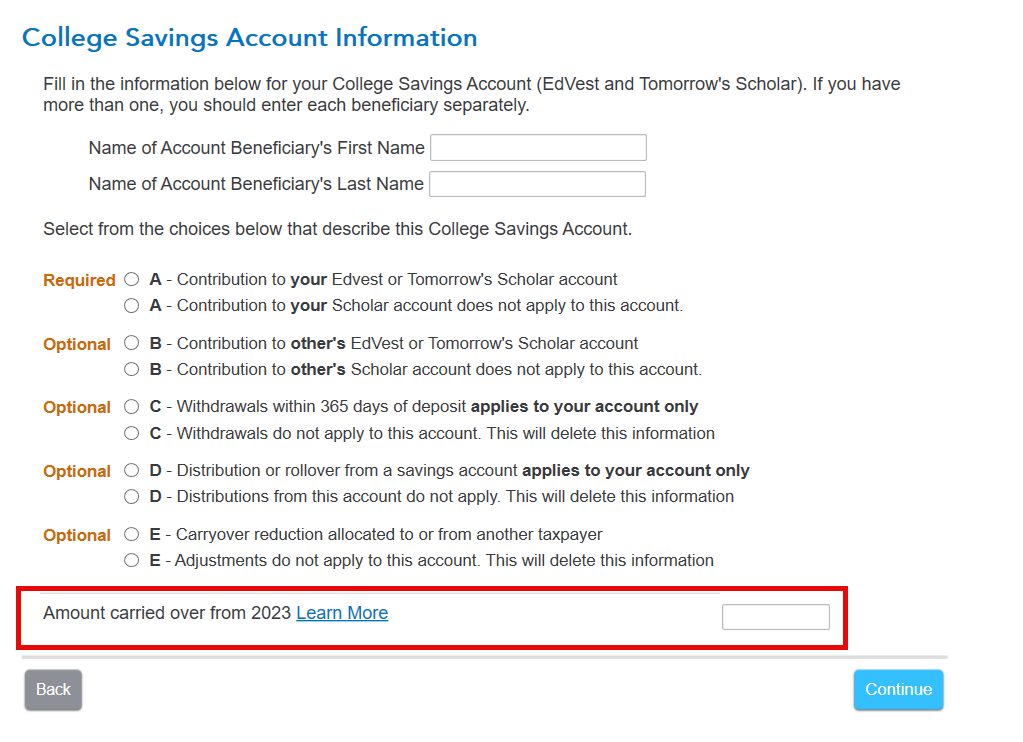

- select College Savings account, enter the information for the beneficiary.

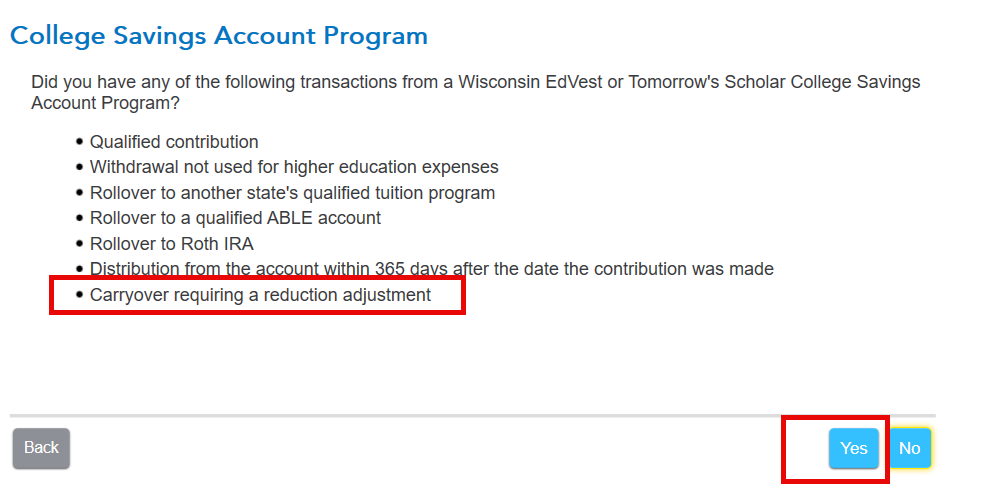

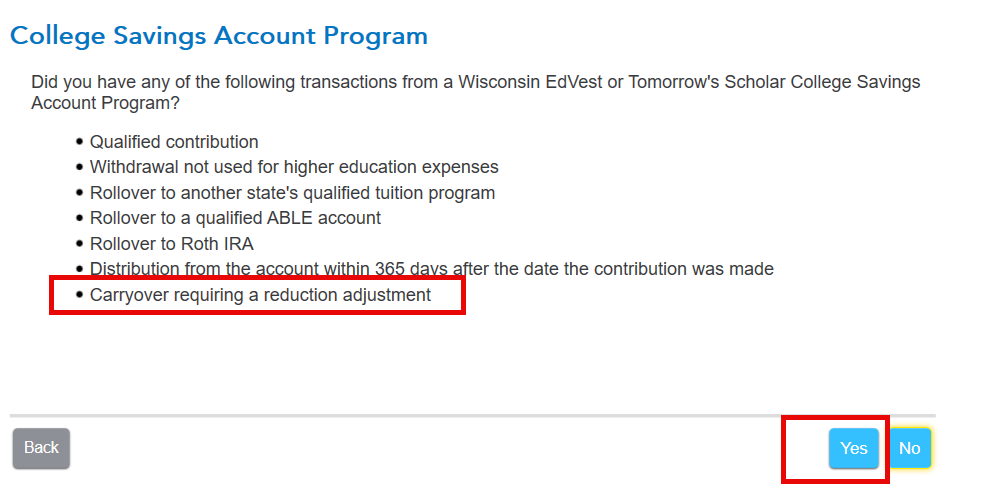

- Select yes to college savings account program which includes carryover

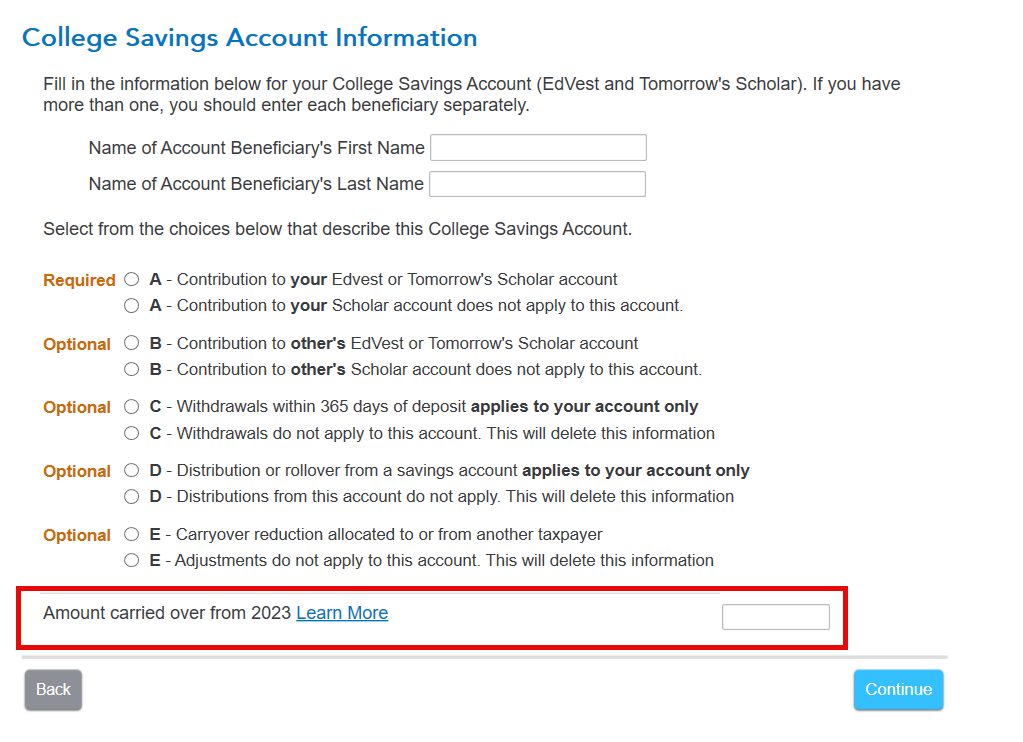

- The bottom of the screen asks for carryover from last year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to get the WI Schedule CS form to generate through the application. So my first question is what do I have to enter to get the form to generate?

Follow these steps:

- Go to WI review page

- Edit income,

- select College Savings account, enter the information for the beneficiary.

- Select yes to college savings account program which includes carryover

- The bottom of the screen asks for carryover from last year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to get the WI Schedule CS form to generate through the application. So my first question is what do I have to enter to get the form to generate?

Thank you. I was able to follow your instructions to trigger the CS form with the carry over amount. However, I am a divorced parent and there is no question on the screen to fill in that check box on the form. I am only allowed to take half the carry over amount which would be $2,500, not $5,000. I updated the checkbox on the form itself, but that does not update the credit amount on the form and I am not allowed to change the credit amount myself. Is there some other place I need to indicate I am a divorced parent on the beneficiary for the credit amount to be calculated correctly?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to get the WI Schedule CS form to generate through the application. So my first question is what do I have to enter to get the form to generate?

You should make the entry in program on the screen shown above, not directly on the form. @rmclemor

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to get the WI Schedule CS form to generate through the application. So my first question is what do I have to enter to get the form to generate?

If you look at the screen shot of the screen, there is a box for the carry over amount. There is no question on this screen that asks me if I am a divorced parent of the beneficiary or student. The only place I can find is on the form itself. So where in the application do I indicate that I am a divorced parent because it is not on the screen you mentioned.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to get the WI Schedule CS form to generate through the application. So my first question is what do I have to enter to get the form to generate?

You will not enter it in the program.

Since you are able to see it on the form, you can check the box there. The rules have changed and the box is just a hold over from last year.

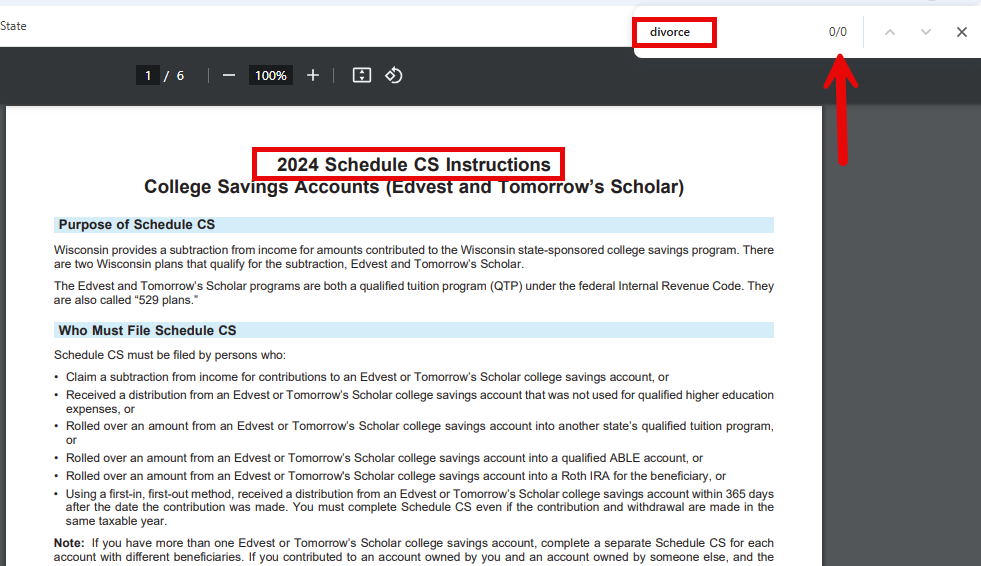

- I went through the 2024 instructions and did not find the word divorce in them. The instructions state that if you are married and filing separately or HOH then there are specific instructions. You should enter the amount of carryover allowed. The instructions have examples to help determine the correct answer.

- I went back to 2023 instructions, and found the word divorce with limitations 2023 Schedule CS Instructions College Savings Accounts ...Mar 1, 2023 instructions— In the case of divorced parents, the total subtraction per beneficiary by the formerly married couple may not exceed $3,860, and the maximum ...

Reference: WI CS instructions for TY2024

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to get the WI Schedule CS form to generate through the application. So my first question is what do I have to enter to get the form to generate?

I am divorced from my children's father so in prior years I could only use half of the carry over. With the new wording and instructions on this form along with the fact that I am remarried and not filing separately, it does appear that on line 10 I can take the full $5,000 instead of $2,500. Thanks for your help.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17570948549

Level 1

Sarmis

Returning Member

RicN

Level 2

alec-ditonto

New Member

pilotman1

Returning Member