- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

You will not enter it in the program.

Since you are able to see it on the form, you can check the box there. The rules have changed and the box is just a hold over from last year.

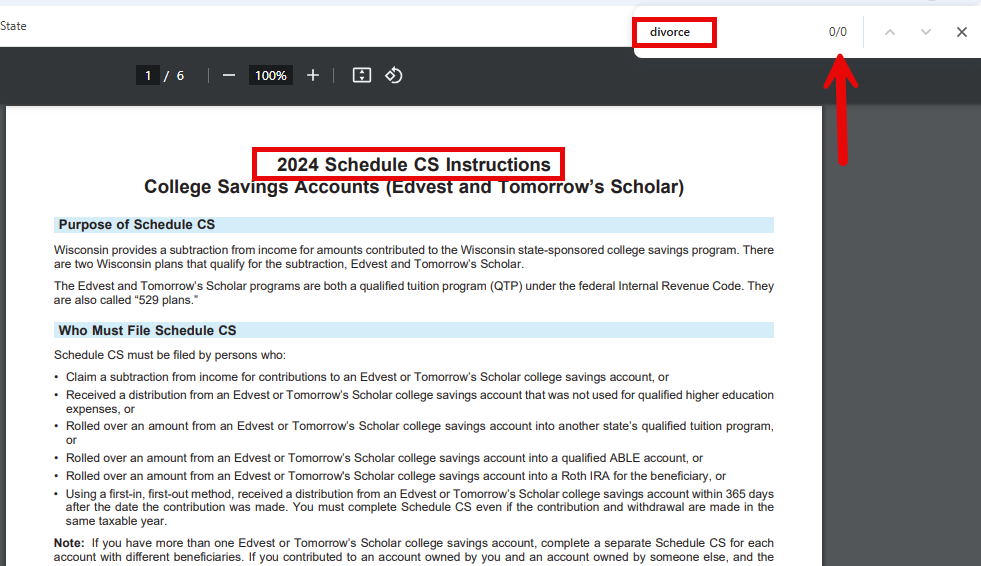

- I went through the 2024 instructions and did not find the word divorce in them. The instructions state that if you are married and filing separately or HOH then there are specific instructions. You should enter the amount of carryover allowed. The instructions have examples to help determine the correct answer.

- I went back to 2023 instructions, and found the word divorce with limitations 2023 Schedule CS Instructions College Savings Accounts ...Mar 1, 2023 instructions— In the case of divorced parents, the total subtraction per beneficiary by the formerly married couple may not exceed $3,860, and the maximum ...

Reference: WI CS instructions for TY2024

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 26, 2025

6:07 PM