- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- I am self-employed but spouse is minister with housing allowance for only half of 2019.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am self-employed but spouse is minister with housing allowance for only half of 2019.

I am self-employed but spouse is minister with housing allowance for only half of 2019. When entering house deductions in my Schedule C, do I include items we paid for with the Housing Allowance?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am self-employed but spouse is minister with housing allowance for only half of 2019.

Also, I have a home office and spouse does not.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am self-employed but spouse is minister with housing allowance for only half of 2019.

You will need to enter two different Self-Employment activities.

As both activities are separate from each other.

You will report your business on its own Schedule C.

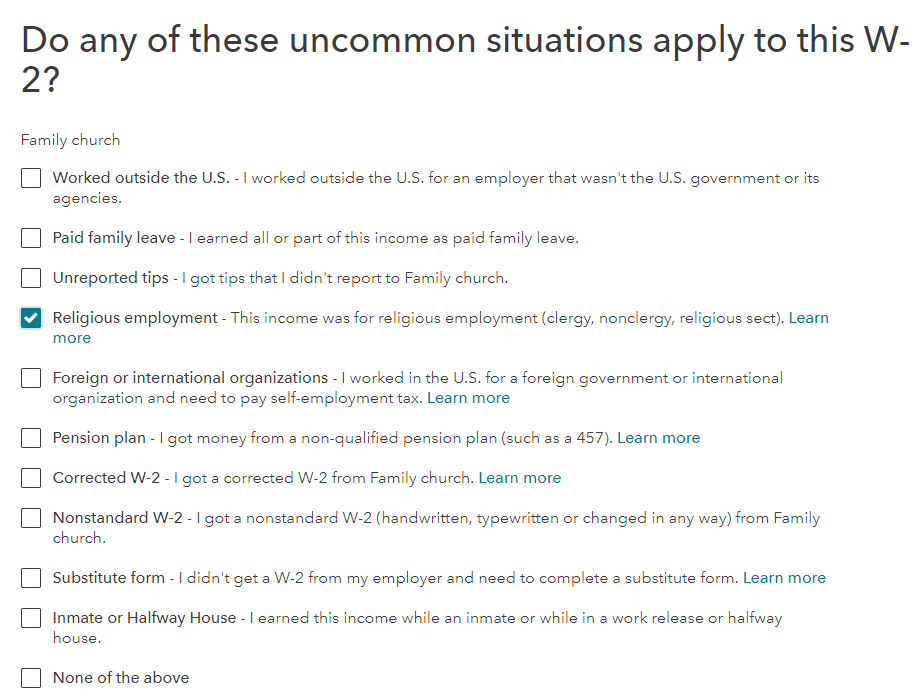

You can then add another Schedule C to report the housing allowance for your spouse. Your spouse should have received a W-2 Form. Make sure to select that they are a member of the clergy. TurboTax will walk you through the steps and will ask for your housing allowance once you mark this box.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

beyerj50265

New Member

jw1578

New Member

bderinger

New Member

scsmith7

New Member

dompedrothompson

Level 1